Walmart Employee Tax Forms – You need to be familiar about the procedures involved in submitting the tax returns of employees. This will allow you to avoid interest, penalties, and all of the hassle associated with it. There are numerous tools to help you navigate this maze.

FICA employer contribution

The Federal government requires that all employers deduct FICA, Social Security and Medicare taxes from their employees pay stubs. Every quarter, employers are required to submit a tax return for their employers. Taxes are reported on Form 941.

FICA The federal tax is the one that funds Medicare and Social Security. The 12.4 percent wage of employees social security levy is the first element of tax.

The Medicare tax is the second component of tax. The Medicare tax is the second element. It does not have any upper wage base limits which means that the tax rate can fluctuate. Employers can write off FICA to cover business expenses, which is a win-win for everyone.

For smaller businesses Form 941 is used to report the employer’s portion of FICA. The form is utilized for the IRS to give details on the tax withheld from the employee’s pay.

Tax return for the quarter for the employer

If your company has to pay employment taxes, it is important to understand how to complete and complete Form 941. Your federal income tax withholding and payroll tax are listed on the form.

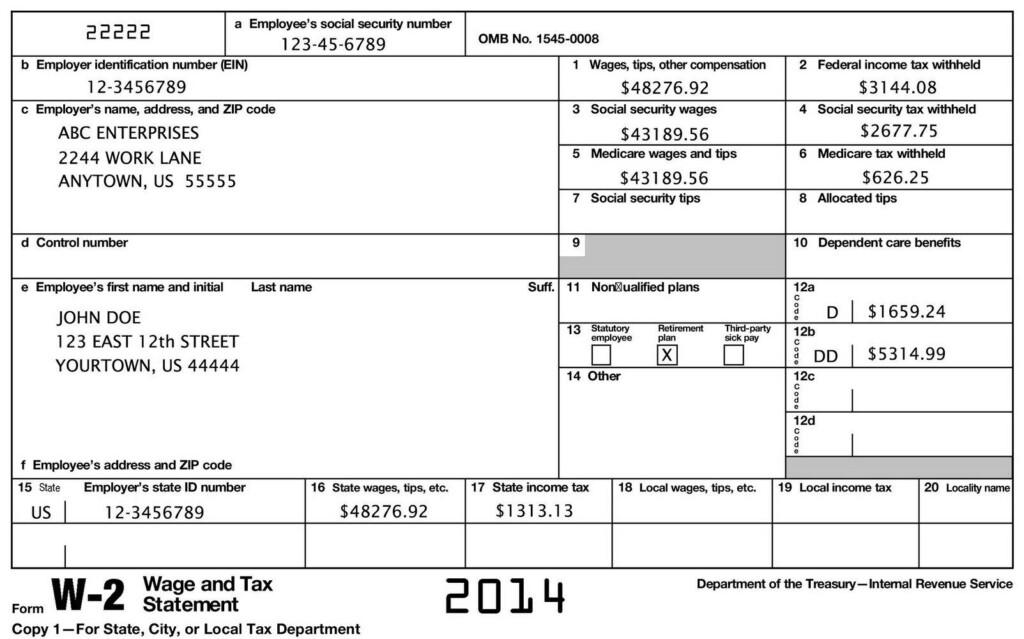

The whole sum of Social Security and Medicare taxes taken from earnings of employees must be declared. The sum here will match the sum shown on the employee’s W-2 form. It is also necessary to indicate how much the employee earns in tips.

The submission should include your business’ name as well as your SSN. Also, you must mention the number of employees employed by your company during the quarter.

It is necessary to fill in 15 lines on your Form 1040. The different elements of your remuneration are represented by each line. These are the employees you have paid, their salary and gratuities.

Farmers receive a salary each year from employers

You are probably aware that IRS Form 943 has to be filed if you own an agriculture firm. It is used to calculate how much tax you are able to withhold from agricultural employers. You need to be aware of a few specifics regarding this form. Online submissions are possible, however, you may need to mail it in.

The most effective way to maximize this tax form’s potential value is to use the most sophisticated payroll software. An account will be required to be registered with the IRS. Once you have an official account number and you are able to accelerate the process by using Web Upload. Before you depositmoney, verify the account number.

Underreporting income can lead to penalties and interest.

It is important to be cautious not to overpay the government when you pay your taxes. In fact, underpaying your taxes is a bad decision which could cost you a lot of money. If you are underpaid then the IRS could impose penalties. So, it is important to ensure that your withholdings and taxes are accurate.

Utilize Form 2210 from the IRS to determine the amount of your debts if you’re uncertain of the amount you are owed. Once you’ve submitted the form, you’ll be able to find out if qualified for the waiver. You may be qualified for a waiver if you reside in an area with high tax rates or significant expenses for work that aren’t reimbursed.

Calculators are also available to help you estimate your withholdings. By using the IRS Tax Withholding Estimator, you can estimate your withholdings.