Independent Employee Tax Forms – It is vital to be aware of the requirements for employee tax returns if you wish to minimize fines, interest and the burden of having to file tax returns. There are a variety of options to help you get through the maze.

FICA employer contribution

The FICA (Federal Income Taxes), Social Security (Medicare taxes) are the three taxes which federal law obliges businesses to deduct from the wages of employees. Employers must submit a quarterly return detailing the tax obligations of their employers. The tax are reported on Form 941.

The federal tax known as FICA is the one that funds Social Security and Medicare. The 12.4 percent wage of employees social security tax is the main component of tax.

The Medicare taxes are the second tax component. FICA’s Medicare tax does not have an upper wage base limitation therefore the tax rate can be adjusted. Employers gain from this since they are able to claim their portion of FICA as an expense for business.

For small firms the Form 941, which details the employer’s share of FICA, is mandatory. This form is utilized by the IRS to submit details on the taxes withheld from an employee’s paycheck.

Quarterly tax return for the employer

If your company must pay employment taxes It’s essential to understand how to submit and complete Form 941. The form provides details regarding your federal income tax withholdings, as well as payroll taxes.

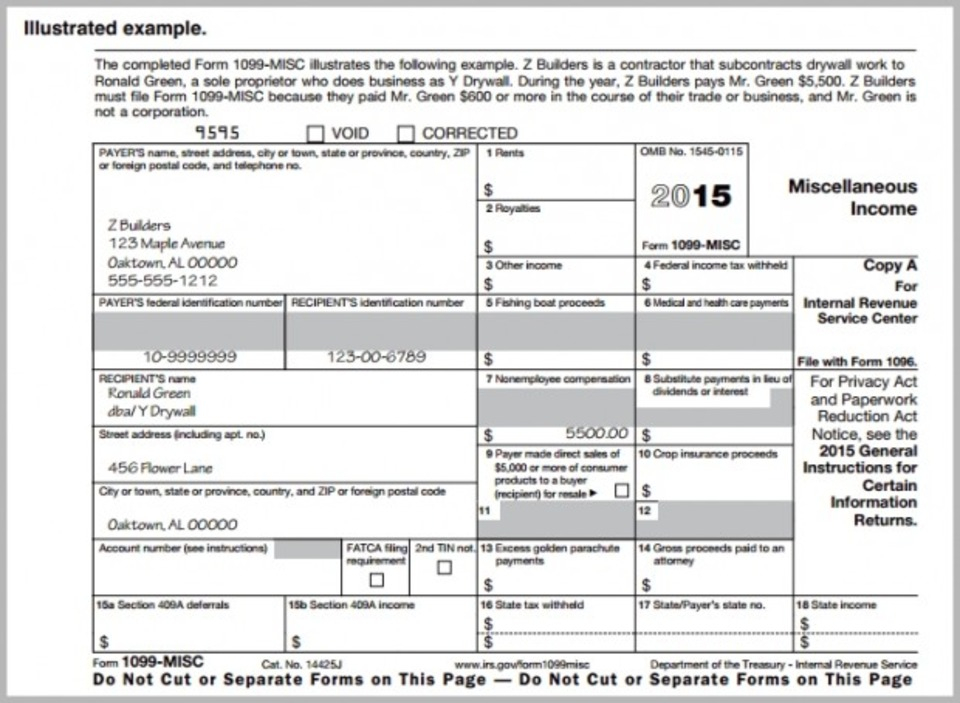

You must report the total amount of Social Security and Medicare taxes that are taken from earnings of employees. The total amount must be the same as the amount shown on the employee’s W-2 form. It is also important to state the amount each employee receives in tips.

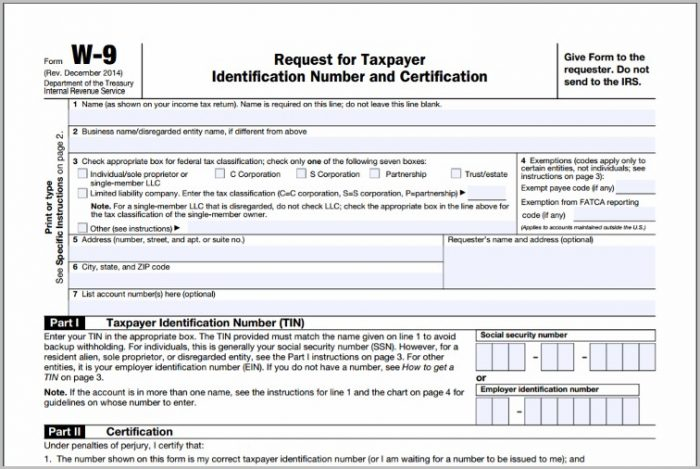

In your application, you must include the name of your company as well as your SSN. It is also important to provide the number and names of all workers employed during the period.

The form 1040 has 15 lines to be filled out. Each line is an element of your compensation. This includes the amount, salaries, and gratuities of all employees.

Annual investment return for employers for agricultural workers

As you are probably aware of, IRS Form 943 is an essential form if you operate an agricultural firm.This form is used to determine the right amount of employee tax withholding for agricultural businesses. You need to be aware of a few particulars regarding this form. It is possible to submit this form online. However, if you aren’t connected to the internet or a computer, you might have to send it by mail.

The most effective way to maximize this tax form’s value is to utilize a the most sophisticated payroll software. The IRS will also require that you open an account. If you already have an account number, you may accelerate the process through the Web Upload service. Before depositing, make sure you verify the number.

Penalties and interest may result from the inability to report income.

Paying taxes on time is essential. Paying too much to the government could lead to financial ruin. The IRS could impose fines on you if you underpay.

Use Form 2210 from the IRS to determine your debt if you’re not sure of the amount you are owed. After you have submitted the form, you’ll be able determine you qualify for waiver. If you’re in a state that has high tax rates or have a sizable amount of unreimbursed job expenses, this may occur.

Calculators can also be used to estimate your tax withholding. By using the IRS Tax Withholding Estimator, you are able to estimate your withholdings.