Contract Employee Form For Taxes – If you want to reduce the amount of interest and fines or the hassle of submitting tax returns for your employees, it’s crucial to be aware of how to deal with your employee tax forms. You have many choices to help you navigate the maze.

FICA employer contribution

The FICA (Federal Income Taxes), Social Security (Medicare taxes) are three taxes which federal law obliges businesses to deduct from employee paychecks. Every quarter employers are required to prepare a tax return for the employer. The tax are included in Form 941.

FICA, the federal income tax, is used to fund Medicare as well as Social Security. The primary part of the tax is the 12.4 percentage social security levy on employee earnings.

The Medicare tax is the second element of tax, is also called the Medicare tax. The Medicare tax is the second component. It does not have any upper wage base restrictions so the tax rate may fluctuate. Employers profit from this as they are able to write off their portion of FICA as business expenses.

For smaller businesses, Form 941 reports the employer’s share of FICA. The IRS employs this form to disclose information about tax taken out of an employee’s pay.

Quarterly tax return for employer

If your company is required to pay employment taxes It is important to know how to submit and complete Form 941. It provides information regarding your federal income taxes withholding and payroll taxes.

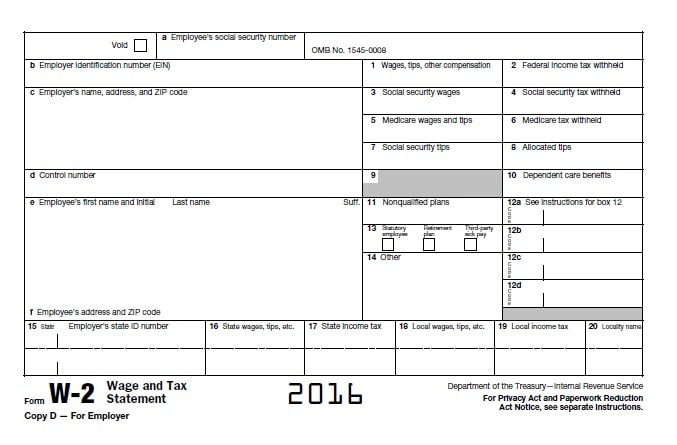

Every single one of the Social Security and Medicare taxes taken out of earnings by employees must also be disclosed. The total amount is similar to the amount reported on the form W-2. In addition, you must disclose the amount that each employee paid in tips.

In your submission, please include the name of your company as well as your SSN. It is also important to include the number as well as names of every worker employed in the period.

You’ll need to complete 15 lines on the Form 1040. Each line details the various aspects of your compensation. They include the number of workers who are paid, their wages, as well as their gratuities.

Annual return on investment for employers for agricultural workers

As you’re probably aware, the IRS Form 943 is a mandatory form if you operate an agricultural firm.This form is used to determine the appropriate amount of tax withholding for employees for agricultural employers. There are several important points to keep in mind while filling out the form. Online submissions are possible, however, you may need send it in person.

Utilizing professional payroll software is the best approach to maximizing the value of this tax form. A tax account must also be registered by the IRS. It is possible to expedite the process by making use of the Web Upload Service once you have a valid account number. Verify the account number prior to you deposit your money.

In the event of a non-reported income, it could lead to interest or penalties.

When you pay taxes, it is important to not underpay the government. In fact, underpaying your taxes is a bad decision that could cost you a significant amount of dollars. The IRS could impose fines on you if you do not pay.

To determine your debt, use Form 2210, which is provided by the IRS in case you’re not certain of the amount. Once you’ve submitted this form, you’ll have to learn if you qualify for an exemption. If you reside in a state with an extremely high tax rate or have a sizable amount of non-reimbursed expenses for work This could happen.

Calculators are also able to estimate your tax withholding. By using the IRS Tax Withholding Estimator, you can calculate your tax withholding.