2023 New York State Employee Form – There are a number of documents that you have to fill out when you hire new employees. They include W-4 as well as I-9 forms. These documents are required to verify that your employee is legally able to operate in the US. The forms you’ll need to fill out are covered in this article.

Checks from the past

Employers can conduct a variety of background checks that they could utilize to make a choice about who to hire. You can verify your credit score, education and your identity. These checks are performed to confirm that the candidate is honest about their qualifications and that they meet the requirements of the job.

Background checks are a valuable tool in protecting the company, its clients and employees. Speeding fines, criminal convictions, and poor driving habits are a few of the warning signs that might be in a candidate’s past. There are also indicators of risk in the workplace, such as violence.

A lot of businesses will employ an independent background investigation firm. The background investigation company will have access to the entire information available from all 94 U.S. federal courts. Some businesses wait for an employment contract with a conditional clause before performing background checks.

Background checks may require some time. Employers need to compile a list. It is essential that applicants have sufficient time to respond. The standard response time is 5 days. day.

Form I-9

Once a potential employee is employed, all employees must fill out the I-9 form. Both state workers and federal contractors must comply. The procedure can be lengthy and tiring.

The form consists of several sections. The first one is crucial and must be completed by you prior to beginning to work. If you are planning to employ an international worker This section should contain the contact information for the employer and any relevant details.

After you’ve completed Section One Make sure all the remaining information is completed. The required Form I-9 should also exist kept on file for 3 years following the date of hiring. In addition, you must continue to pay Form 6A-related fees.

When filling in the Form I-9, consider how you might decrease the chance of being fraudulent. For instance, you need to ensure that each employee is added to the database E-Verify. It is also important to submit all contributions and administrative expenses on time.

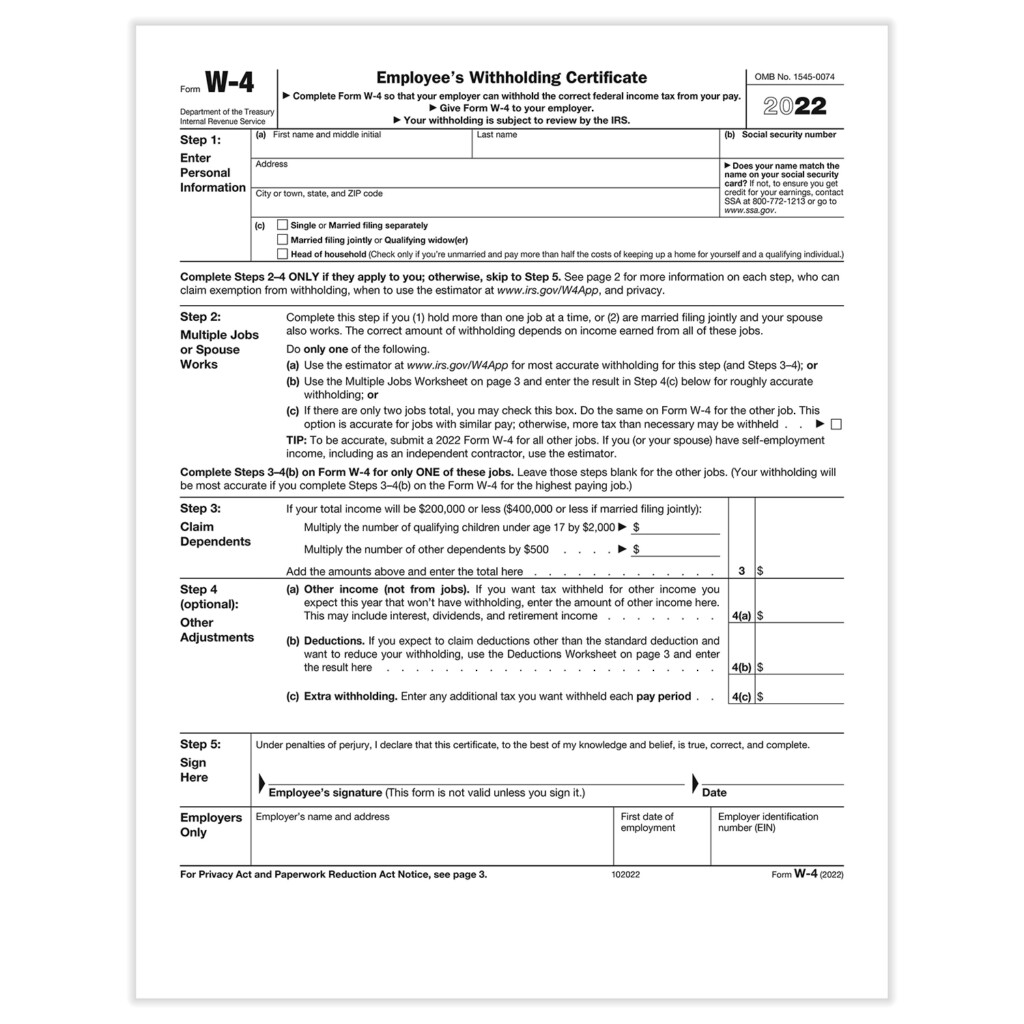

Formulas W-4

W-4 forms are among the most essential documents new employees will need to complete. On this form it is possible to see the tax deduction from their salary. You can also use this page to get more information regarding your tax obligations. If they are able to know the tax deductions the government takes from their income, they may be eligible for a bigger amount.

It’s crucial because it informs employers about how much to deduct the wages of employees. This information can be used to calculate federal income tax. To avoid surprise tax bills, it can be beneficial to track how much you are able to deduct.

The easy Form W-4 contains your name, address, as well as other information that could affect your federal income taxes. The form can be completed correctly to ensure you don’t overpaying.

There are many variations of the W-4. The form is available for online submission along with printing and manual filling. Whatever method you choose to submit be sure to submit all paperwork before you receive your first paycheck.

Apply for an opening

Employers use application forms to assess candidates. They enable the creation of a detailed description of the applicant’s education background and work experience.

Your personal information, contact information, and other details will be requested when you fill out a job application form. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

On paper or online You can submit an application for an employment. Your form must be simple to read and include all of the necessary information.

Before you apply for a job, you should consult a qualified expert. You can be sure you aren’t submitting any illegal content through this.

Many employers keep applications on file for a time. Employers can then contact prospective applicants about openings that might be forthcoming.

Most job applications require your complete name, address, and email. This is one of the most commonly used methods employed by companies to contact potential candidates.