South Carolina New Employee Tax Forms – There is a chance that you’ll need to fill out a range of documents, such as I-9 and W-4 forms, when you hire new employees. These forms are essential to ensure that your employees are legally able to work in the United States. The forms you’ll need to fill out are provided in this post.

Checks that were written in the past

Employers can conduct a range of background checks in order to choose the right candidate to hire. There are many background checks that employers are able to conduct to decide who they want to employ. These include identity checks, credit verifications as well as motor vehicle record checks. These checks verify that applicants are true to their identity and meet the requirements for the position.

Background checks can help in safeguarding the company as well as its customers as well as its employees. Criminal convictions, speeding tickets and bad driving habits are just a few possible red flags that could be present in the past of a candidate. Signs of occupational risk like violence could also be present.

Many companies will utilize a third-party background investigator firm. They now have access to the database of all 94 United States federal courts. Some companies prefer waiting until a conditional offer is accepted before conducting background checks.

Background checks can take a long time. Employers need to compile a list. It is crucial to give applicants ample time to reply. The standard time to receive an answer is five days.

Form I-9

Each employee has to fill out the I-9 form at least once while they are newly hired. Federal contractors as well as state employees are required to fill out the form. This could be difficult and lengthy.

There are many components to the form. The first section is essential and must be completed by you before you start working. The section contains both the employer’s information and the worker’s relevant information. If you intend to recruit someone from overseas, you will be asked to prove that they are legally able to work in the United States.

After you have completed Section 1, you should make sure that the rest of the form is completed in time. It is important to save the Form I-9, which you need for employment purposes to be on file for at minimum 3 years. You must continue to pay the required 6A fees.

While filling out Form I-9, be sure to think about the many ways you can decrease your risk to being a victim of fraud. In the beginning, make sure that each employee is included on the database E-Verify. Donations and administrative costs should be submitted promptly.

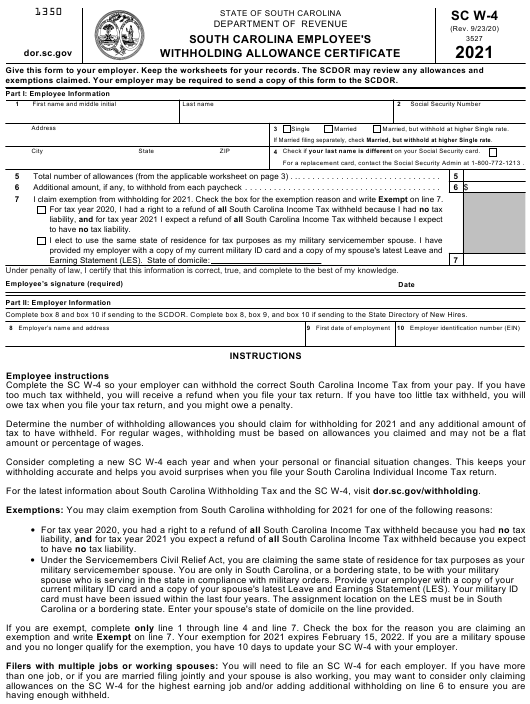

Forms W-4

The W-4 form will be one of the first forms new hires must fill out. On this form you will see the tax deduction from their salary. You can also use this page to find out more regarding your tax obligations. A better understanding of what deductions the government can make to their earnings can help them get a bigger amount of tax.

Because it instructs businesses on how much to take from the paychecks of employees In this regard, the W-4 is essential. This information will help calculate the federal tax rate. It is a good idea to keep an eye on your withholdings in order to stay clear of unexpected shocks in the future.

The W-4 forms contain your name and address along with any other details that might affect the federal income taxes you pay. It is possible to avoid paying too much by taking the time to fill out the form accurately.

The W-4 comes in a variety of variants. It can be filed online, printed and filled out manually. Whatever method you decide to use you need to complete the form before you receive your first paycheck.

Apply for an opening

Employers make use of applications for jobs to evaluate prospective applicants. They assist in forming an exact picture of the applicant’s academic background and professional background.

When you submit a job application, your personal and contact information are required. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Job applications can be submitted online or by post. Your application should be easy to read and contain all information required.

Before you submit an application for employment, you should seek out a professional who is qualified. You can be certain that you aren’t submitting any illegal content by following this.

Many companies store applications in their the file for an extended period of period of. Employers then have the option to contact applicants regarding the possibility of openings in the future.

Your entire name, address, and email are often required on forms for job applications. These are the most common methods companies use to reach candidates.