Canada New Employee Tax Forms – When you hire new staff it is possible that you will be asked to complete a number of forms, including W-4 forms and I-9 forms. These documents will be required to confirm that your employees are permitted to travel freely in the US. This article outlines the forms you’ll require.

Checks written in the Past

Employers can conduct a range of background checks to determine the best candidate to hire. You can verify your education, credit, and identity. These checks verify that applicants have authentic identities and meet the requirements for the job.

Background checks may be helpful in protecting the company and its clients , as well as its staff. Criminal convictions, and speeding fines are all potential red flags. Signs of occupational danger like violence may also be present.

A majority of businesses will hire a third party background investigation firm. They will have access to the databases of all 94 United States federal courts. However, some companies choose to not conduct background checks until the time of conditional offers to employees.

Background checks can be lengthy. Employers need to prepare a list. It is crucial that applicants are given enough time to respond. The typical wait time for a response to the request is 5 days.

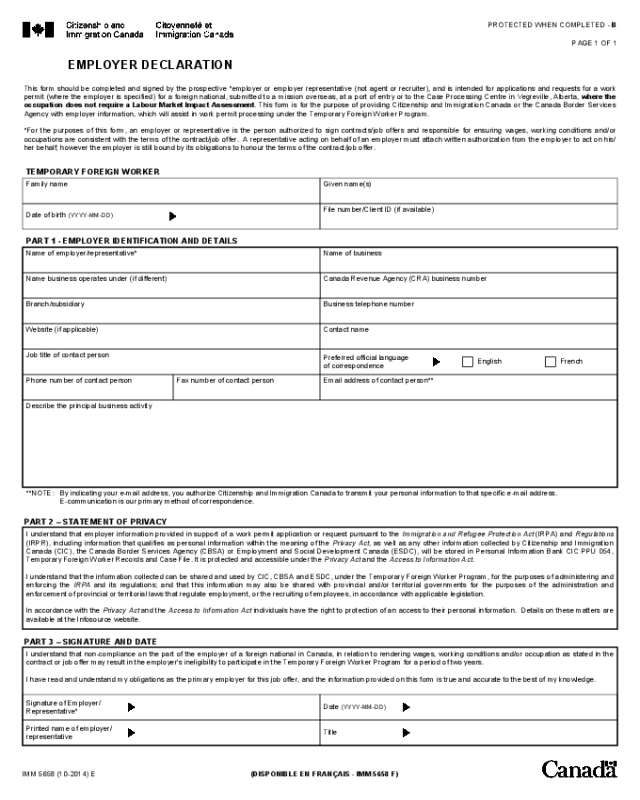

Formula I-9

If they’re a new employee, each employee must complete an I-9 form. Federal contractors and state employees must complete the form. However, the procedure might be lengthy and complicated.

The form is comprised of multiple sections. The first one is the most fundamental and should be completed when you start working. The section contains both the information of the employer as well as the details of the employee. If you are going to hire someone from abroad You will need to prove that they are legally able to work in the United States.

When you’ve completed Section 1, make sure the rest of the form was completed on time. It is important to keep the Form I-9, which you must have for purposes of employment, on file for at least 3 years. You must continue to pay the necessary fees on Form 6A, too.

As you fill out your Form I-9 you should consider all the ways you can reduce your risk for fraud. First, make sure that each employee is included on the database E-Verify. Also, you should mail the donations and administrative costs on time.

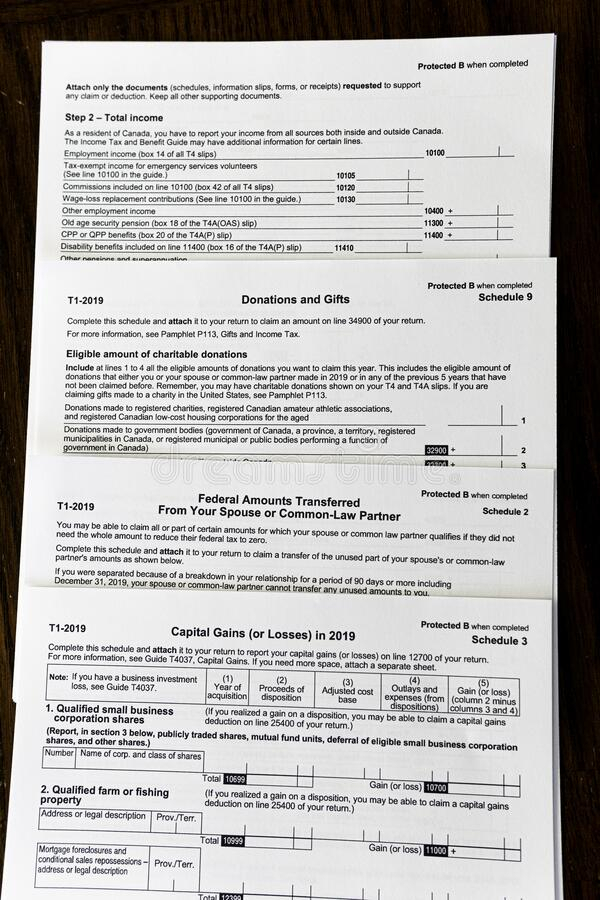

Forms W-4

One of the documents new employees will need to complete is the form W-4. On this form, you can find out how much tax was taken from the salary. This page can be used by anyone looking to learn the details of their tax obligations. People may be able receive a larger paycheck if they have a better understanding about the deductions the government can make out of their income.

W-4 is critical because it provides guidelines to companies on the amount they can take from the wages of employees. This information will help calculate federal income tax. You might find it useful to track your withholdings to avoid unexpected surprises later on.

The simple W-4 is a simple form. W-4 contains your address, name and other details that may have an impact on the federal tax returns for income. To avoid paying more than you should, make sure that you fill out the form in a timely manner.

The W-4 comes in a variety of forms. It is possible to fill out the form online, or print it out and manually fill it manually. Whichever method you decide to use, make sure that you complete the forms before you receive your first paycheck.

Make an application for a job

Applications for jobs are used by businesses to evaluate applicants. They allow for the creation of a detailed description of the applicant’s education background and experience.

You’ll need to provide personal information and contact details when filling out a job request form. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Job applications can be submitted online or in writing. The application must be easy to read and contain all the required information.

When you are submitting your job application, make sure to seek out a professional who is qualified. This will ensure that your application doesn’t contain any illegal information.

Many companies retain applications for a period of time. Employers have the option to contact applicants regarding forthcoming openings.

On forms for job applications the complete name address, email, and phone number are required. This is usually one of the best methods for employers to contact potential candidates.