Illinois State Employee Withholding Tax Form – It is crucial to know the rules for employee tax returns for a better chance of avoiding fines, interest and the hassle of filing them. Fortunately, there are several tools at your disposal to guide you through this maze.

FICA employer contribution

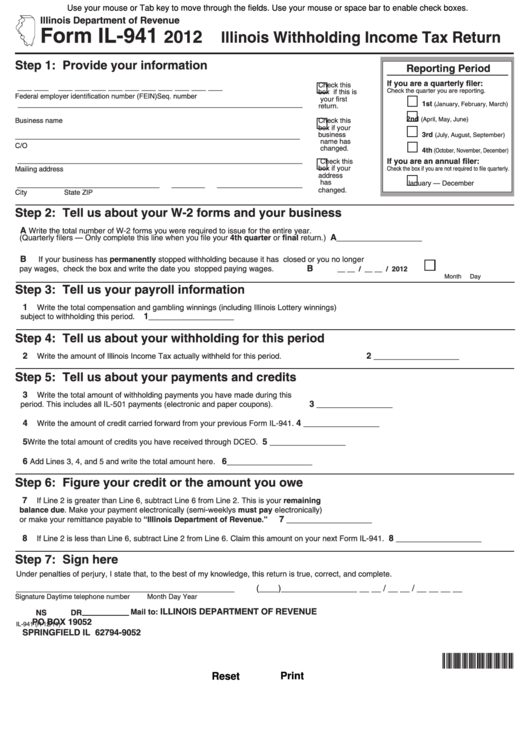

The FICA, Social Security and Medicare taxes are federal taxes that businesses have to deduct from their employees’ paychecks. Employers are required to submit an annual tax return for their employers. The tax returns are filed using the form known as Form 941.

FICA The federal income tax, funds Medicare as well as Social Security. The 12.4 percent wage of employees social security levy is the main component of the tax.

The Medicare tax is the second component of tax. FICA’s Medicare component doesn’t have any limitations on the wage base, which means that the tax rates are subject to alter. Employers can write off FICA as business expenses and this is a win-win for everyone.

For small businesses, Form 941 reports the employer’s share of FICA. The IRS can utilize this form to provide the details of taxes withheld from an employee’s pay.

