New Employee Tax Withholding Form – There could be a variety of paperwork you must complete when hiring new employees. They include W-4 as well as I-9 forms. These documents are needed to confirm that your staff is legally able to operate in the United States. This article will outline the forms that you will require.

Checks that were made in the past

Employers may use a variety of background checks when deciding whom to employ. These checks include verifications of the applicant’s education, credit score, identity and motor vehicle record checks. These checks are done to confirm that the candidate has been honest in their statements and also to verify that they have met the requirements of the job.

Background checks can help in safeguarding the company as well as its customers as well as its employees. Criminal convictions, speeding fines and bad driving habits are a few of the warning signs that might be in the past of a candidate. Other indicators of occupational danger like violence could be present.

The majority of businesses will contract a third-party firm to conduct background investigations. They will have access to a database of information from all federal courts across the United States. Some businesses prefer to wait until a conditional acceptance is received before conducting background checks.

Background checks could take quite a while. Employers must make a list. It’s important that applicants are given enough time to reply. The standard response time is five days. day.

Formula I-9

If a new recruit is hired, each employee must fill out the I-9 form. Federal contractors as well as state employees are required to comply. It can be tedious and time-consuming, however.

The form is divided into many sections. The most basic section must be completed when you begin your job. It includes the employer’s identifying information , as and the worker’s specific information.You will be required to show evidence of a foreign national’s ability to work in the United States if you intend to employ them.

After completing Section 1, make sure that the rest of the form has been completed on time. You should keep the Form I-9 required for your hiring date for three years. It is also necessary to pay Form 6A-related fees.

When filling out Form I-9, you should consider the different ways you can decrease your risk to fraud. In particular, you should ensure that each employee is included in the database of E-Verify. Also, it is important to make sure that you pay your contributions and administrative costs in time.

