Employee Tax Form Washington State – If you want to avoid penalties and interest as well as the hassle of preparing a tax return it is essential to be familiar with how to use your tax forms for employees. There are a variety of tools available to help you navigate this maze.

FICA employer contribution

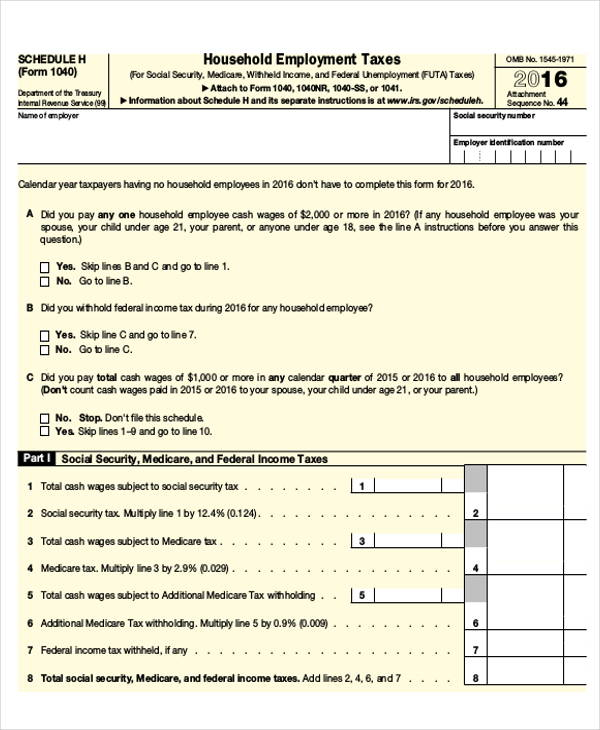

The FICA (Federal Income Taxes), Social Security (Medicare taxes) are three taxation which federal law obliges businesses to deduct from employee paychecks. Employers are required to prepare a quarterly tax report. The tax returns are filed using an application known as Form 941.

FICA The federal income tax funds Medicare and Social Security. The 12.4 percent social security levy on wages of employees is the first component of the tax.

The Medicare tax is the second part of tax. FICA’s Medicare component does not have any restrictions on the wage base, so the tax rates are subject to change. Employers benefit from this because they are able to claim their portion of FICA as business expenses.

For small businesses The form 941 is utilized to record the employer’s share of FICA. This form is used by the IRS to submit details on the taxes withheld from an employee’s paycheck.

