Federal Witholding Tax Form Employee – You should understand what you should do with your tax forms if your goal is to keep interest, fines and the hassle of having to submit an annual tax return for your employees to an absolute minimum. There are many options to guide you through this maze.

FICA employer contribution

Federal government requires that all companies deduct FICA, Social Security and Medicare taxes from their employees pay stubs. Employers are required to submit a quarterly employer tax return. The tax returns are filed using the form known as Form 941.

FICA is the federal income tax is used to fund Medicare as well as Social Security. The 12.4% social safety levy on the wages of employees is the first part of the tax.

The Medicare tax is the second component of tax is called the Medicare tax. FICA’s Medicare tax does not have an upper wage base limitation therefore the tax rate is adjusted. Employers can write off FICA to cover business expenses that is a win-win-win.

For small businesses, Form 941 is used to record the employer’s share of FICA. The IRS utilizes this form to disclose specifics about taxes removed from the employee’s paycheck.

Tax return for the employer’s quarterly.

If your business is required by law to pay tax on employment it is essential to understand how to complete the Form 941. This form will provide information about the federal income tax withholdings and payroll taxes.

Every single one of the Social Security and Medicare taxes that are deducted from earnings of employees must be reported. The amount will be equal to the amount shown on the W-2 form. It is also necessary to disclose the tips that each employee is paid.

The name and SSN of your business when you are submitting your application. The number of employees you paid in the period must also be included.

Complete the 15 lines on the Form 1040. Each line outlines the different components of your pay. These are the employees you’ve paid, their salaries as well as their gratuities.

The annual return of workers from agriculture to employers

As you probably know that the IRS Form 943 is a required form if you operate an agricultural firm.This form is used to determine the appropriate amount of tax withholding by employees for employers who are agricultural. It contains crucial information to be aware of. While you are able to fill out the form online, it is possible to send it to the address below if your computer doesn’t allow you to.

A payroll system that is professionally designed is the most efficient method of maximising the value of the tax return. You will also need to open an account with IRS. You may be able to speed up the process using Web Upload, once you have established a valid account number. Double-checking the number before making a deposit is recommended.

Insufficient reporting of income may cause penalties and even interest.

When you pay taxes, it is important to pay the right amount to the government. Paying too much to the government could result in financial ruin. In reality it is possible that the IRS could impose fines if you underpay.

If you’re not certain of what amount of debt you owe You can use the form 2210 provided by IRS to determine it. Once you’ve submitted the form, you’ll need to find out if you’re eligible for the waiver. This could be the case if you live in a state with a high tax rate, or have large unreimbursed expenses due to your job.

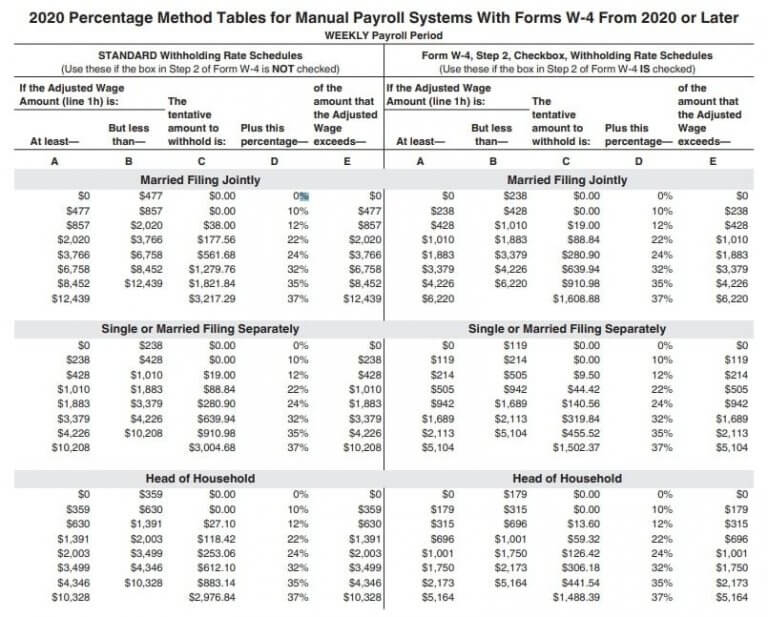

There are calculators for estimating your tax withholdings. Utilizing the IRS Tax Withholding Calculator, you’ll be able to do this.