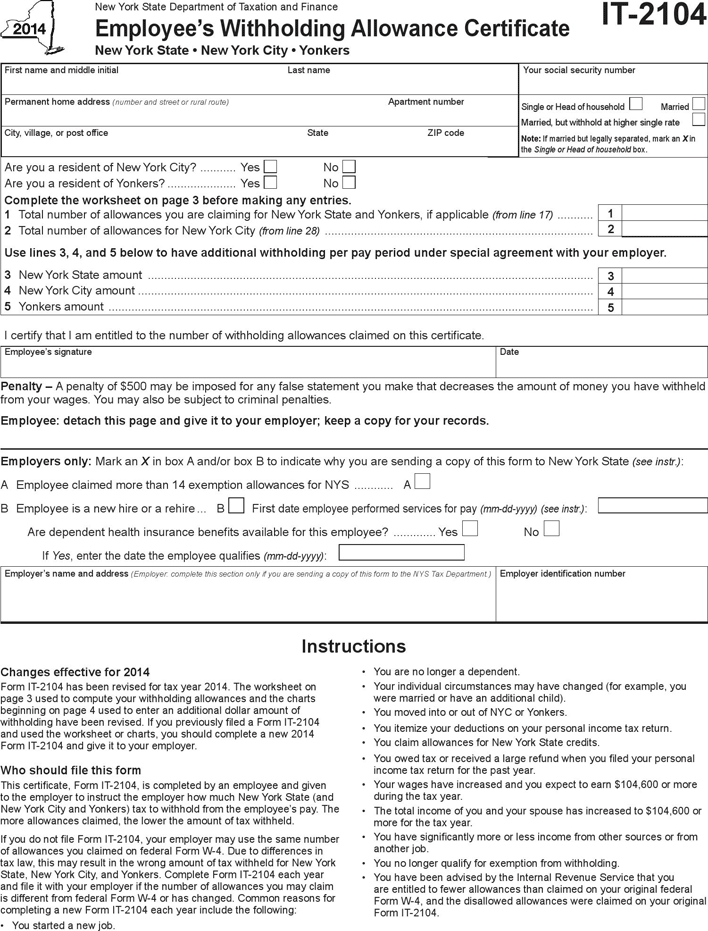

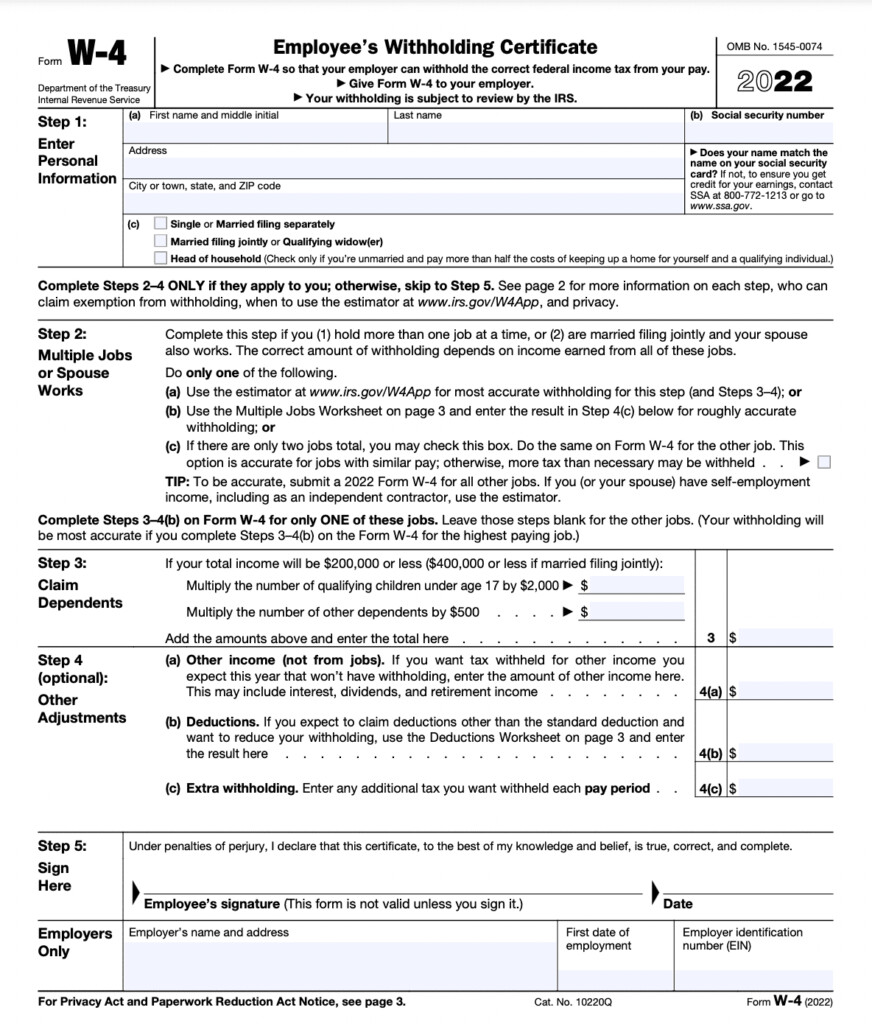

Forms W-4

One of the first documents new employees will need to fill out is the W-4 form. On this page it is possible to look up the tax deduction they receive from their wages. It’s also helpful for people to understand the tax obligations they face. They could be eligible to receive a bigger tax refund when they have a clear knowledge of the deductions that the government can make on their earnings.

The W-4 is vital because it tells businesses how much they should deduct from employees’ paychecks. This data will assist in calculating the federal tax rate. You might find it useful to keep track of your withholding in order to avoid unexpected shocks in the future.

The W-4 form is easy to fill out and contains your address, name and other data that could influence the federal income tax you pay. Avoid paying more than you should by taking the time to fill out the form accurately.

The W-4 comes in a variety of variants. Online submission is also possible and manual printing. Whatever method you chooseto use, ensure that you submit the forms before you receive your first salary.

Apply for an opening

Employers use applications to assess the potential candidates. They aid in creating a precise image of the applicant’s education background and professional experience.

Filling out job applications will require you to provide personal information and contact information. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Online or on paper, job applications are accepted on paper or online. Make sure that your application is simple to comprehend and include all the information.

When you submit a request for employment It is recommended to consult a qualified expert. This will ensure that your application doesn’t contain any untrue information.

Many employers retain applications for quite a while. Employers are able to contact prospective applicants to discuss openings in the near future.

When filling out forms for job applications On job application forms, it is standard to ask for your complete name along with your email address, address, and phone number. These are typically the best ways for companies to communicate with potential candidates.