Lilly Hr Former Employee Tax – It is essential that you understand the requirements for tax returns for employees in order to avoid penalties, interest and hassle of making the returns. There are many tools to help get through this maze.

FICA employer contribution

The FICA, Social Security and Medicare taxes are federal taxes that businesses must take out of the pay of their employees. Employers must submit an annual return that details their employer’s tax obligations. Taxes are reported on an application known as Form 941.

FICA The federal income tax funds Medicare and Social Security. The 12.4% social safety levy on the wages of employees is the first part of this tax.

The Medicare tax is the second element of the tax. The Medicare component of the FICA tax has no upper wage base restrictions, therefore the tax rate is subject to be adjusted. Employers benefit from this because they are able to write off their FICA part as an expense for business.

For smaller businesses, Form 941, which reports the employer’s portion FICA, is required. The form is used by the IRS to report the details of the tax withheld from an employee’s paycheck.

Quarterly tax return from the employer

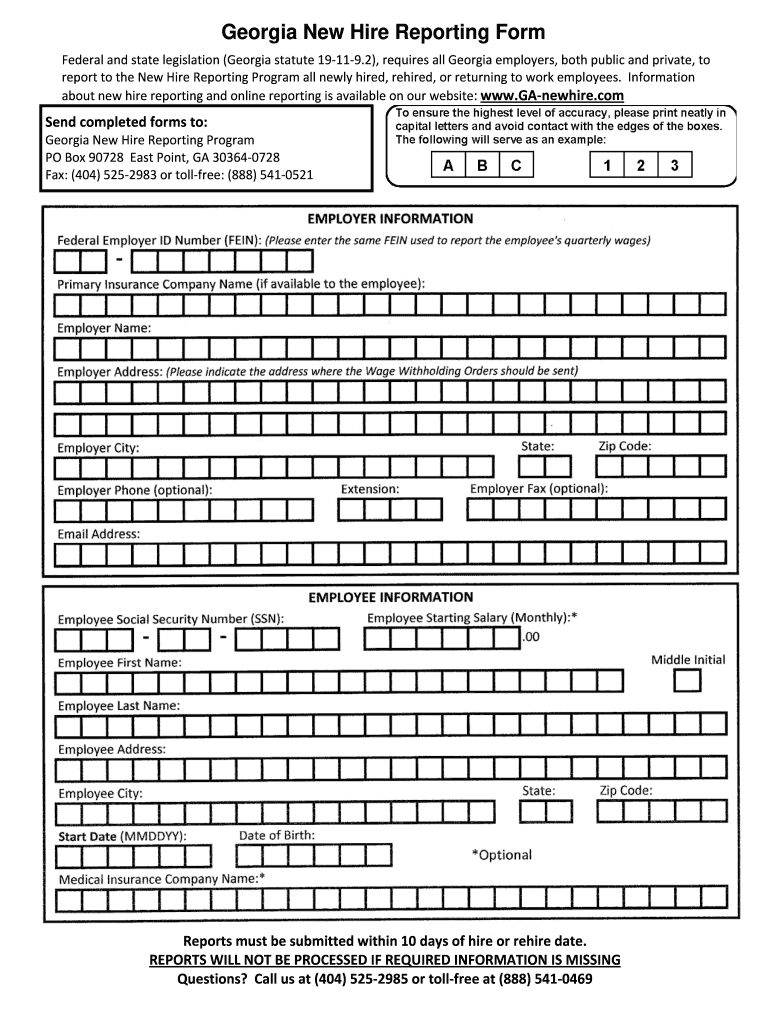

If your business requires employment tax to be paid, you need to understand how to fill out and submit the Form 941. The form contains details about your federal income taxes withholding and payroll taxes.

All Social Security and Medicare taxes that are deducted from earnings of employees must be declared. The sum here will match the amount on the W-2 for the employee. Furthermore, it is essential to reveal the amount of tips paid to employees.

In your application, you must include the name of your company as well as your SSN. Include the number of employees that you hired in the last quarter.

Complete the 15 lines on the Form 1040. Each line represents the different components of your remuneration. Each line represents different elements of your remuneration. They include the total number and pay of employees as well as their gratuities.

Agriculture workers’ annual return to the employer

As you are aware, the IRS Form 933, which is mandatory for all agricultural businesses and is used to determine the correct amount of withholding tax by agricultural employers. You should know a few particulars about this form. While you may complete the form online, it is possible to send it to the address below if your computer does not allow it.

A professional payroll program is the most effective method to maximize the value of this tax return. It is also necessary to establish an account with IRS. Once you have obtained an account number that is legal, you can accelerate the process by using Web Upload. Make sure you verify the number before you deposit your money.

Failure to report income correctly could cause penalties and even interest.

You must be careful not to pay too much to the government when you pay taxes. You will regret it and end with a higher tax bill. If you’re underpaid you could be fined by the IRS may impose penalties. So, it is important be sure that your withholdings as well as taxes are accurate.

If you’re unsure of the amount of debt you have, you can use Form 2210 from IRS to calculate it. When you’ve submitted the form, you’ll be able to learn if your application is eligible for a waiver. If you live in a country with high tax rates or have a substantial amount of non-reimbursed expenses for work, this may occur.

Calculators can also be used to estimate your tax withholding. By using the IRS Tax Withholding Estimator, you are able to calculate your tax withholding.