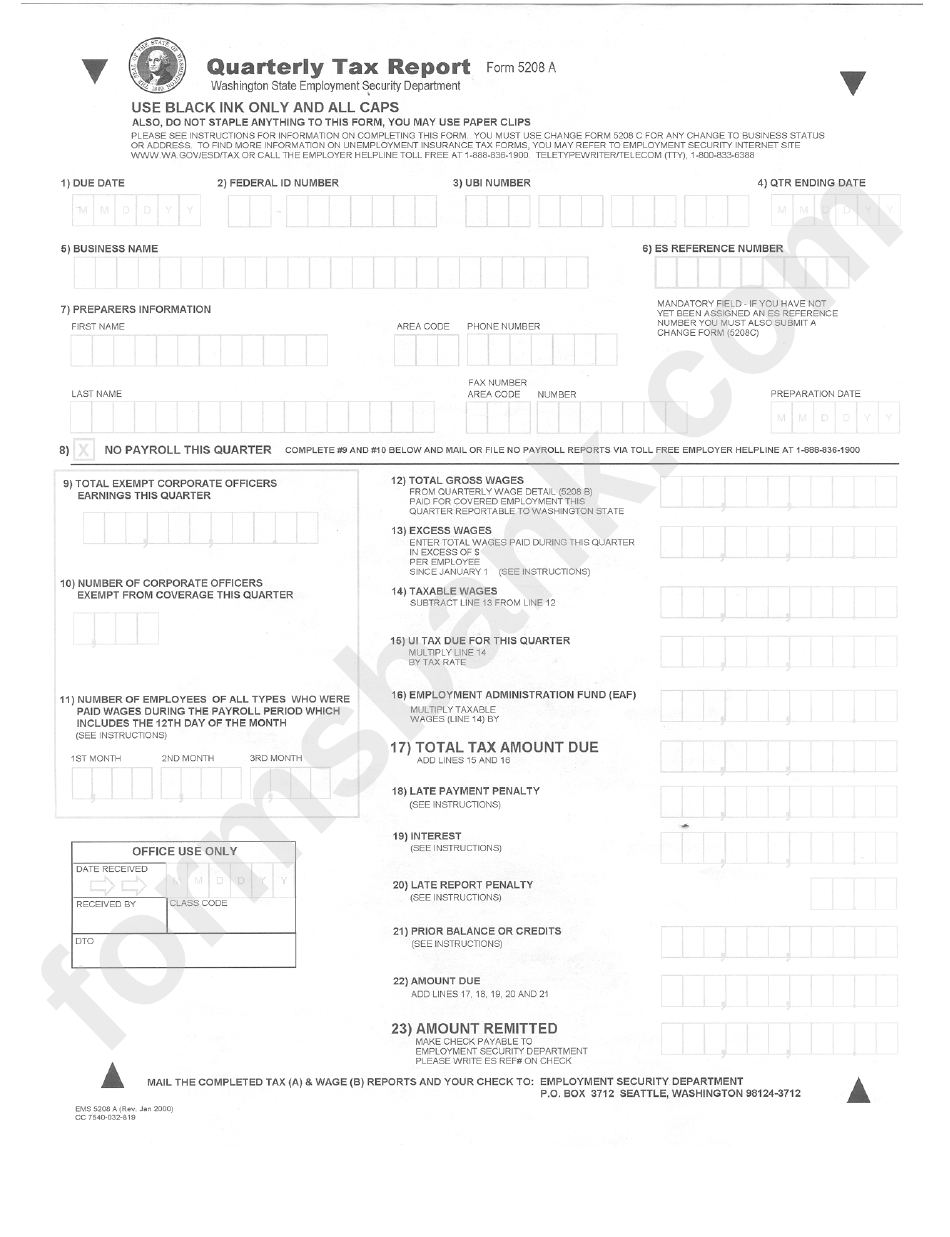

Quarterly tax return for employer

If your company is legally required to pay employment taxes it is vital to know how to fill out the Form 941. The federal income tax withholding and payroll taxes are described on the form.

Every single one of the Social Security and Medicare taxes deducted by employee earnings are also required to be declared. The amount reported must be the same as that shown on an employee’s W-2. In addition, you must disclose the amount each employee is receiving in tips.

When submitting your submission, you must include the name and SSN of your business. The number of employees you paid during the quarter must be also included.

There are 15 lines on the Form 1040 you have to fill in. Each line lists the various components of your pay. Each line represents the different components of your remuneration. These include the number and wages of employees, and their gratuities.

The workers in the agricultural sector receive a salary each year from employers

The IRS Form 943, which you probably know, is required if your agricultural enterprise is required to be registered with IRS. This form is used to determine the proper amount of tax withholding from employees of agricultural employers. These forms have important details that you must be aware of. This form can be completed on the internet, however if you don’t have access to the internet, you may have to mail it in.

The most effective way to maximize this tax form’s value is to employ a the most sophisticated payroll software. It is also necessary to create an account with IRS. The Web Upload service can be used to speed up the process once you have a valid account number. It is advisable to verify your account’s number prior to making a deposit.

Insufficient reporting of income may cause penalties and even interest.

Making sure you pay taxes on time is crucial. You’ll regret it later and end having to pay more. In fact, if you are underpaid then the IRS could fine the taxpayer, so be sure that your withholdings are in order.

To figure out your amount of debt, you can use Form 2210 issued by the IRS if you are not certain of the amount. After you have submitted the form, you can determine if you’re eligible for an exemption. This may be possible when you reside in a state with high taxes, or have a large amount of unreimbursed expenses related to your job.

You can also use calculators to calculate your withholdings. This is done using the latest IRS Tax Withholding Estimator.