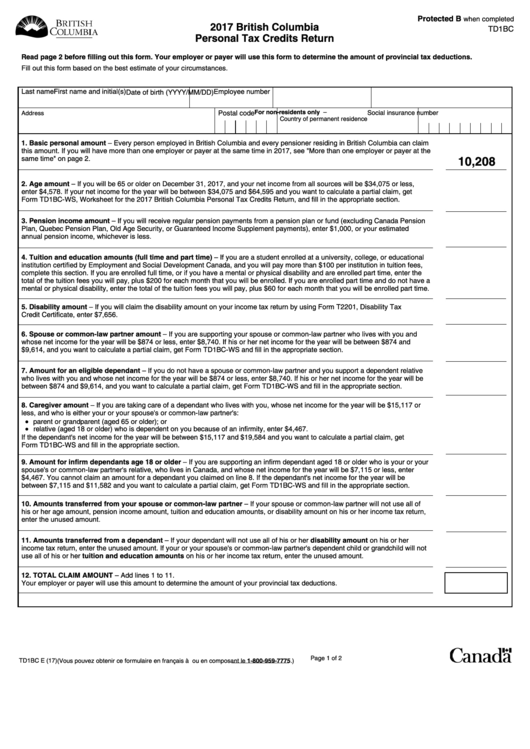

Bc Tax Form New Employee – You may require completing various forms when employing new staff, including W-4 and I-9 forms. These forms are required to ensure that your employees have the right to work in the USA. This article will outline the forms that you will require.

In the past, checks

Employers are able to conduct background checks they can use to make a decision on who to hire. The verification of education, credit and identification are just a handful of these, along with the checks for motor vehicle records. These checks ensure applicants have authentic identities and meet the requirements for the position.

Background checks can help in defending the company, its clients, and employees. Poor driving habits, criminal convictions, and speeding fines are all possible red flags. Potential indicators of occupational threat like violence could also be present.

Most businesses hire a third party firm to conduct background checks. They will have access now to information from all 94 United States Federal Courts. Some businesses prefer waiting until they get an employment contract with a conditional offer prior to conducting a background screening.

Background checks can take some time. Employers should create a list of inquiries. It is vital that applicants are given enough time to respond. It can take five days to get an average response.

Formula I-9

Every employee has to fill out the I-9 form at minimum one time when they are an employee new. Federal contractors as well as state employees must complete the form. This can be complicated and time-consuming.

There are many components of the form. The most basic part must be completed prior to the start of your job. This section includes the employer’s details as well as the information of the worker. If you are going to recruit someone from overseas You will need to provide proof that they have the right to work in the United States.

Make sure that the remainder of the form is completed by the deadline after you have completed Section 1. You should keep the Form I-9 required for your appointment date for three years. In addition, you must continue to pay Form 6A-related fees.

You should think about the many ways you can decrease your risk of fraud while you fill out Form I-9. To begin with, ensure that each employee is included on the database E-Verify. Also, you must submit all administrative and donation costs on time.

Forms W-4

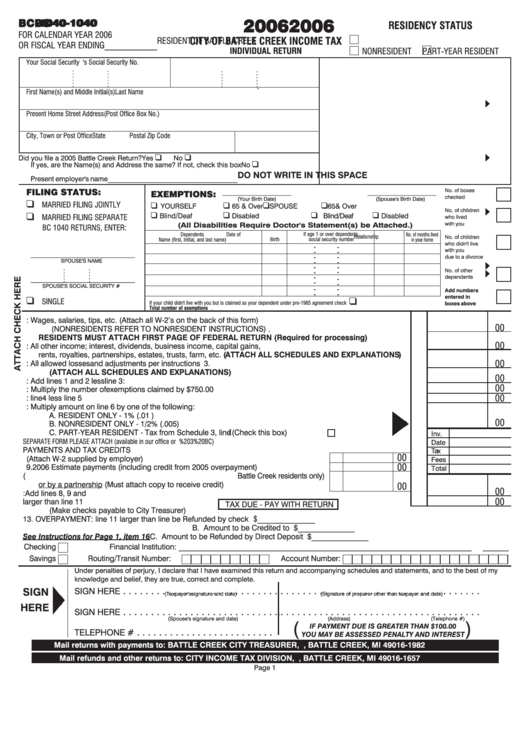

W-4 form will be one of the first forms new hires must fill out. The form displays the tax amount that was taken from their earnings. It is also useful for individuals to know their tax liabilities. It is possible that they will receive a bigger tax refund when they have a clear understanding of the deductions the government will make from their income.

The W-4 is crucial as it informs businesses of how much they should deduct from employees’ paychecks. The information used in the W-4 is used to compute federal income tax. To avoid surprises, it may be beneficial to keep track of how much you are able to deduct.

The W-4 is a basic form that includes your name, address and any other information that could affect federal income tax. You can avoid overpaying by making sure you complete the form correctly.

There are several variations of the W-4. It can be submitted online in addition to manual and printing. Whatever your method of submission be sure to submit all forms and documents before receiving your first paycheck.

Apply for a Job

Employers make use of applications to review the potential candidates. These forms aid in creating a clear picture of the candidate’s education and work experience.

If you complete a job application form, your personal information including contact information is required. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Applications for jobs can be made via the internet or in person. Your application should be easy to read and contain all required information.

Before you send out a request for work before submitting a job request, you should consult a qualified expert. This will allow you to ensure your application doesn’t contain untrue information.

Many employers retain applications for quite a long time. Employers can call applicants to inquire about opportunities in the future.

Many job applications require your complete name, address, and email. These are the preferred methods for applicants to be contacted by companies.