Harford Memorial Hospital Employee Tax Forms – It is important to know what you need you should do with your employee tax forms if you wish to reduce the amount of interest, fines and the stress of having to submit an annual tax return for your employees to an absolute minimum. There are numerous tools that can help you through this maze.

FICA employer contribution

The FICA, Social Security and Medicare taxes are federal taxes that businesses have to subtract from their employees’ paychecks. Employers are required to submit an annual tax return for their employers. The tax returns are filed using Form 941.

FICA is the tax that federal governments impose that funds Social Security and Medicare. The 12.4% employee wage social security levy is the primary component of the tax.

The Medicare tax is the additional component of tax. The Medicare tax is the second part. It does not have any upper wage base limitations so the tax rate may alter. Employers profit from this as they are able to claim their portion of FICA as an expense for business.

The employer’s portion of FICA is filed on Form 941, which is for small businesses. The form is utilized by the IRS to submit details on the tax deductions from the employee’s pay.

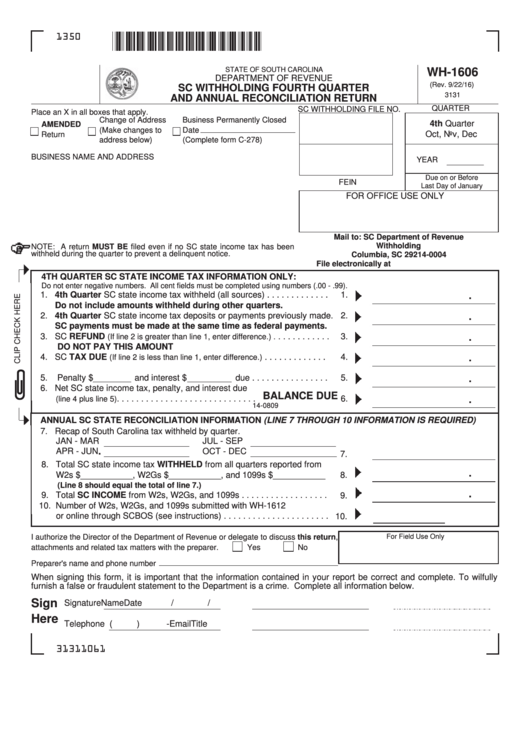

The quarterly tax return of the employer

If your company is required to pay employment taxes, it’s important to learn how to complete and submit Form 941. It contains information about the withholding of federal income taxes and payroll tax.

Report the total amount of Medicare and Social Security taxes taken from earnings of the employee. The total amount you report must be in line with the information that is on the W-2 for the employee. It is also important to show how much the employee earns in tips.

In your submission, please be sure to include your company and your SSN. You must also mention the number of employees that you employed during the period.

The Form 1040 contains 15 lines that need to be filled out. The different components of your remuneration are presented on each line. Each line represents different components of your remuneration. These include the number and pay of employees as well as their bonuses.

Annual return to employers for employees in the field of agriculture

As you probably know of, IRS Form 943 is an essential form if you operate an agricultural firm.This form will determine the right amount of tax withholding for employees for agricultural businesses. It contains crucial information that you must know. Although you can complete the form online, it’s possible to mail it in if your computer isn’t able to.

The best method to maximize this tax form’s potential is to employ a the most sophisticated payroll software. A bank account is required to be registered with the IRS. You might be able to expedite the process by using Web Upload, once you have established a valid account number. Prior to making the deposit you may need verify that the account number is accurate.

Inaccurate reporting of income could result in penalties and interest.

You must be careful not to underpay the government when you pay your taxes. Underpaying your taxes is a bad decision that could cost you lots of dollars. If you’re not paid, the IRS could issue fines. So, it is important be sure that your withholdings and tax rates are accurate.

If you’re not sure the amount of debt you have to pay then fill out Form 2210. Once you’ve submitted the form, you will be able to find out if qualified for an exemption. This may be possible when you reside in a state with a high tax rate, or have significant unreimbursed costs due to your job.

To determine your tax withholdings, you can utilize calculators. This can be accomplished with the help of the most current IRS Tax Withholding Estimator.