Employee Federal Tax Return Forms – You need to be familiar about the procedures necessary to file tax returns for employees. This will enable you to stay clear of penalties, interest and the mess that comes with it. You can choose from a wide range of choices to help you navigate the maze.

FICA employer contribution

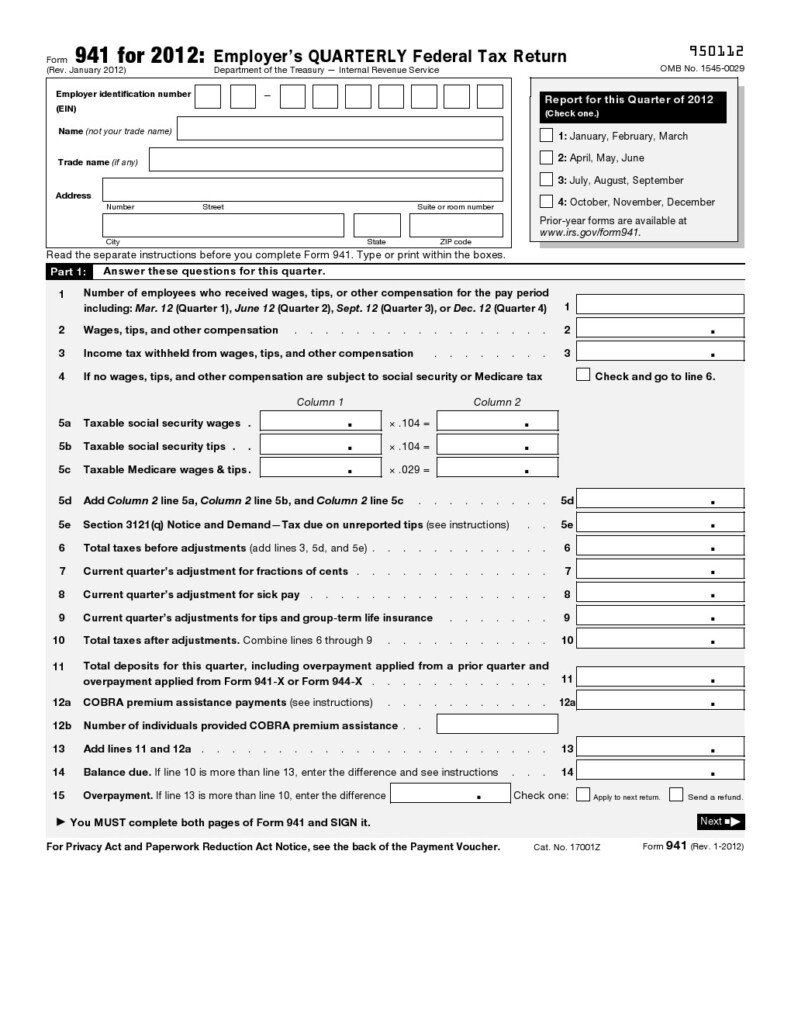

The FICA, Social Security and Medicare taxes are federal taxes that companies must deduct from their employees’ paychecks. Every quarter, employers are required to submit a tax return for their employers. The tax are filed in Form 941.

FICA The federal income tax, funds Medicare as well as Social Security. The 12.4 Social Safety levy of 12.4 percent on employees’ wages is the first component of the tax.

The Medicare tax is the second component of tax. The Medicare tax is the second part. It doesn’t contain any higher wage base restrictions so the tax rate may fluctuate. Employers can write off FICA to cover business expenses and this is a win-win situation.

For small companies For small businesses, Form 941 reports the employer’s FICA portion. The form is utilized by the IRS to provide details about the tax withheld from the employee’s pay.

quarter’s tax return for the employer

If your business is legally required to pay employment taxes it is vital to be aware of how to fill out Form 941. The form contains details about the federal tax withholdings, as well as payroll taxes.

It is required to declare the entire amount of Medicare and Social Security taxes that were deducted from employee earnings. The sum here will match the sum shown on the W-2 for the employee. In addition, it is important to reveal the amount of tips given to employees.

When you submit your submission ensure that you mention your company’s name and SSN. Also, you must provide the number of employees employed by your company during the period.

You’ll need to fill out 15 lines on your Form 1040. Each line is a representation of different aspects of your compensation. These comprise the number of employees you paid their wages, and their gratuities.

Agriculture workers’ annual return to their employer

As you may know, IRS Form 943 is required in order to determine the appropriate amount of tax withholding for employees by employers who employ agricultural workers. This form includes some important information you must be aware of. Although you can submit this form online, it is possible to mail it in if the computer isn’t able to.

A professional payroll software is the best way of maximising the value of this tax return. The IRS requires that you open an account. Web Upload is a Web Upload service can be utilized to speed up the process once you have an official account number. It is advisable to verify your account’s number prior to making a payment.

Penalties and interest may result from the inability to report income.

Be careful not to overpay the government in the event that you have to pay your taxes. Underpaying the government can cause financial ruin. The IRS could impose penalties on you if you do not pay.

To calculate quickly your financial obligations, download Form 2210 from IRS. Once you’ve submitted this form, you should determine if you are eligible to receive the waiver. You may be eligible for a waiver, if your state has a high rate of taxation or you have significant unreimbursed employment expenses.

There are calculators for estimating your tax withholdings. Utilizing the IRS Tax Withholding Expert you can do this.