New Employee Forms Indiana – There is a chance that you’ll have to fill out several documents, such as W-4 and I-9 forms, when you employ new staff. These forms are required to confirm that your employees are granted liberty to work within the US. The forms you’ll need are covered in this article.

In the past , written checks were issued.

Employers may conduct a variety of background checks to select the most suitable candidate to employ. There are many background checks employers can do to decide who they want they will hire. This includes identity checks, credit verifications as well as motor vehicle record checks. These checks are done to make sure an applicant is the person they say they are and they satisfy the requirements for the job.

Background checks can be beneficial in defending the company and its customers as well as the employees. Criminal convictions, speeding fines and driving violations are a few of the possible red flags that could be present in a candidate’s past. Possible indicators of occupational risk or violence may also be present.

The majority of businesses employ an independent background investigation firm. The background investigation firm will have access to all the information available from all 94 U.S. federal courts. However, some businesses decide to wait until the stage of a conditional job offer before conducting a background screening.

Background checks could take quite a while. Employers should create a list of inquiries. It is crucial to give applicants ample time to reply. The standard time to receive an answer is five business days.

Formulation I-9

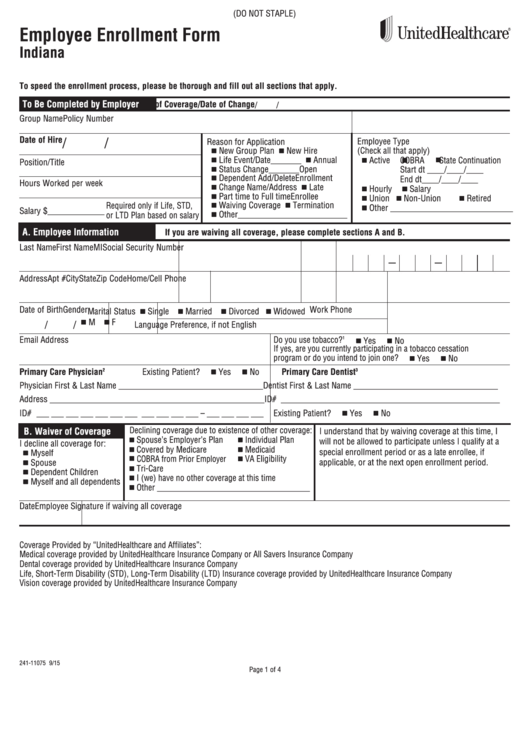

Every employee must fill out the I-9 form at least once upon becoming an employee new. Federal contractors and state workers must complete the I-9 form. The procedure can be lengthy and tiring.

There are many parts of the form. The most basic part must be completed prior to the start of your job. If you intend to hire an international worker the section must include the details of the employer, as well as the relevant information.

It is important to ensure that the remainder of the form is finished on time following the completion of Section 1. Additionally you must ensure that the Form I-9 must be kept in file for a period of 3 years from the day you started your employment. It is necessary to keep paying Form 6A fees.

When filling the Form I-9, you should consider all the ways you could reduce your vulnerability to being a victim of fraud. You should ensure that all employees are registered to the E Verify database. Additionally, it is crucial to send in your donations and administrative expenses on time.

Forms W-4

W-4 forms will be the first form that new employees must fill out. This page shows the amount of tax deducted from their salary. This is also a good page to find out more on your tax obligations. If they are aware of the tax deductions earned from their earnings, they might be able receive a bigger check.

W-4 is crucial since it provides companies with guidelines on the amount to deduct from the wages of employees. The data can be used to calculate federal income taxes. You might find it useful to track your withholding in order to avoid unexpected surprises in the future.

The W-4 forms include your name and address as well any information that could affect your federal income taxes. Making the effort to accurately complete the form might aid you in avoiding overpaying.

There are numerous methods to fill out the W-4. You can submit the form online, or print it and then manually fill it manually. Whatever method you chooseto use, ensure that you submit the paperwork prior to the date you will receive your first salary.

applying for a job

Employers use applications to review the potential candidates. They help in creating an accurate representation of an applicant’s educational background as well as professional experiences.

If you fill out an application for a job the personal and contact details will be required. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Online or on paper, job applications are accepted on paper or online. The application should be simple to read and include all the required information.

A qualified expert should always be sought out prior to applying for a job. This will ensure that your job application doesn’t contain illicit content.

Many companies retain applications for a period of time. Employers can contact applicants to inquire about opportunities in the future.

Most job applications require your complete name, address, and email. These are the methods that companies most frequently employ for contacting candidates.