New Employee State Tax Forms – There may be a range of documents that you have to complete when hiring new employees. This includes W-4 and I-9 forms. These documents are essential to make sure that your staff can legally work in the US. This article will give you all the required forms.

Checks that were written in the past

Employers may conduct a range of background checks before making a decision on who to employ. There are many background checks employers can do to decide who they want to hire. This includes ID checks, credit verifications, and motor vehicle record checks. These checks verify that an applicant is truly who they claim to have been and meet the requirements of the position.

Background checks are a valuable tool in protecting the company, its clients, as well as its employees. Criminal convictions, speeding fines and driving violations are just a few possible red flags that could be present in a candidate’s past. Signs of occupational danger or violence might also be present.

Businesses will often hire background investigators from third-party companies. They will have access to a database of data from all federal courts across the United States. Some businesses choose to wait until they have reached the stage of a conditional job offer prior to conducting a background screening.

Background checks might require a long time. Employers should make an inventory. It is essential to give applicants enough time to respond. It takes five days to get an average response.

Formulation I-9

If they’re a new employee, they has to fill out an I-9 form. Federal contractors as well as state employees are required to fill out the form. However, the procedure might be time-consuming and difficult.

There are many components of the form. The first one is crucial and must be filled out by you prior to beginning working. This covers both the employer’s identification and worker’s pertinent information. It is necessary to provide proof that the person is allowed to work in the United States, if you wish to employ them.

After you have completed Section 1, it is important to complete the remainder of the form in time. It is also important to save the Form I-9, which you need for employment purposes to be on file for at least three years. It is necessary to keep paying Form 6A dues.

Think about the numerous ways you can decrease your vulnerability to fraud when filling the Form I-9. In the beginning, make sure that each employee is included on the database E-Verify. Administrative and donation costs must be paid on time.

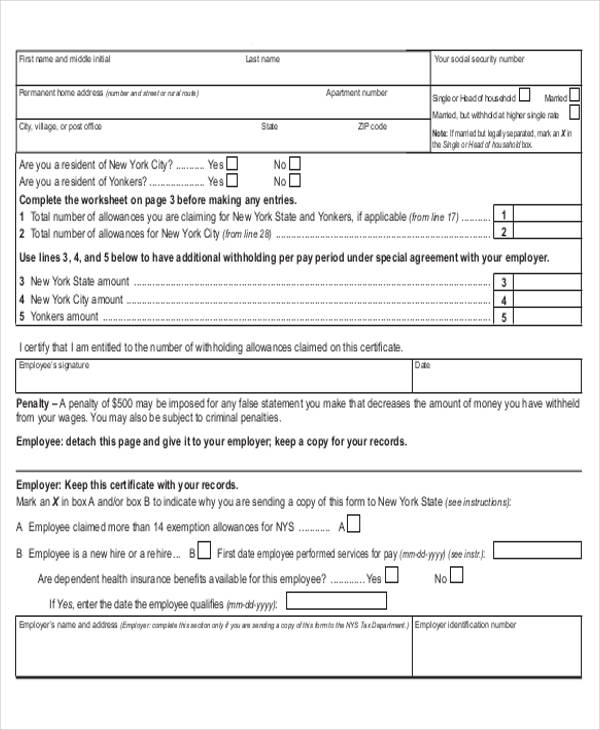

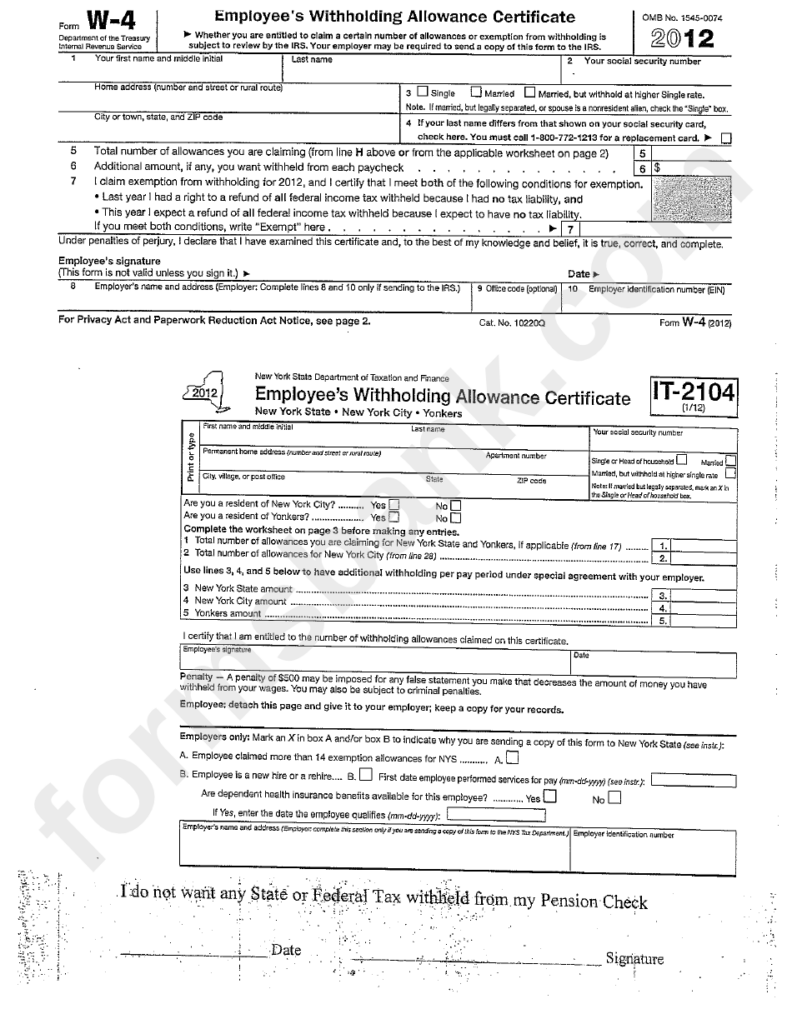

Formulas W-4

W-4 forms are among the most crucial documents new employees will need to complete. On this form, you can be able to see the amount of tax taken from the wages. This page can be used by anyone to find out more about the tax obligations they have to meet. With a better understanding on the tax deductions made from their income, they might be able receive a bigger check.

Since it instructs companies on how much to deduct from employee’s paychecks The W-4 is vital. This information will help calculate the federal income tax. It is possible to keep track of your withholding in order to avoid unexpected surprises later on.

The W-4 form is straightforward and will include your name, address and other information that can have an impact upon the federal income tax you pay. Making the effort to accurately complete the form might aid you in avoiding overpaying.

The W-4 can be found in a variety of variations. It is both feasible to submit the W-4 online, print it or fill it out manually. Whatever method you chooseto use, make sure that you complete the form prior to receiving your first paycheck.

How to apply for an employment

Forms for job applications are utilized by companies to assess the qualifications of applicants. They aid in the creation of a detailed picture of the applicant’s education background as well as professional experience.

The application process will require you to submit the information regarding your personal details and contact details. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Online or on paper, job applications are accepted on paper or online. It is essential to make the form simple to comprehend and include all the required information.

Before submitting a job request It is recommended to seek out a professional who is qualified. This will help you ensure your application does not contain untrue information.

A lot of companies keep their applications on file for quite a while. Employers may contact applicants to discuss future openings.

On job application forms the complete name, address, email, and phone number are required. These are the preferred methods for applicants to be contacted by employers.