Indiana Tax New Employee Form – There is a chance that you’ll need to fill out several documents, like W-4 and I-9 forms, when you employ new staff. These forms are required to confirm that your staff is legally able to operate in the US. This article provides all the necessary forms.

Checks from the past

Employers can perform a variety of background checks prior to making a decision on who to employ. You can check your educational background, credit history and your identity. These checks confirm that an applicant is truly the person they claim to have been and that they meet the requirements of the position.

Background checks are a fantastic method to safeguard the business, its customers and employees. Criminal convictions, speeding tickets and bad driving habits are just a few potential red flags in a candidate’s past. The indicators of danger in the workplace, such as violence, might exist.

The majority of companies will employ a third-party background investigation firm. They now have access to the database of all 94 United States federal courts. Some companies prefer to wait until they have received an employment contract with a conditional offer prior to doing a background check.

Background checks can be lengthy. Employers must compile an outline. It is essential to give applicants enough time to respond. The typical time for response to a request is five days.

Formula I-9

Every employee must fill out the I-9 form at least once when they are a new recruit. Federal and state employees as well as contractors must follow the rules. However, the procedure could be lengthy and complicated.

The form is made up of several sections. The most crucial one is and must be completed prior to you start your job. If you are planning to hire foreign nationals, this includes the identifying details of those hired.

After you’ve completed Section One ensure that the remainder of the form is completed. Keep the required Form I-9 on file for three years beginning with the date of hire. It is mandatory to continue paying the required 6A fees.

As you fill out your Form I-9 , you should think about all ways you could reduce your vulnerability to fraud. First, make sure that each employee is included on the database E-Verify. Additionally, it is crucial to submit your donations and administrative expenses on time.

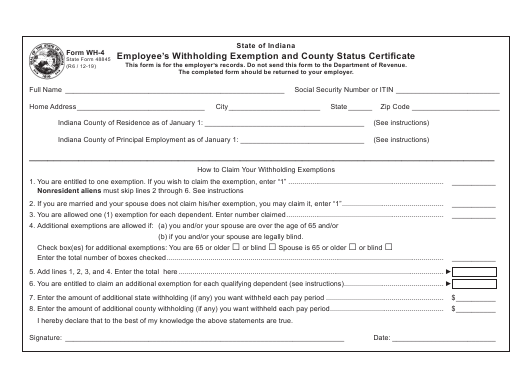

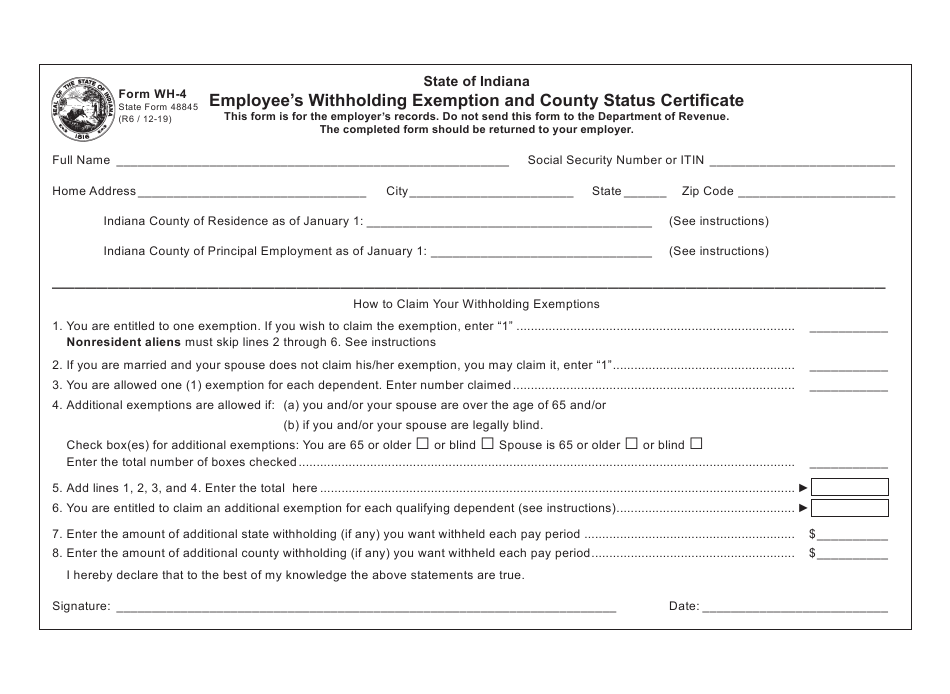

Formulas W-4

The W-4 form is among the first documents new hires complete. This form lets you see how much tax was taken out of the salary. It can also help individuals to know their tax liabilities. An understanding of the deductions the government can make to their income could assist them in getting a larger pay.

Since it instructs companies on the amount to deduct from employee’s paychecks, the W-4 is vital. Federal income taxes are calculated using this data. It is a good idea to keep the track of your withholdings so that you can stay away from unexpected surprises later on.

The W-4 is a simple form that lists your address, name along with any information that might have an impact on federal income taxes. To avoid paying too much, be sure to fill out the form correctly.

The W-4 is available in a range of forms. You can submit the form online or print it out and manually fill it. Whichever method you decide to use, make sure that you complete the paperwork prior to receiving your first paycheck.

Apply for an opening

Companies use job applications to select candidates. They assist in creating a precise image of the applicant’s educational background and professional experiences.

If you fill out a job application form, your personal information including contact information is required. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Job applications can be submitted via the internet or in person. It is important that your application be clear and succinct.

Before you submit your job application, ensure that you consult a qualified professional. This will help you ensure your application doesn’t contain any illegal information.

A lot of companies keep applications on file for a period of time. After that, employers are able to contact candidates about potential future openings.

On the forms used for job applications On job application forms, it is standard to ask for your complete name, address and email. These are the techniques companies most frequently employ to contact candidates.