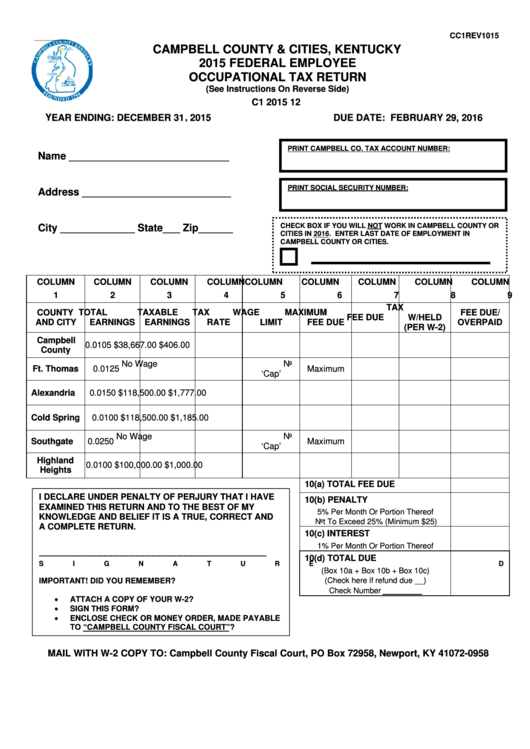

Fed Employee Tax Form – It is vital to know the rules for tax returns of employees for a better chance of avoiding fines, interest and the inconvenience of filing the returns. There are numerous tools that can help you through this maze.

FICA employer contribution

The FICA and Social Security taxes are the three mandatory deductions that most employers must make from pay stubs of employees. Employers are required to submit an annual tax return for their employers. Taxes are reported on Form 941.

FICA, the federal income tax funds Medicare as well as Social Security. The 12.4 percent social security levy on employees’ wages is the first part of the tax.

The Medicare tax, which is the second part of tax, is also known as the Medicare tax. FICA’s Medicare component doesn’t have any restrictions on the wage base, so the tax rates may alter. Employers benefit from this because it enables them to claim their portion of FICA as a business expense.

For smaller businesses, Form 941 reports the employer’s part of FICA. The IRS may make use of this form to record the details of taxes withheld from the time of an employee’s salary.

Quarterly tax return by the employer

It’s important to know how to complete and submit Form 941 if your business is required to pay employee taxes. This form will provide information about your federal income tax withholdings, as well as payroll taxes.

All Social Security and Medicare taxes that are deducted from earnings of employees must also be declared. The total amount must match the amount on the W-2 form for the employee. You should also be clear about the amount of tips that each employee is paid.

When you are submitting your application, be sure to mention your company’s name as well as your SSN. The number of workers you paid in the period should also be listed.

Complete the 15 lines on the Form 1040. The different elements of your pay are represented on each line. Each line is a representation of the various components of your remuneration. They include the total number and pay of employees as well as their bonuses.

The annual report of agricultural workers to the employer

The IRS Form 943, which you may have heard of is required if your farm business needs to be registered with the IRS. The form determines the correct amount of tax withholding for employees of agricultural employers. This form has a few important details that you should be aware of. The form is available on the internet. If you don’t have an internet connection the form may have to be sent in.

Professional payroll software is the most effective method to increase the value of your tax form. It is important to note that the IRS will also require you to open an account. It is possible to expedite the process by making use of Web Upload, once you have established a valid account number. You may want to double-check your account’s number prior to making a payment.

Interest and penalties can result from underreporting income.

Paying your taxes in full is a smart idea. It will be regrettable and you’ll end up paying more. The IRS may impose penalties on you if you underpay.

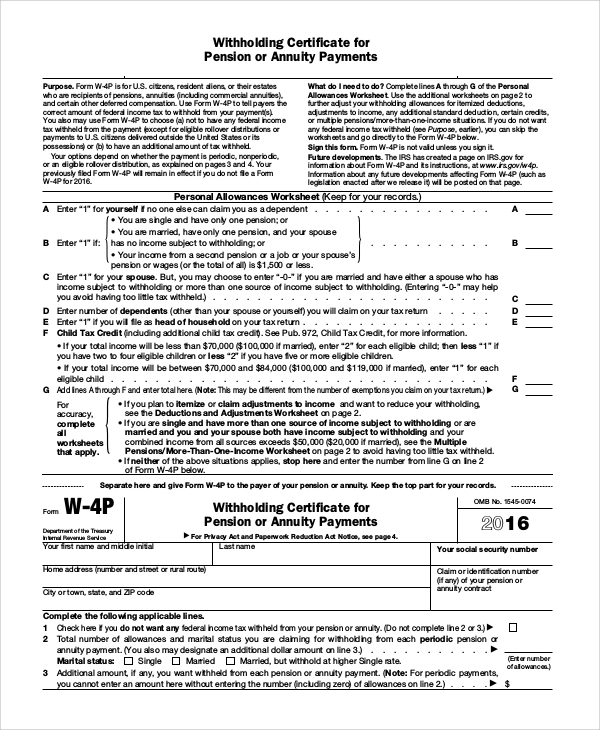

If you’re not sure what amount of debt you owe You can use the form 2210 provided by IRS to calculate it. After you have submitted the form, you can determine if you’re qualified for a waiver. It is possible that you are eligible for a waiver if the state you live in has a high percentage of taxation or you have substantial unreimbursed work expenses.

Calculators can also be utilized to estimate your withholdings. Utilizing the IRS Tax Withholding Calculator, you are able to accomplish this.