Tax return for the quarter from the employer

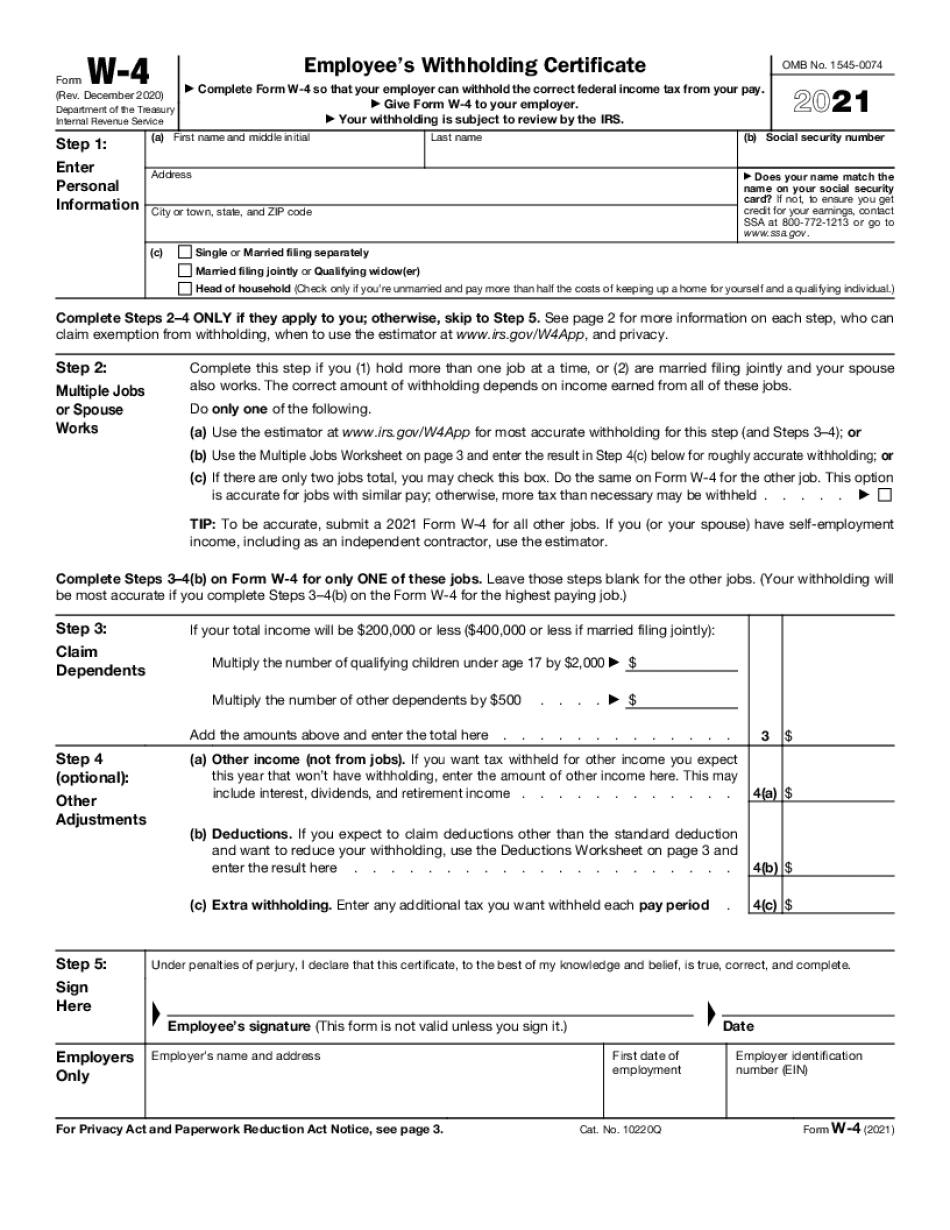

If your business is required to pay for employment taxes it is essential to know how to fill out and submit Form 941. There are details about the federal income and payroll tax on the form.

It is required to report the total amount of Medicare and Social Security taxes that were deducted from employee earnings. This sum will be equivalent to the amount stated on the form W-2. Furthermore, it is essential to disclose the amount of tips paid to employees.

In your report, include the name of your business as well as your SSN. Also, you must include the number of employees you’ve paid each quarter.

Fill out the 15 lines of your Form 1040. Each line describes the various components of your compensation. Each line is a representation of the various elements of your remuneration. They include the total number and salaries of employees, as well as their gratuities.

Annual return on investment by employers for agricultural workers

The IRS Form 943, as you probably know is required if your agricultural enterprise is required to be registered with the IRS. The form determines the correct amount of tax withholding for employees for agricultural employers. There are several important points to keep in mind when filling out this form. It is possible to submit it online, but you may have to submit it by mail.

Payroll software that is professional-designed and certified will increase the value of tax forms. In addition, you’ll have to open an IRS account. You might be able to speed up the process making use of Web Upload, once you have obtained a valid account number. You may want to double-check your account’s number prior to making a deposit.

Interest and penalties can result from not reporting income.

It is essential not to underpay government tax taxpayers. You’ll regret it later and end having to pay more. In fact, if you’re not paid, the IRS may impose fines on the taxpayer, so ensure that your withholdings are correct.

If you’re not sure how much you owe you, complete Form 2210. Find out what waivers are available after you’ve completed the form. This could be the case if you live in a state that has high taxes, or have significant unreimbursed costs due to your job.

Calculators can also aid you in estimating your tax withholdings. With the IRS Tax Withholding Estimator, you are able to calculate your tax withholding.