Federal Tax Form For Employee – It is important to know what you need you should do with your tax forms if you want to reduce the amount of interest, fines, and the trouble of having to submit the tax returns of your employees to the minimum. You can choose from a wide range of options to help you get through the maze.

FICA employer contribution

The federal government mandates that all employers deduct FICA, Social Security and Medicare taxes from employees their paychecks. Employers must submit an annual return that details their employer’s tax obligations. Taxes are reported on Form 941.

FICA is the federal income tax, helps fund Medicare and Social Security. The main component of FICA is the 12.4 percent Social Security levy that is levied on employees’ earnings.

The Medicare taxes are the second tax component. The Medicare portion of the FICA tax is not subject to any upper wage base limitations, therefore the tax rate can be adjusted. This is a benefit for employers as it allows them to write off a portion of FICA as an expense.

The employer’s portion of the FICA is listed on Form 941 for small businesses. This form allows you to provide details about taxes taken from the paychecks of employees by the IRS.

Tax return for the quarter of the employer

If your company has to pay employment taxes it is essential to understand how you complete and complete Form 941. You will find details on the federal income tax and payroll taxes on the form.

The entire sum of Social Security and Medicare taxes taken from earnings of employees must be reported. The sum here will match the amount on the W-2 form of the employee. It is also necessary to state how much the employee earns in tips.

In your application, you must be sure to include your business and your SSN. Also, include the number workers you have paid in each quarter.

Fill out the 15 lines on the Form 1040. Each line is a representation of different aspects of your remuneration. These comprise the number of workers you paid their wages and gratuities.

The workers in the agricultural sector receive a salary each year from their employers

As you probably know that the IRS Form 943 is a required file if you own an agricultural firm.This form is used to determine the proper amount of tax withholding by employees for agricultural employers. It is important to know some specifics about this form. It is possible to submit it online, however, you might need to mail it in.

A professional payroll program is the most effective method of maximising the value of the tax return. It is also essential to create an account with the IRS. You can speed up the process by making use of the Web Upload Service once you have a valid account number. You may want to double-check your account number before making a payment.

The incorrect reporting of income can result in interest and penalties.

It is important to be cautious not to underpay the government in the event that you have to pay your taxes. Paying too much to the government could lead to financial ruin. In fact, if you’re underpaid then the IRS may impose fines on the taxpayer, so make sure your withholdings are in order.

To calculate quickly your debt, download Form 2210 from IRS. After you have submitted the form, you’ll be able to learn if your application is eligible to be waived. This may be possible when you reside in a state that has high taxes, or have large unreimbursed expenses from your job.

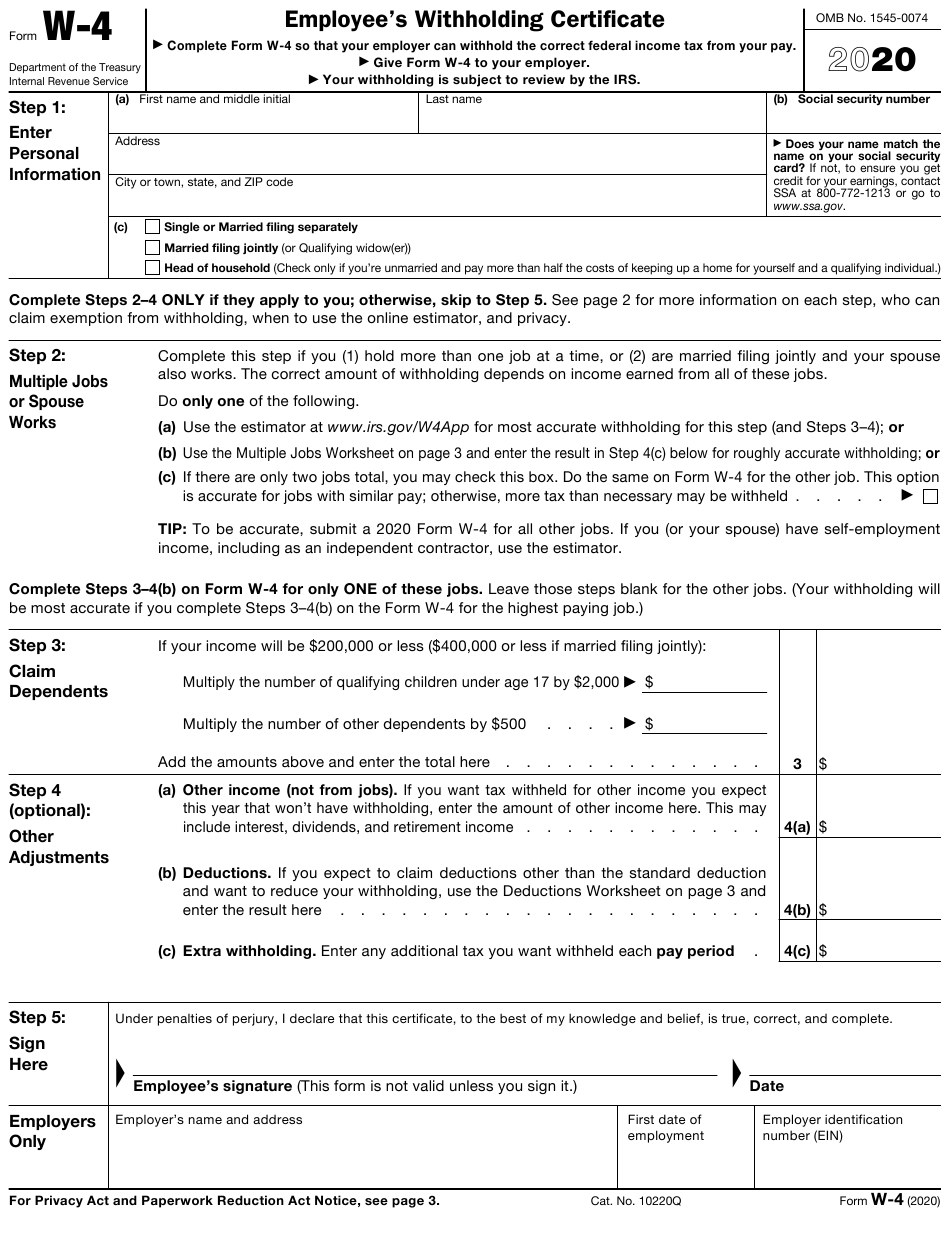

To calculate your withholdings you can make use of calculators. You can do this using the most up-to-date IRS Tax Withholding Estimator.