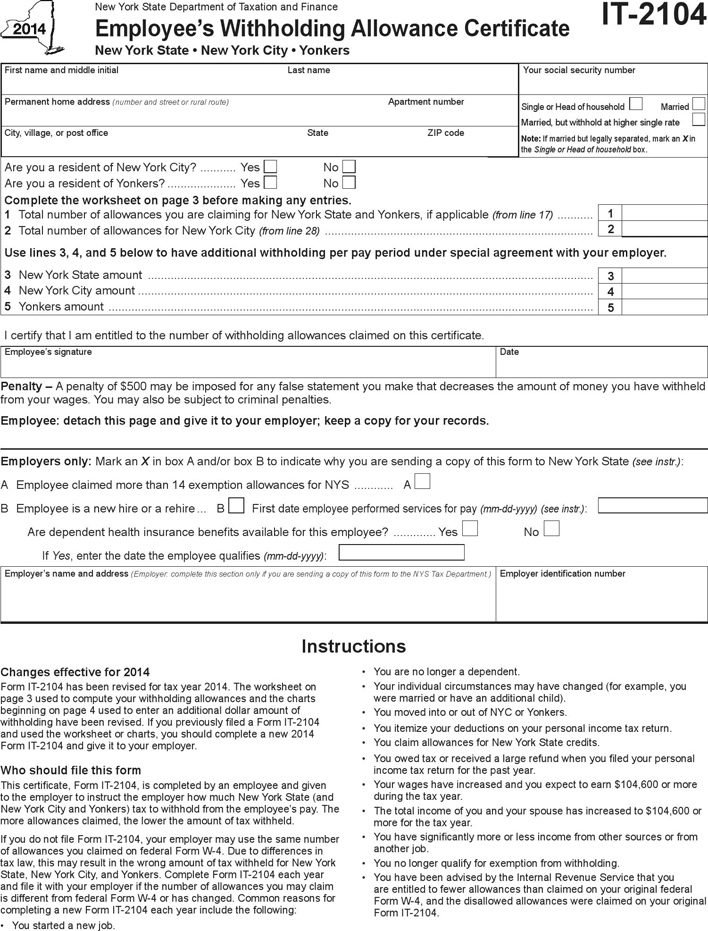

Employee Tax Withholding Form – It is important to know what you need you should do with your tax forms if your goal is to keep interest, fines, and the trouble of submitting an annual tax return for your employees to the minimum. There are many tools available to assist you through this maze.

FICA employer contribution

The FICA, Social Security, and Medicare taxes are the three taxes that the federal government has mandated that the majority of businesses to deduct from paychecks of employees. Employers are required to submit an annual tax return for their employers. Taxes are reported on Form 941.

FICA The federal tax, funds Medicare and Social Security. The main part of the tax is the 12.4 percentage social security levy on employee wages.

The Medicare tax forms the second part of the tax. FICA’s Medicare component is not subject to any restrictions on the wage base, which means that the tax rates are subject to alter. Employers can claim FICA as a business expense.

For small businesses, Form 941 reports the employer’s part of FICA. The form is utilized by the IRS to report the details of the tax deductions from the employee’s pay.

Quarterly tax return from the employer

It’s important to know how to fill out and submit Form 941 in case your company is required to pay employee taxes. Your federal income tax withholding and payroll taxes are described on the form.

It is required to report the total amount of Medicare and Social Security taxes that were deducted from employee earnings. The total here must be equal to the sum shown on the W-2 form of the employee. Furthermore, it is essential to declare the amount of tips paid to employees.

In your submission, you must include the name and SSN for your business. It is also important to include the number and names of every worker employed during the period.

The Form 1040 contains 15 lines that need to be completed. Each line describes the various elements of your compensation. They include the total amount of gratuities, wages, and salaries of all employees.

The annual report of agricultural workers to their employer

As you are probably aware of, IRS Form 943 is an essential file if you own an agricultural firm.This form is used to determine the right amount of tax withholding by employees for employers who are agricultural. It contains crucial information that you must know. It is possible to submit it online, but you may have to mail it in.

The best way to maximize the tax form’s potential is to employ a professional payroll software. A bank account is required with the IRS. If you already have an account number, you can accelerate the process by using the Web Upload service. Make sure you verify the number before you deposit your money.

Interest and penalties can result from the inability to report income.

When you pay taxes it is important to not underpay the government. In fact, underpaying the government could lead to financial ruin. Underpaying can lead to fines by the IRS. It is important to ensure that your withholdings are correct.

Utilize Form 2210 from the IRS to determine the amount of your debt if you’re not sure of the amount you are owed. Once you’ve submitted the form, you’ll need to determine if you are eligible for a waiver. If you live in a state with high tax rates or have a sizable amount of unreimbursed work expenses it could be that you qualify.

Additionally, you can use calculators to determine your withholdings. Utilizing the IRS Tax Withholding Calculator, you are able to do this.