New York State Employee Forms – When you hire new staff it is possible that you will be asked to complete a number of documents , such as I-9 and W-4 forms. These documents are needed to prove that your employees have the liberty to work in the US. This article will cover the forms you’ll require.

In the past, checks were used to make

Employers can perform a variety of background checks prior to selecting the person to hire. There are numerous background checks that employers can conduct to determine who to hire. These include credit verifications, identification checks as well as motor vehicle record checks. These checks verify that an applicant is truly the person they claim to be been and that they fulfill the requirements for the job.

Background checks are a great way to protect clients and employees and the business. Poor driving habits, speeding tickets, and convictions for criminality are some of the warning signs that may be present in a person’s past. It is also possible to find signs of risk in the workplace, such as violence.

A lot of businesses will employ an independent background investigation firm. They’ll have access to an information database of all 94 federal courts in the United States. Some companies wait for an employment contract with a conditional clause before conducting background checks.

Background checks can take time. Employers need to have an agenda of questions. It is also important to allow applicants sufficient time to answer. The typical time for response to a request is five days.

Formula I-9

Each employee must complete the I-9 form at least once when they become an employee who is new. State employees and federal contractors must follow the rules. It can be tedious and time-consuming, but it is not impossible.

The form is divided into many sections. The first one, which is the most important, must be completed before you begin working. If you are planning to employ a foreign national the section must include the contact information for the employer as well as the relevant details.

After you have completed Section 1, you should make sure the rest of the form was completed by the deadline. In addition it is important to note that the Form I-9 must be kept on file for three years after the date you were hired. It is also necessary to pay Form 6A-related fees.

When filling out your Form I-9 , you should think about all ways you could reduce your vulnerability for fraud. You should ensure that all employees have been added to the E Verify database. Donations and administrative costs should be made promptly.

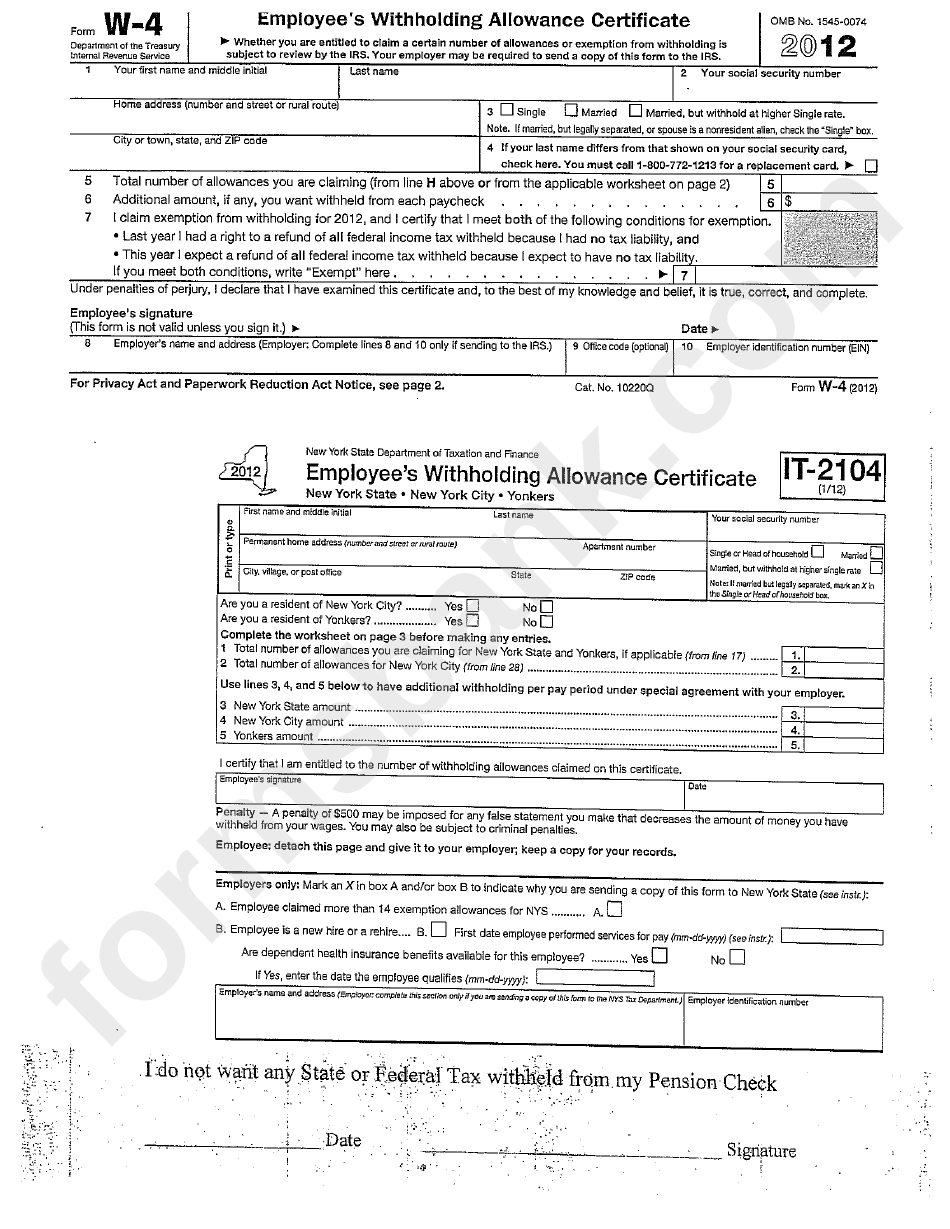

Forms W-4

The W-4 form is one the first documents that new employees need to fill out. On this page you will see how much tax was taken from the pay. This page can be used to help individuals understand their tax liabilities. If they can understand the tax deductions that the government can take from their earnings, they may be eligible for a bigger amount.

W-4 is critical because it provides guidelines to companies on what amount they should take from the wages of employees. The information provided will aid in calculating federal income tax. In order to avoid surprises, it may be helpful to keep track the amount you deduct.

The W-4 is a simple form that contains your address, name and any other information that could have an impact on federal income tax. You can avoid overpaying by taking the time to complete the form correctly.

There are a variety of variations to the W-4. Online submission is possible and manual printing. Whatever method you select, you must submit the forms before you get your first salary.

Apply for a job

Employers use application forms to screen candidates. They help in creating an accurate picture of an applicant’s educational background and professional experience.

When you complete a job application, your personal and contact information are required. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Job applications can be submitted on the internet or via post. It is important to make sure that your application is clear and concise.

When you are applying for an opportunity, it is recommended to talk to a certified expert. This will allow you to ensure your application doesn’t contain illegal information.

Many companies keep applications in their files for a time. Employers can contact candidates to discuss potential open positions in the near future.

On job application forms on job applications, you’ll often be requested to supply your full name address, postal address, and email address. This is one of the most commonly used methods employed by companies to contact applicants.