Form W-3 Taxes Withheld Employee & Employer – It is vital to know the rules for employee tax returns for a better chance of avoiding interest, fines and inconvenience of making tax returns. There are numerous tools to help you navigate this maze.

FICA employer contribution

The FICA (Federal Income Taxes), Social Security (Medicare taxes) are the three taxes that federal law requires businesses to deduct from the wages of employees. Employers must submit a quarterly return detailing their tax obligations to their employers. These taxes are reported using the form known as Form 941.

The tax that is referred to as FICA is the source of funding for Social Security and Medicare. The first component is the 12.4% Social Security Levy on Employee Wages.

The Medicare tax, which is the second element of tax is called the Medicare tax. The Medicare tax is the second part. It does not have any upper wage base restrictions which means that the tax rate can fluctuate. This allows employers to write off FICA as business expenses.

The employer’s portion of the FICA is filed on Form 941, which is for small firms. The IRS employs this form to reveal information about taxes taken out of an employee’s pay.

Tax return for the quarter from the employer

If your company is required to pay employment taxes to be paid, you need to be aware of how to complete and submit Form 941. The federal income tax withholding and payroll tax are listed on the form.

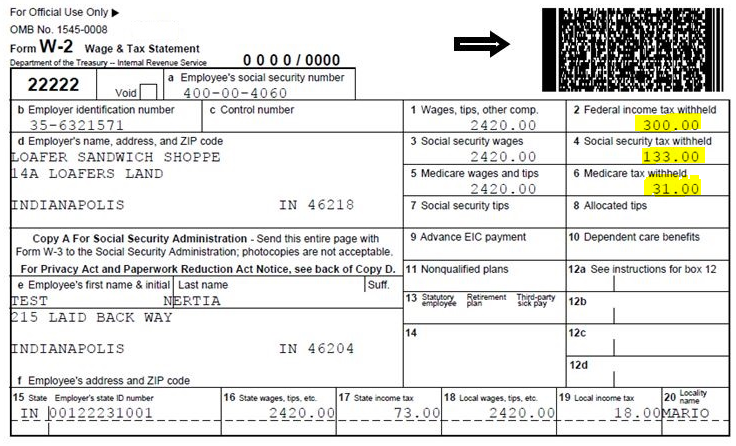

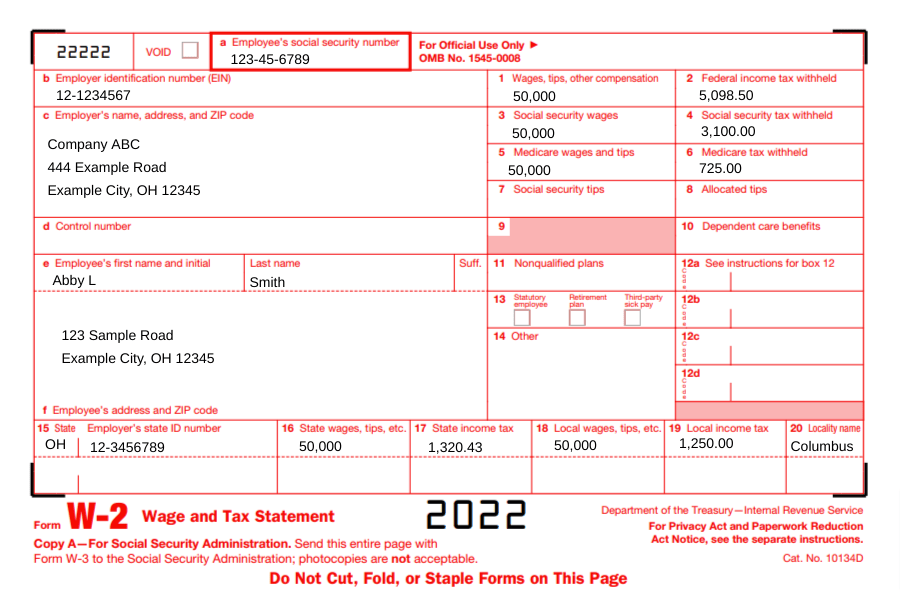

The whole amount of Social Security and Medicare taxes deducted from employee earnings must be declared. The amount reported will match that shown on an employee’s W-2. Additionally, it is necessary to disclose how much tips are paid to employees.

Your submission must include your company’s name and SSN. Include the number of employees you hired in the last quarter.

The form 1040 has 15 lines to be filled in. The different components of your remuneration are presented on each line. These comprise the number of employees you paid, their salaries, and their gratuities.

The annual return of workers from agriculture to their employers.

You are probably aware that IRS Form 943 has to be completed if you run an agricultural business. The form is used to determine the amount of tax is withheld from employers of agricultural businesses. You should know a few particulars regarding this form. Although you can complete the form online, it is possible to mail it in if your computer doesn’t allow you to.

Professional payroll software is the most effective method to increase the value of your tax form. You will need to open an account with the IRS. Once you have an official account number and you are able to speed up your process by using Web Upload. Verifying the account number prior to depositing is a good idea.

Unreported earnings could be the cause of interest or penalties.

Making sure you pay taxes on time is vital. In fact, underpaying taxes is a risk which will cost you money. The IRS could impose fines on you if you underpay.

Use the Form 2210 of the IRS to calculate your debts if you’re unsure of how much you have to pay. After you’ve filled out this form, you’ll have to determine if you are eligible to receive an exemption. You might be eligible if you live or work in a highly taxed state.

To estimate your withholdings, you can use calculators. Utilizing the IRS Tax Withholding Expert you can do this.