New Hire Employee Tax Forms – If you are looking to hire new staff members, you may need to fill out several documents such as W-4 or I-9 forms. These documents are needed to confirm that your staff is legally able to operate in the United States. This article contains all of the forms you will need.

In the past, checks

Employers may use several background checks to determine which candidates to hire. These checks include verifications of educational, credit, identification and motor vehicle record checks. These checks confirm that the person applying for employment is the person they claim to be been and meet the requirements of the job.

Background checks are an effective tool to protect the business, its customers and employees. Bad driving habits, criminal convictions and speeding tickets could all be red flags. Indicators of occupational danger, such as violence, could also be present.

Many businesses will use an outside background investigator company. They’ll have access to an information database from all 94 federal courts in the United States. Some businesses wait for a conditional offer of employment prior to conducting background checks.

Background checks may take a while. Employers should create an inventory. It’s important that applicants have enough time to reply. Five business days is the standard amount of time required to receive a reply.

Formulation I-9

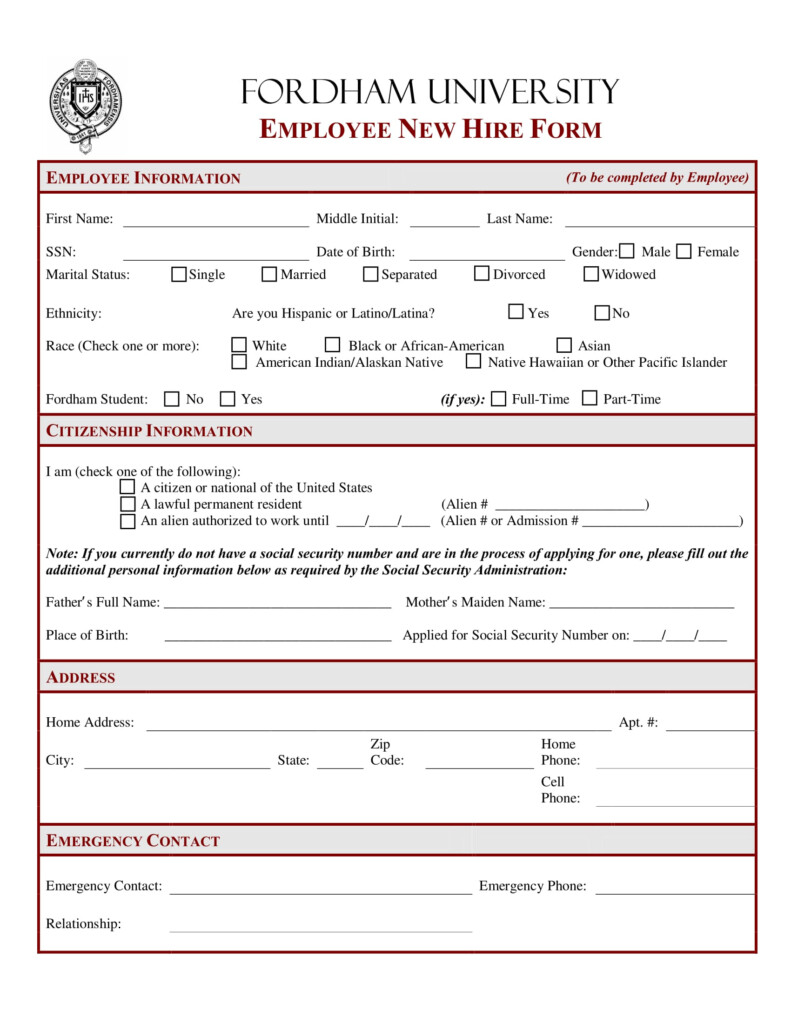

Every employee has to fill out the I-9 form at least once upon becoming an employee who is new. State employees and federal contractors must follow the rules. This can be complicated and long-winded.

There are many components of the form. This is the most essential and must be completed before you start working. If you are planning to hire foreign nationals, this includes the identifying details of those hired.

