Tax Form For New Employee Nz – There could be a variety of paperwork you must complete when hiring new staff. They include W-4 as well as I-9 forms. These forms are required to confirm that your staff is legally able to operate in the United States. The forms you’ll require are provided in this post.

Checks from the past

Employers can conduct a variety of background checks to determine who they want to employ. The verification of education, credit, and identification are a handful of these and so are the checks for motor vehicle records. These checks verify that the applicant is the person they claim to have been and that they meet the requirements for the position.

Background checks could be useful to defend the business and its customers as well as the employees. A candidate’s criminal record, driving records that are poor, or speeding penalties are just a few examples of red flags that could be raised. Possible indicators of occupational risk like violence could also be present.

The majority of businesses will hire a third party firm to conduct background investigations. They’ll now have access to the information of all of the 94 United States Federal Courts. Some businesses decide to not conduct background checks until they reach the stage of conditional employment offers.

Background checks could be lengthy. Employers need to compile an outline. It is crucial that applicants have sufficient time to reply. The average response time is 5 business day.

Formulation I-9

Every employee must complete an I-9 form every time they hire. State employees and federal contractors must follow the rules. The process can be long and tedious.

The form consists of multiple sections. The most basic section must be completed when you begin your job. This covers both the employer’s identification as well as the worker’s relevant information. You must show proof that a foreign national is authorized to work in the United States if you want to employ the person.

After you have completed Section 1, make sure that the rest of the form is completed by the deadline. The necessary Form I-9 should also exist on file for 3 years after the date of hiring. It is necessary to continue paying the Form 6A fees.

It is important to think about the many ways you can decrease your risk of fraud while you fill out your Form I-9. In particular, you need to make sure that each employee is included in the E-Verify database. You should also send in all contributions and administrative expenses in time.

