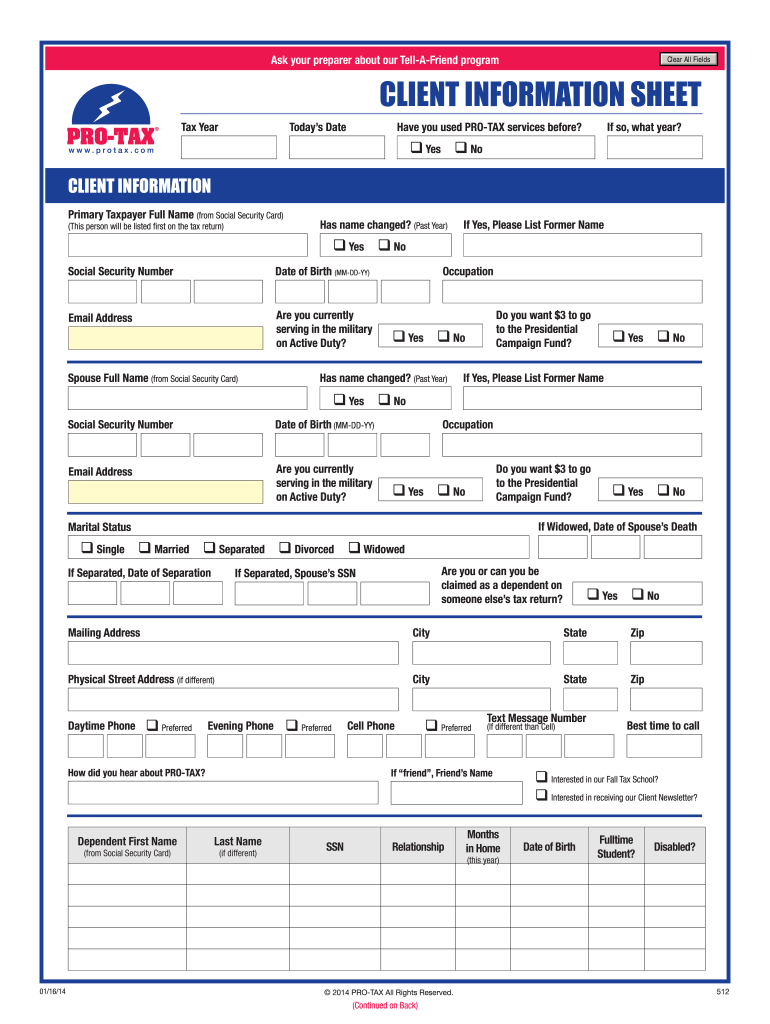

California Tax Form Employee Development State Of Cal – It is important to know what you need to do with your tax forms if your goal is to keep interest, fines, and the trouble of having to submit a tax return for your employees to the minimum. There are a variety of options to help you navigate the maze.

FICA employer contribution

The FICA and Social Security taxes are the three compulsory deductions that most employers have to take from their the wages of their employees. Every quarter employers are required to prepare a tax return for the employer. The tax is reported on the Form 941.

The federal tax known as FICA is what funds Social Security and Medicare. The first component is the 12.4% Social Security Levy on wages of employees.

The Medicare tax is the second part of tax. FICA’s Medicare component has no upper wage base limit which means that the tax rate can fluctuation. Employers can write off FICA for business expenses and this is a win-win situation.

The employer’s portion of the FICA is listed on Form 941 for small firms. This form is used by the IRS to give details on the tax deductions made by an employee’s paycheck.

Tax return for the quarter from the employer

If your company has to pay taxes on employment it is essential to understand how you complete and submit Form 941. It provides information regarding your federal income taxes withholding and payroll taxes.

Every single one of the Social Security and Medicare taxes deducted by employee earnings are also required to be disclosed. The total amount here must match the amount that is on the W-2 for the employee. Also, you must disclose any tips that each employee is paid.

You must mention the name and SSN of your company when you are submitting your application. Include the number of employees you hired in the last quarter.

The form 1040 has 15 lines to be filled in. The different elements of your pay are represented on each line. This includes the amount of gratuities, wages, and salaries of all workers.

The annual return of workers from agriculture to employers

The IRS Form 943, as you are likely aware of is required if your agricultural business is to be registered with the IRS. This form determines the proper amount of tax withholding to employees employed by agricultural employers. The forms contain important information that you must be aware of. While you are able to fill out this form online, it’s possible to mail it in if the computer doesn’t allow you to.

Professional payroll software is the ideal method to increase the value of your tax form. Additionally, you’ll need to establish an IRS account. Web Upload is a Web Upload service can be used to speed up the process once you have a valid account number. You may want to double-check your account’s number prior to making a deposit.

Unreported earnings could be the cause of interest or penalties.

It is important to be cautious not to overpay the government when you pay taxes. It will be regrettable and you’ll end up paying more. Incorrectly paying taxes can result in fines from the IRS. You must ensure that your withholdings are correct.

If you’re unsure of how much debt you owe You can use the form 2210 provided by IRS to figure it out. After you’ve completed the form, you’ll need to find out if you’re eligible to receive a waiver. You may be eligible for a waiver in the event that you reside in a state with high taxes or significant work expenses that are not reimbursed.

There are calculators to estimate your withholding. Utilizing the IRS Tax Withholding Calculator, you’ll be able to accomplish this.