New Employee Tax Forms Canada – If you’re planning to hire new staff members, you may need to fill out several documents like W-4 or I-9 forms. These documents are needed to confirm that your staff is allowed to legally operate in the US. This article outlines the documents you’ll need.

Checks written in the past

Employers may use a variety of background checks to decide who to hire. These checks include verifications of educational, credit, identification and motor vehicle record checks. These checks are required to make sure that the applicants are who they say they are and that they have all the necessary qualifications for the position.

Background checks can ensure the safety of employees and customers and the business. Poor driving habits, criminal convictions, and speeding fines are all possible warning signs. There are indicators of danger in the workplace, such as violence.

A majority of businesses will employ a third-party background investigation firm. They will have access to a database of records of all federal courts in the United States. But some businesses choose to not perform background checks until they reach the stage of conditional offers to employees.

Background checks can take a while. Employers must prepare a list of questions. Employers must give applicants enough time to get a response. Five business days is the average time it takes to get a reply.

Formula I-9

Every employee must complete the I-9 form at least once when they are an incoming employee. Federal contractors as well as state workers must complete the form. It’s not easy and time-consuming, but it is not impossible.

The form consists of multiple sections. The first section is essential and must be completed by you prior to your start working. This includes both the employer’s identifying as well as the worker’s relevant information. You will need to provide proof that the person is legally authorized to work in America, if you wish to hire the person.

After completing Section 1, you should make sure the rest of the form was completed by the deadline. The necessary Form I-9 should also exist kept on file for 3 years after the date of your hiring. It is also necessary to pay Form 6A fees.

While filling out Forms I-9, be sure to think about the various ways that you can minimize your vulnerability to being a victim of fraud. It is important that you connect each employee to the database E-Verify. It is equally important that you send in any donations or administrative costs.

Formulas W-4

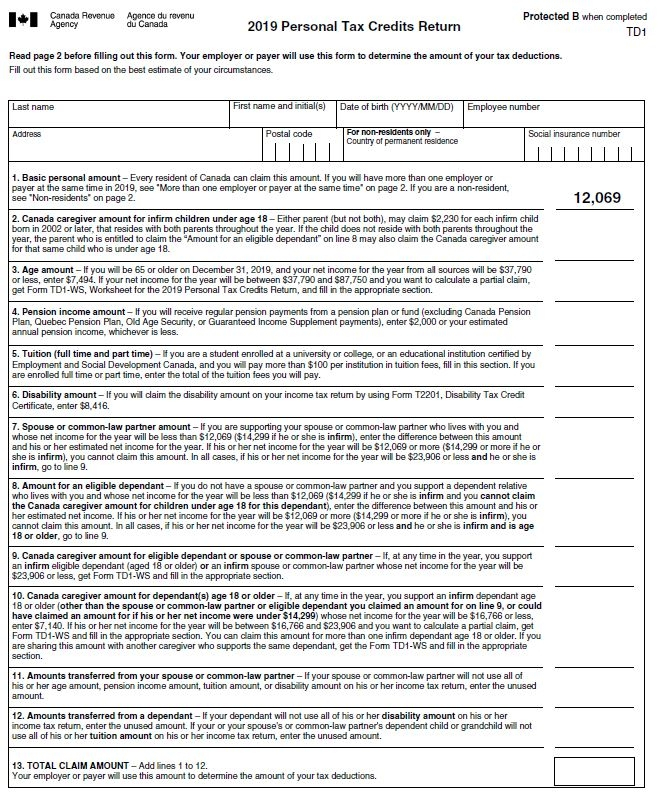

W-4 forms are one of the most essential documents new employees must fill out. On this page it is possible to find the tax deductions from their wages. It is also possible to use this page to learn more about your tax liabilities. They may be able to receive a larger check in the event that they have a better understanding of the deductions the government will make on their earnings.

W-4 is vital since it provides companies with guidelines on how much to take from the wages of employees. The information is used to calculate federal income taxes. In order to avoid surprise tax bills, it can be helpful to keep track the amount you deduct.

The W-4 is a basic form that includes your name, address and any other information that may affect federal income tax. The form can be completed accurately to help you avoid overpaying.

There are a variety of methods to fill out the W-4. It is available for online submission in addition to printing and manual completion. No matter what method you decide to use, you must submit the forms before you get your first salary.

Apply for a job

To assess job candidates, businesses use form for application forms. These forms aid in creating an accurate picture of the candidate’s education and work experience.

When filling out applications for jobs, it will require you to submit the information regarding your personal details and contact details. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

On paper or online Applications for jobs can be submitted. Your application should be easy to read and contain all required information.

A qualified expert should always be consulted before submitting a job application. This will ensure you do not include any material that is illegal.

Many employers keep applications in file for a while. Employers then have the option to contact candidates about forthcoming openings.

Your entire name, address, and email are often asked for on application forms for jobs. This is the most preferred method for applicants to be contacted by companies.