After you have completed Section 1, you should make sure that the rest of the form has been completed in time. Additionally it is important to note that the Form I-9 must be kept on file for 3 year from the day you started your employment. It is mandatory to continue paying the required fee of 6A.

Consider the various ways to reduce your risk of being a victim as you fill out your Form I-9. First, make sure that each employee is included on the database E-Verify. Additionally, it is crucial to submit your donations and administrative costs on-time.

Formulas W-4

The W-4 form is one the very first forms that new employees need to fill out. On this form it is possible to look up the tax deduction they receive from their pay. People can also use it to understand the tax obligations they face. If they are aware of the tax deductions earned from their earnings it is possible to get a larger check.

It is vital because it informs employers of the amount to deduct from employees’ pay. This information will be utilized for federal income tax purposes. It can be beneficial to keep the track of your withholdings in order to steer clear of unexpected shocks later on.

The simple form W-4 includes your name, address and any other information that may have an impact on the federal income tax returns. Making an effort to correctly complete the form might help you avoid overpaying.

There are a variety of methods to fill out the W-4. It can be submitted online as well as printing and manual filling. Whichever method you decide to use you need to complete the forms before you get your first paycheck.

Make an application for a job

Employers make use of applications for jobs to evaluate potential applicants. They can be used to create an accurate picture of the applicant’s educational background and work experiences.

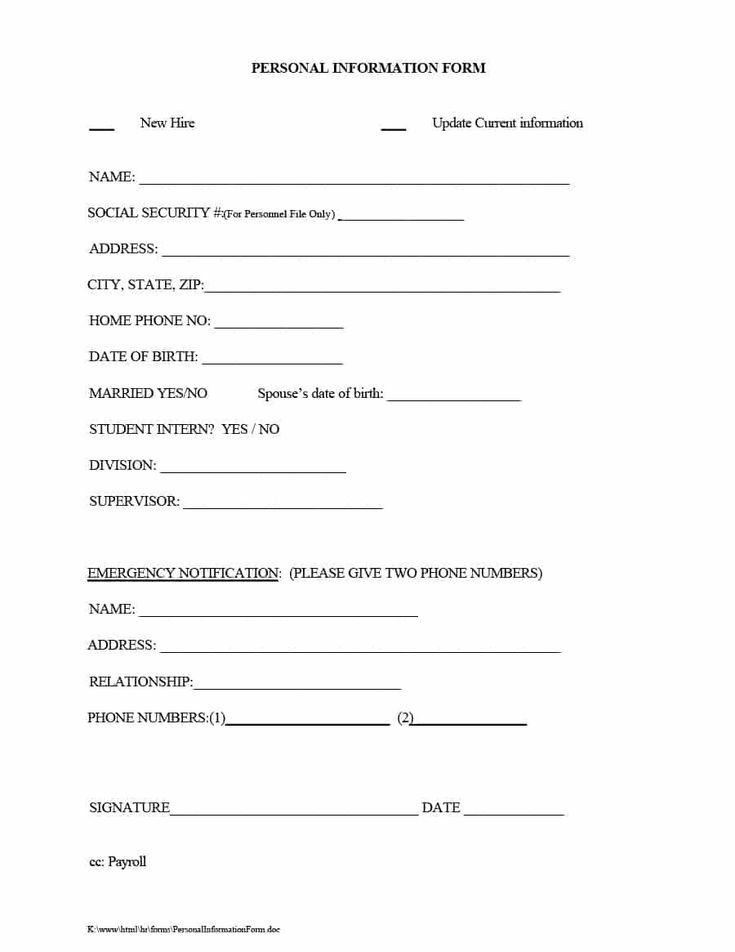

When you submit an application form, personal information such as contact details, is required. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Job applications can be made online or in writing. The application form must be simple to read and include all necessary information.

Before applying for an employment opportunity, talk to a certified expert. This will ensure that the job application is not filled with illegal content.

Many companies maintain applications on file for a while. Employers can contact candidates to discuss potential open positions in the near future.

Many applications for jobs require your complete name address, email, and postal address. These are the main methods used by companies to reach out to potential candidates.