Formulas W-4

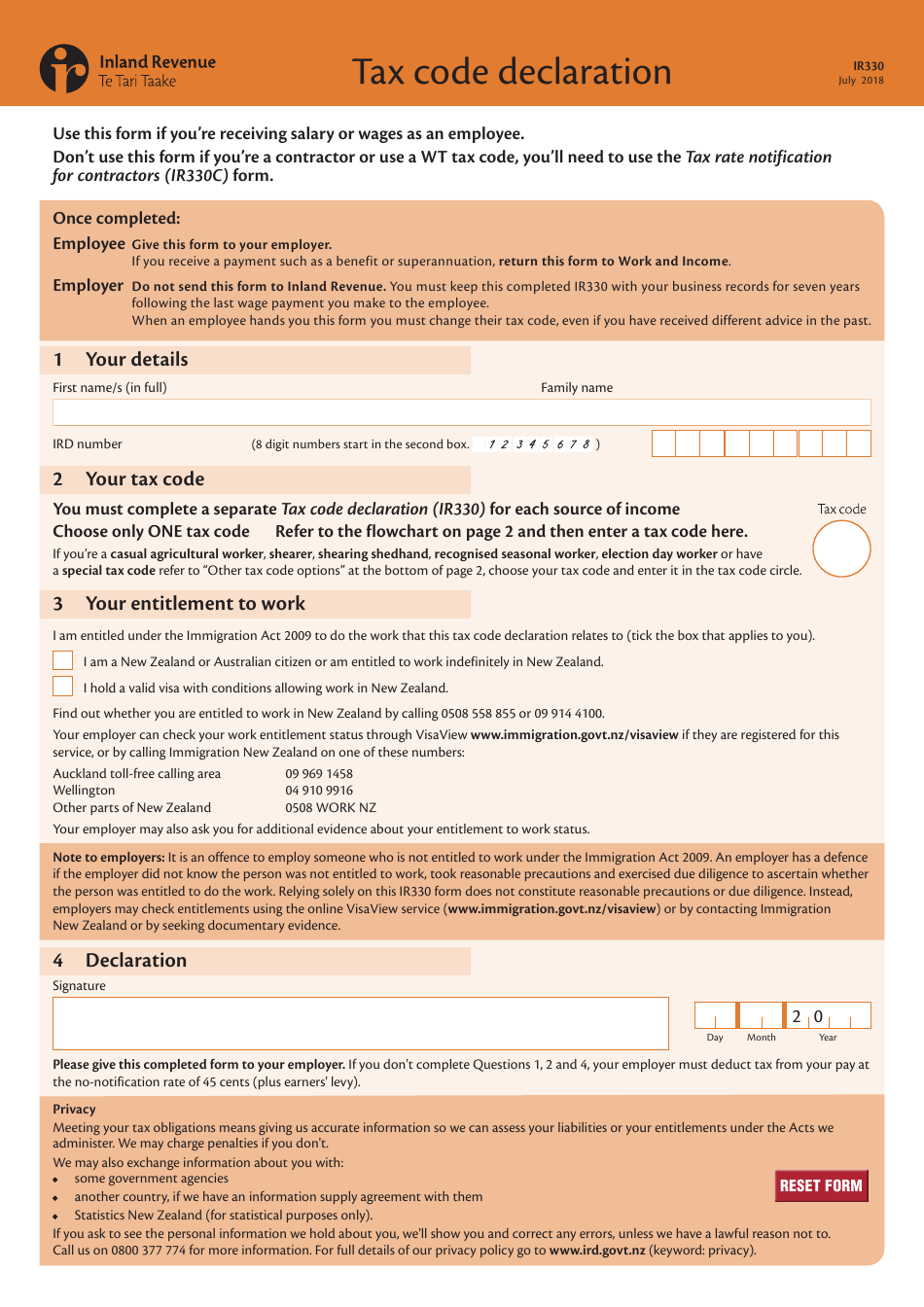

The form W-4 is one the first documents that new employees must fill out. On this form, you can be able to see the amount of tax taken from the wages. This is also a good page to get more information regarding your tax obligations. They could be eligible to receive a larger check if they have a better understanding of the deductions the government can make on their earnings.

The W-4 is important as it informs businesses of how much to subtract from the wages of employees. This data will be utilized for federal income tax purposes. To avoid any surprise tax bills, it can be beneficial to keep track of how much you are able to deduct.

The W-4 forms include your address and name, and any other details that might affect the federal income taxes you pay. You can avoid overpaying by taking the time to complete the form correctly.

There are a variety of variations of the W-4. It is available online for submission as well as printing and manual filling. Whatever method you select to use it is essential that you fill out the paperwork before your first salary.

Looking for an employment

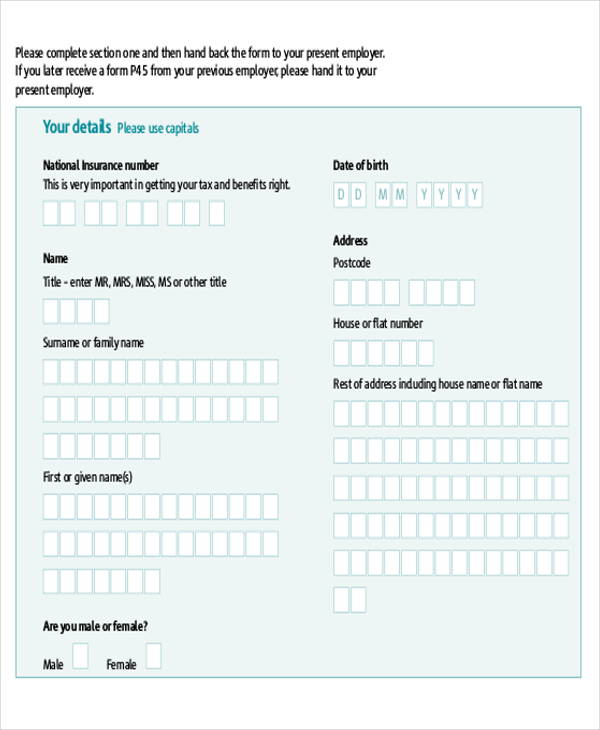

Employers use job application forms to applications to evaluate the qualifications of applicants. These forms help to create a clear picture of the applicant’s educational background and experience in the workplace.

You will need to submit the personal details and contact information when filling out a job request form. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

If you are online or using paper You can submit an application for a job. The application form must be easy to read and contain all necessary information.

When you are submitting your job application, make sure to speak with a certified professional. You can ensure that you’re not submitting illegal content through this.

Many employers keep their applications on file for a long time. Employers may then contact potential candidates to discuss openings for the future.

Your entire address, name, and email are often required on forms for job applications. These are the techniques companies most frequently employ to reach out to candidates.