Local Tax Form To Takeout Employee Loal Tax – You need to be familiar of the process involved in submitting employee tax returns. This will allow you to avoid interest, penalties, and all of the hassle associated with it. There are numerous tools to help you navigate the maze.

FICA employer contribution

The FICA, Social Security and Medicare taxes are three federal taxes that companies must deduct from the wages of their employees. An employer must file a quarterly tax return. These taxes are reported using the form known as Form 941.

FICA is the federal tax that is what funds Medicare as well as Social Security. The first part is the 12.4 Social Security Levy of 12.4 percent on Employee Wages.

The Medicare tax is the second element of tax. The Medicare tax is the second component. It does not have any upper wage base limits which means that the tax rate can change. Employers are able to write off FICA as a business expense.

For smaller companies Form 941 is used to report the employer’s FICA portion. The IRS can use this form to report the details of taxes withheld from the employee’s wages.

Tax return for the quarter of the employer

If your company requires employment tax to be paid, you need to be aware of how to complete and submit Form 941. Your federal income tax withholding and payroll tax are listed on the form.

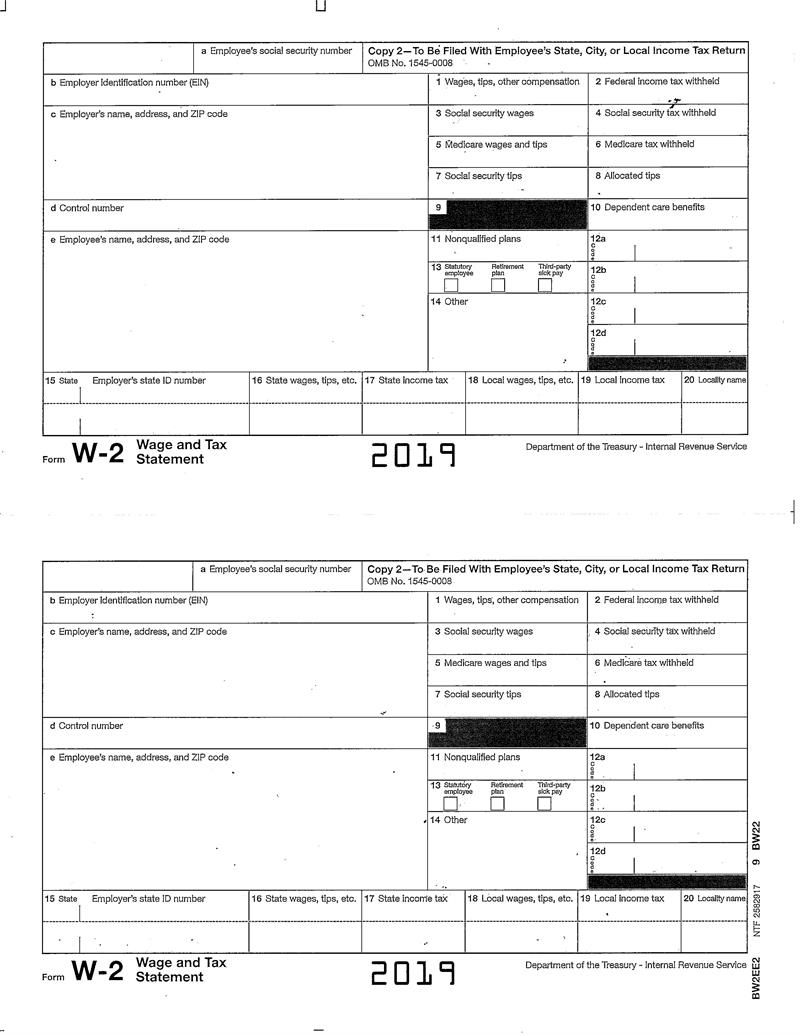

The whole sum of Social Security and Medicare taxes that are deducted from the earnings of employees have to be disclosed. The amount reported will match that shown on an employee’s W-2. In addition, it is important to reveal how much tips are paid to employees.

When you submit your report it must contain the name and SSN of your business. The number of employees you paid during the quarter must also be included.

Your Form 1040 has 15 lines that need to be completed. Each line represents different elements of your remuneration. This is the employees you’ve paid, their salary and their gratuities.

Annual return to employers for employees in the field of agriculture

You are probably aware that IRS Form 943 must be filed if you own an agriculture firm. It is used to calculate how much tax is withheld from employers of agricultural businesses. There are several important points to be aware of when filling out this form. This form can be completed on the internet, however if you don’t have access to the internet, you might need to mail it in.

Employing a payroll program that is professional is the best approach to maximizing the value of this tax form. The IRS will also require you to create an account. Web Upload is a Web Upload service can be used to accelerate the process once you have an official account number. You may want to double-check the account number prior to making a payment.

Penalties and interest can result from underreporting income.

Making sure you pay your taxes in full is a smart idea. Paying taxes too low is a poor choice that can end up costing you lots of money. In actual fact, the IRS could impose fines for underpayment.

To figure out your amount of debt, you can use Form 2210 issued by the IRS in case you’re not certain of the amount. Once you’ve completed the form, you can determine if you’re qualified for the waiver. It is possible that you are qualified for a waiver in the event that your state has a very high rate of tax or you have substantial unreimbursed work expenses.

Calculators can also assist you in estimating your withholdings. With the IRS Tax Withholding Expert, this can be done.