Wisconsin New Employee Tax Forms – It is possible that you will need to fill out various forms when you hire new employees for example, I-9 and W-4 forms. These documents are needed to prove that your employees have the liberty to work within the US. This article provides all the forms you will need.

Checks that were written in the past

Employers could use a variety of background checks to determine the people they’d like to hire. These checks include verifications of educational, credit, identification and motor vehicle record checks. These checks verify that applicants have authentic identities and are able to meet the requirements of the position.

Background checks can help safeguard employees and clients and the business. Candidates’ past criminal convictions such as speeding tickets, traffic violations, and poor driving habits could all be warning signs. Possible indicators of occupational risk like violence could also be present.

The majority of companies will employ a third-party background investigation firm. They’ll be able to access an information database from all 94 federal courts in the United States. Some businesses prefer waiting until they have received an employment contract with a conditional offer prior to doing a background check.

Background checks could be lengthy. Employers must create an inventory. Employers should give applicants sufficient time to get a response. The average wait for a response to an application is five days.

Formula I-9

Every employee must complete the I-9 form at least once when they are an incoming employee. Federal contractors as well as state employees must comply. This can be complicated and time-consuming.

There are many parts of the form. The first section is essential and should be completed by you before you start working. This section includes both the information of the employer as well as the information of the worker. If you are going to employ someone from outside the country You will need to prove that they have the legal right to work in the United States.

After you have completed Section 1, it is essential to fill out the rest of your form on time. The required Form I-9 should also exist on file for 3 years from the date of your hiring. It is mandatory to continue paying the required 6A fees.

Think about the numerous ways you can lessen your vulnerability to fraud as you fill the Form I-9. It is important to ensure that all employees are registered to the E Verify database. The cost of administrative and donations should be submitted on time.

