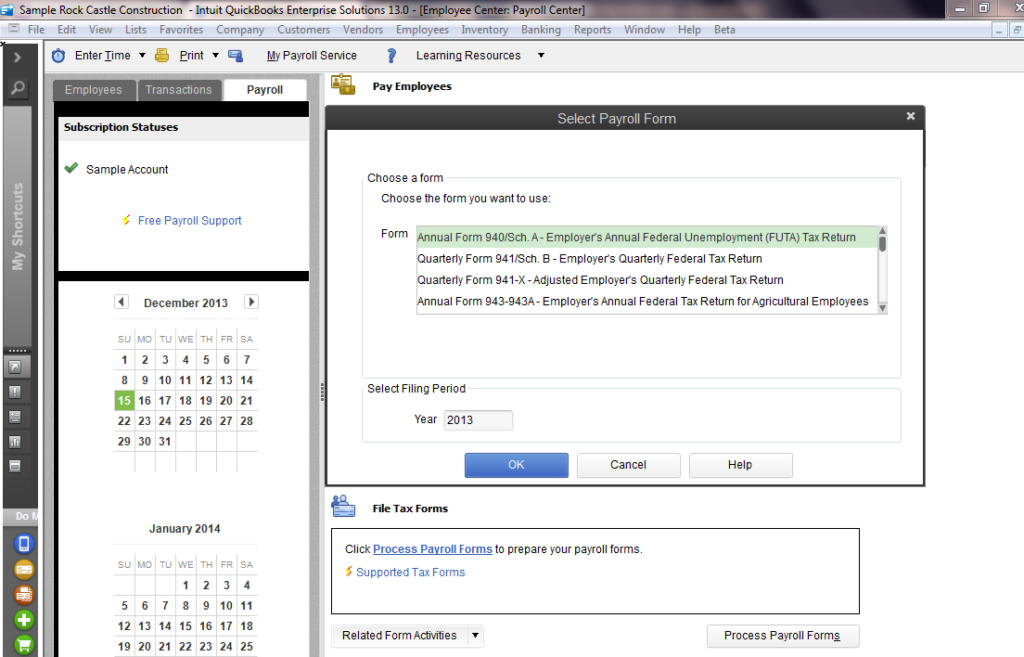

Quickbooks New Employee Forms – There are a number of documents you need to complete when hiring new staff. They include W-4 as well as I-9 forms. These forms are essential to ensure that your employees have the legal right to work in America. This article includes all the forms you will need.

Checks that were written in the past

Employers may conduct a range of background checks before deciding who to hire. There are many background checks that employers can conduct to determine who they will hire. These include credit verifications, identification checks as well as motor vehicle record checks. These checks are performed to confirm that the candidate is honest about their qualifications and also to verify that they have met the qualifications for the job.

Background checks are an excellent option to protect your business, its customers and employees. Speeding fines, criminal convictions and driving violations are a few of the warning signs that might be that a person’s history may reveal. Indicators of occupational danger including violence might exist.

The majority of businesses will contract a third-party firm to conduct background checks. They now have access to a database of records from all federal courts across the United States. Some companies prefer waiting until a conditional offer is made before conducting background checks.

Background checks can take a long time. Employers should have an inventory of questions. It is also important to allow applicants sufficient time to respond. It takes five business days for an average response.

Form I-9

When a recruit is hired, every employee must fill out the I-9 form. Federal contractors as well as state employees must fill out the I-9 form. The procedure can be lengthy and tiring.

There are many components to the form. The most basic part must be completed before you start working. This includes the employer’s identifying information as and the worker’s specific information.You intention be instructed to show the proof of a foreign citizen’s ability to work in the United States if you intend to employ the person.

You must ensure the completion of Section 1 is on time. Keep the Form I-9 required for your hire date for a period of three years. You should continue to make the required payments on Form 6A.

As you fill out your Form I-9 , you should think about all ways you can reduce your risk to being a victim of fraud. To begin with, ensure that each employee is included in the E-Verify Database. It is crucial that you send in any contributions or administrative expenses.

Forms W-4

The W-4 form is one of the first documents that new employees need to fill out. The form reveals the amount of tax deducted from their salary. This is also a good page to learn more about your tax liabilities. An understanding of the deductions that the government makes to their income could aid them in getting a larger pay.

W-4 is vital because it gives businesses instructions on the amount to deduct from wages paid to employees. The data will be used to calculate federal income tax. It might be helpful to keep an eye on your withholdings in order to steer away from unexpected surprises in the future.

The W-4 form is easy to fill out and contains your name, address and other data that could influence the federal income tax you pay. Making an effort to correctly fill in the form can save you from paying too much.

There are a variety of variations to the W-4. It can be submitted online in addition to printing and manual completion. No matter how you submit the form ensure that you complete all forms and documents before receiving your first pay check.

Apply for an opening

For evaluating job applicants Employers use forms to evaluate job applications. These forms help to create a clear picture of the candidate’s education and experience in the workplace.

If you complete a job application form, your personal information including contact information is required. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

If you are online or using paper You can submit an application for an employment. The application should be simple to read and contain all information required.

Before applying for an opportunity, it is recommended to seek out a professional who is qualified. This will help you ensure your application doesn’t contain untrue information.

A lot of companies keep applications in their files for a time. Employers may contact applicants to inquire about opportunities in the future.

On job application forms on job application forms, your full name address, email, and phone number are required. This is usually one of the best methods for employers to contact candidates.