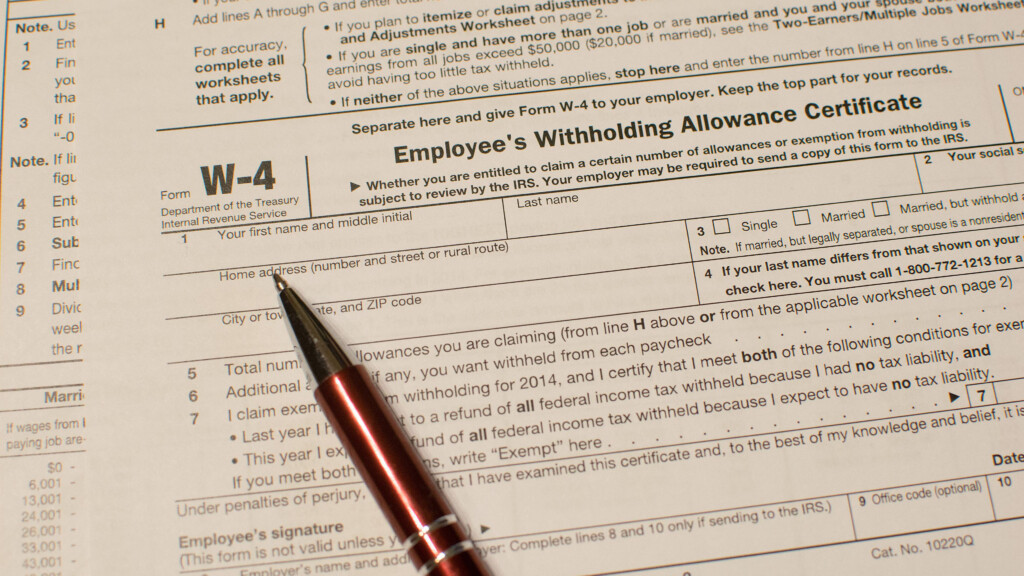

Johns Hopkins Employee Tax Forms – If you’re looking to decrease the amount of interest and fines or the hassle of submitting a tax return to your employees, it’s important to understand how to deal with the tax forms for your employees. There are a variety of options to help you navigate the maze.

FICA employer contribution

The Federal government requires that all employers deduct FICA, Social Security and Medicare taxes from their employees’ paychecks. Employers are required to submit an annual tax return for their employers. The tax returns are filed using Form 941.

FICA The federal income tax, is used to fund Medicare as well as Social Security. The primary component of the tax is the 12.4 percent Social Security levy that is levied on employees’ earnings.

The Medicare tax is the second component of the tax. The Medicare component of the FICA tax is not subject to any upper wage base restrictions and therefore, the tax rate can be adjusted. Employers can write off FICA as business expenses and this is a win-win-win.

For small businesses, Form 941 reports the employer’s share of FICA. The form is used by the IRS to provide information on the taxes withheld from the employee’s pay.

The quarterly tax return from the employer

If your company is required to pay employment taxes to be paid, it’s important to be aware of how to complete and submit the Form 941. It contains information about your federal income taxes withholding and payroll taxes.

The total amount to be reported is the amount of Medicare and Social Security taxes taken from earnings of the employee. The W-2 of the employee will reveal exactly how much. In addition, it is important to disclose how much tips are paid to employees.

Your submission must include your business’ name as well as your SSN. The number of workers you paid in the quarter should also be listed.

Your Form 1040 has 15 lines to be filled out. Each line shows the components of your remuneration. These include the number of gratuities, wages, and salaries of all employees.

Annual return on investment by employers of agricultural workers

The IRS Form 943, as you may have heard of is required when your farm business needs to be registered with the IRS. This form is used to determine the correct amount of tax withholding for employees of agricultural employers. These forms have important details you should be aware of. The form can be completed online. If you do not have internet access the form may have to be mailed in.

A payroll system that is professionally designed is the most efficient method of maximising the value of this tax return. Also, you will need to create an IRS account. You can speed up the process by making use of the Web Upload Service once you have a valid account number. You may want to double-check the account number prior to making a payment.

Underreporting income can lead to penalties and interest.

Paying taxes on time is vital. In fact, underpaying taxes is a risk that will end up costing you money. If you are underpaid, the IRS may impose fines on you, which is why you should be sure that your withholdings are accurate.

To calculate your debt, fill out Form 2210 issued by the IRS If you’re not certain of the amount. After you have submitted the form, you’ll be able to find out if you are qualified to be waived. You could be eligible if you reside or work in an extremely taxed state.

Calculators are also a good option to estimate your withholding. You can do this using the most current IRS Tax Withholding Estimator.