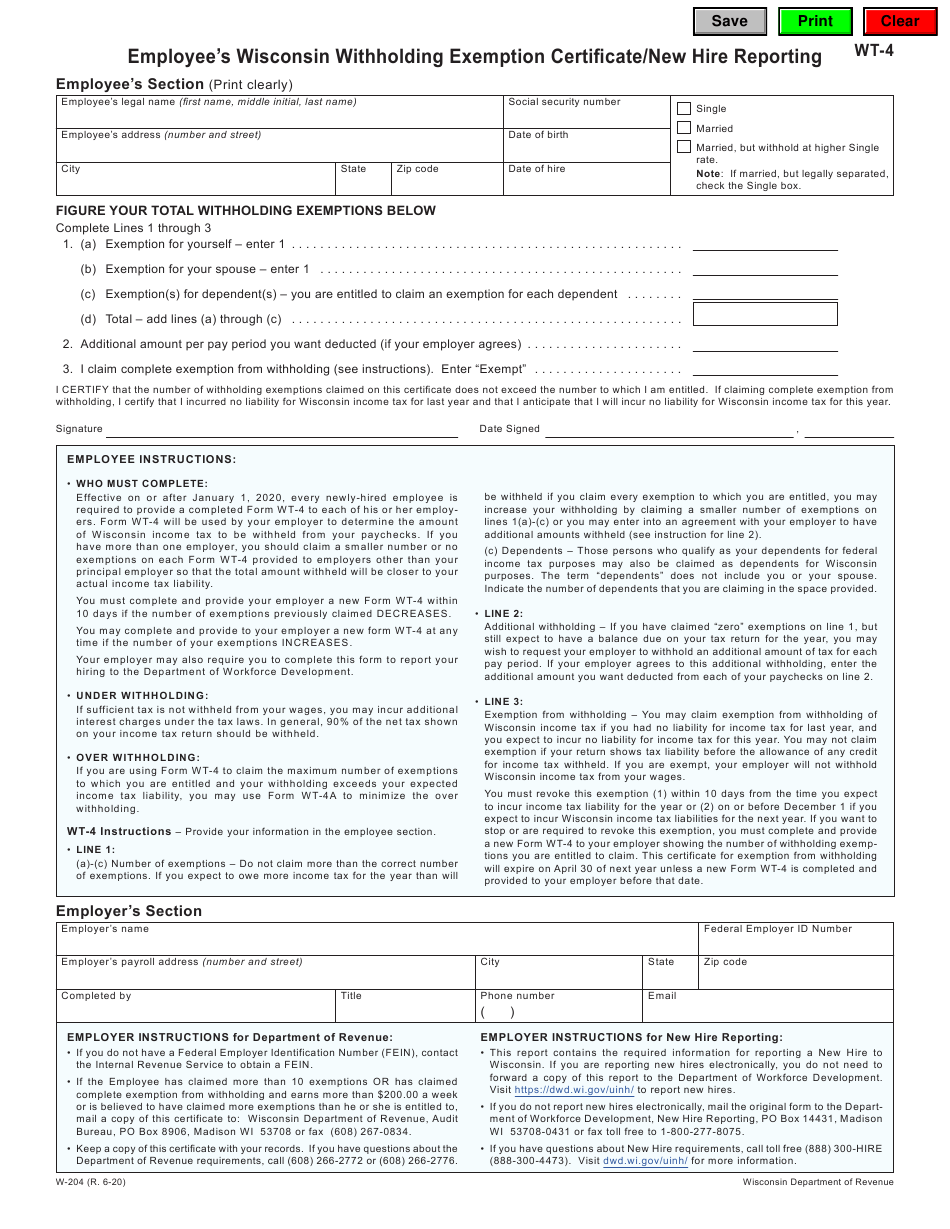

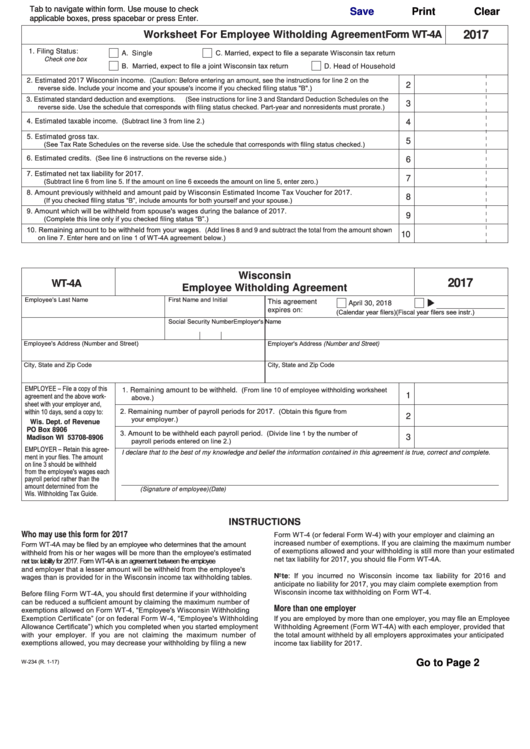

Formulas W-4

One of the first forms new employees will need to fill out is the form W-4. The W-4 form will show the amount of tax taken out of their pay. People can also use it to learn more about the tax obligations they face. With a better understanding on the tax deductions earned from their earnings and expenses, they could be able to receive a bigger check.

W-4 is crucial as it gives guidance to businesses about what amount they should deduct from employees’ pay. Federal income taxes are calculated based on this information. To avoid unexpected surprises later, it might be helpful to keep track of your withholding.

The simple W-4 is a simple form. W-4 includes your name, address as well as other information that could affect your federal income tax. It is possible to avoid paying too much by taking the time to complete the form in a timely manner.

There are several variations of the W-4. You can submit the form online, or print it and then manually fill it manually. Whatever method you chooseto use, make sure you complete the form prior to receiving your first salary.

Apply for a job

Forms for job applications are used by businesses to evaluate the qualifications of applicants. They aid in creating an accurate representation of the applicant’s academic background as well as professional experience.

Your personal details, including contact information and other information will be requested when you complete an application form. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Paper or online, job applications can be made on paper or online. You must make your form simple to comprehend and include all the required information.

When you are applying for an employment opportunity, consult a qualified expert. You can ensure that you’re not sending any illegal content through this.

A lot of companies keep applications for a period of time. Employers can then call potential candidates to discuss openings for the future.

On job application forms on job application forms, your full name address, email address, and phone number are required. This is one of the most commonly used ways companies reach candidates.