Employee Tax Forms New Hire – It is possible that you’ll need to fill out a range of documents, like W-4 and I-9 forms, when you employ new staff. These documents are needed to confirm that your staff is legally able to operate in the US. The forms you’ll require are covered in this article.

Checks written in the Past

Employers can use various background checks to determine whom to employ. There are numerous background checks that employers could use to verify the identity, credit, education and driving record of potential applicants. These checks are required to make sure that applicants are who they say they are and that they have all the necessary qualifications for the job.

Background checks can be a valuable tool in protecting the company, its clients as well as employees. Speeding fines, criminal convictions and driving violations are just a few warning signs that might be in a candidate’s past. Potential indicators of occupational threat or violence might also be present.

Companies often employ background investigators from third-party companies. They now be able to access a database of information of all federal courts in the United States. But some businesses choose to not perform background checks until the time of offers for conditional employment.

Background checks can be lengthy. Employers must prepare an agenda. It is crucial that applicants have sufficient time to reply. The typical time for response to the request is 5 days.

Formulation I-9

Each employee has to fill out an I-9 form every time they recruit. Both federal contractors and state employees must comply. It can be tedious and time-consuming, but it is not impossible.

There are many different parts to the form. The most fundamental section should be completed prior to the start of work. This includes both the employer’s identification and worker’s pertinent information. You will need to show proof that the person is authorized to work in the United States in order to employ them.

After you’ve completed Section One Make sure the remainder of the form gets completed. The required Form I-9 should also exist in the file for three years following the date of your hiring. You must continue to pay the necessary fees on Form 6A, too.

As you fill the Form I-9, you should consider all the ways you can reduce your risk for fraud. Make sure that all employees have been added to the E Verify database. It is equally important that you promptly send in any contributions or administrative expenses.

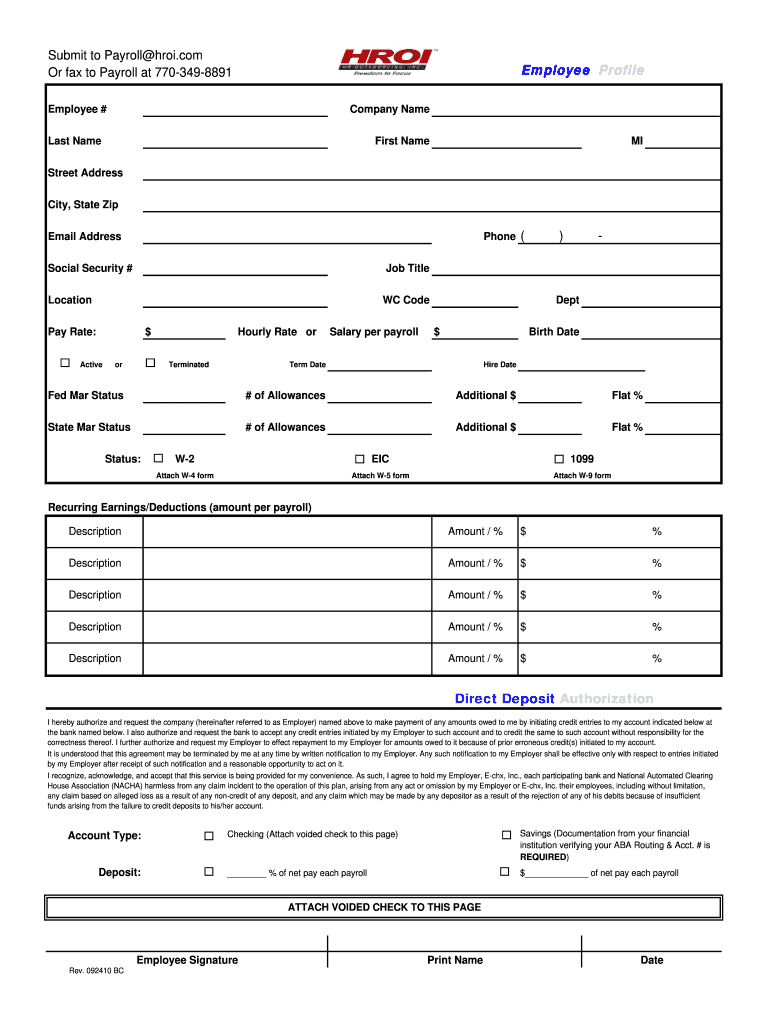

Forms W-4

The W-4 form is one the very first forms that new hires must complete. The form reveals the amount of tax deducted from their salary. It is a good resource for anyone to find out the details of their tax obligations. An understanding of the deductions the government will make to their earnings can aid them in getting a larger check.

