Employee Tax Forms For New Employees – It’s possible that you’ll have to fill out several documents, such as W-4 and I-9 forms, in the event that you hire new staff. These forms will be required to confirm that your staff are allowed to travel without restriction within the US. This article outlines the forms you’ll need.

Checks written in the past

Employers can use a variety of background checks to determine who to hire. There are many background checks that employers can conduct to determine who to hire. These include ID checks, credit verifications and motor vehicle records checks. These checks are made to ensure that the applicant is who they say they are and they meet the requirements of the position.

Background checks can aid in defending the company as well as its clients as well as its employees. A criminal record of a candidate or driving record that is poor and speeding fines are only a few instances of red flags that could be raised. There could be signs of occupational danger like violence.

A majority of businesses will employ a third-party background investigation company. They now have access to the database of all 94 United States federal courts. But, some companies decide to wait until the stage of a conditional job offer before conducting a background screening.

Background checks can take time. Employers must have a list of questions. Employers must allow applicants adequate time for a response. The typical time for response to a request is five days.

Formulation I-9

Every employee must complete the I-9 form at least once when they are an incoming employee. Federal and state employees as well as contractors are required to comply. This process is time-consuming and difficult.

There are many different parts of the form. The first that is the most crucial, must be completed before you begin working. This includes the employer’s name as well as the worker’s relevant information. You must provide proof that the foreign national is legally authorized to work in America in order to hire the person.

After completing Section 1, you should ensure that the remainder of the form is completed in time. Additionally, the Form I-9 must be kept on file for three years from the day you started your employment. It is mandatory to continue paying the required 6A fees.

Take a look at the various ways you can reduce your risk to fraud as you fill out Form I-9. First, make sure that all employees are included in the E-Verify Database. Also, you should mail in donations and administrative costs in time.

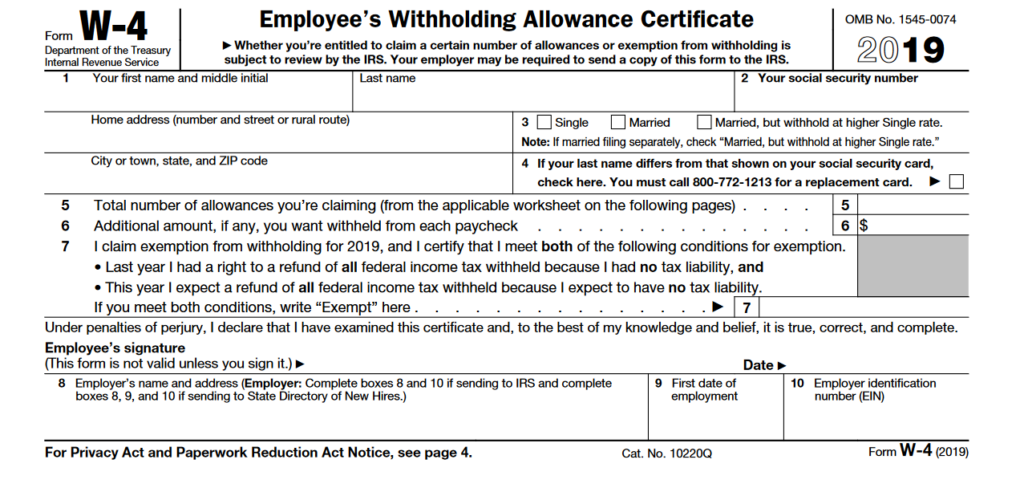

Formulas W-4

The W-4 form is the first paper new employees must fill out. This form shows the amount of tax taken from their wages. It is a good resource for anyone to find out more about the tax obligations they have to meet. A better understanding of what deductions the government will make to their earnings could help them get a bigger check.

Since it instructs companies on the amount to deduct from employees’ paychecks, the W-4 is crucial. Federal income taxes are computed using this information. It can be helpful to track and keep track of your withholdings so that you do not get caught off guard later.

The easy form W-4 includes your name, address as well as any other information that could have an effect on your federal tax returns for income. You can avoid overpaying by making sure you complete the form correctly.

There are many options for the W-4. You can submit the form online or print it out and manually fill it. No matter how you submit the form, make sure you submit all forms and documents before receiving your first paycheck.

seeking an employment

Employers use application forms to screen candidates. They aid in creating a precise image of the applicant’s education background and professional background.

You will need to submit personal information and contact details when making a request for employment form. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Job applications are accepted on the internet or in writing. Your application must be easy-to-read and contain all required information.

Before you send out an application for employment, you should consult with a qualified expert. This will ensure you do not include any material that is illegal.

A lot of companies keep applications for a specified period of time. Employers may contact applicants to inquire about future opportunities.

Your full address, name, as well as email address are usually asked for on application forms for jobs. This is the most preferred method for applicants to be contacted by employers.