W-4 is crucial because it gives businesses instructions regarding how much they can deduct from wages paid to employees. Federal income taxes will be calculated based on this information. It may be helpful to keep track on your withholding in order to avoid unexpected shocks later.

The W-4 form is easy to fill out and includes your address, name and other information that can influence your federal income taxes. To avoid overpaying, make sure that you fill out the form in a timely manner.

There are several different versions of the W-4. Online submission is also possible and manual printing. Whatever method you choose, make sure you complete the form before you receive your first salary.

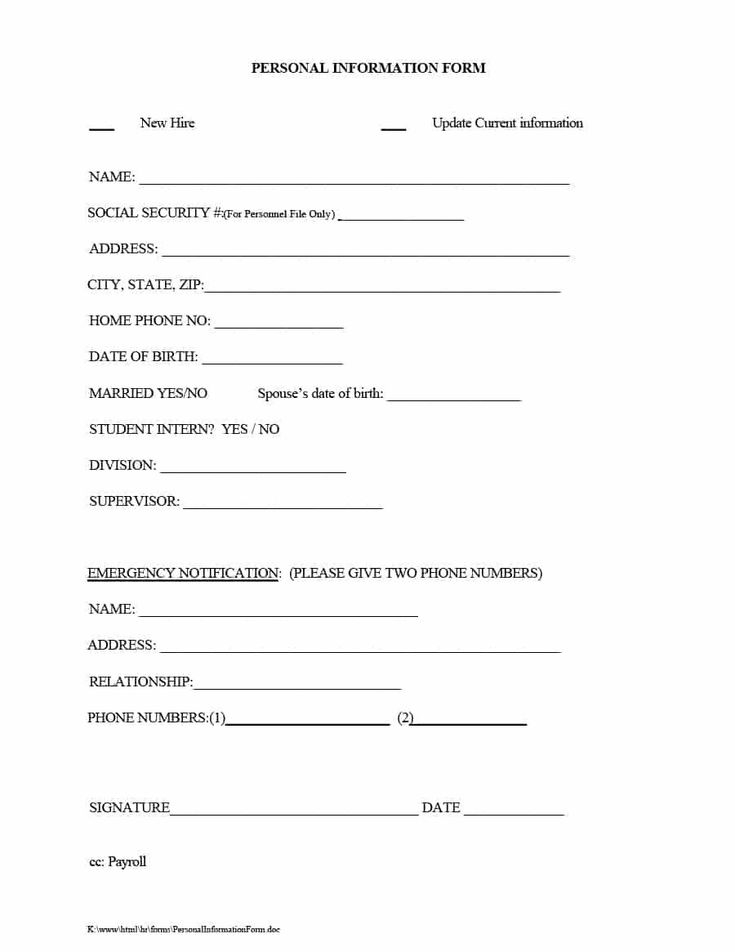

Apply for a job

Companies use forms for job applications to evaluate applicants. They enable the creation of a complete description of the applicant’s education background and previous experience.

You’ll need to provide your personal information as well as contact details when you fill out a job application form. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Job applications can be submitted on the internet or in writing. It is important to make sure that your application is clear and concise.

Before you send out a request for work, it is advisable to consult a qualified expert. This will make sure that you are not submitting any illegal material.

A lot of companies keep applications for a period of time. Employers can contact candidates to discuss potential open positions in the near future.

On job application forms, it is common to request your complete name, address and email. This is the preferred method for candidates to be contacted by employers.