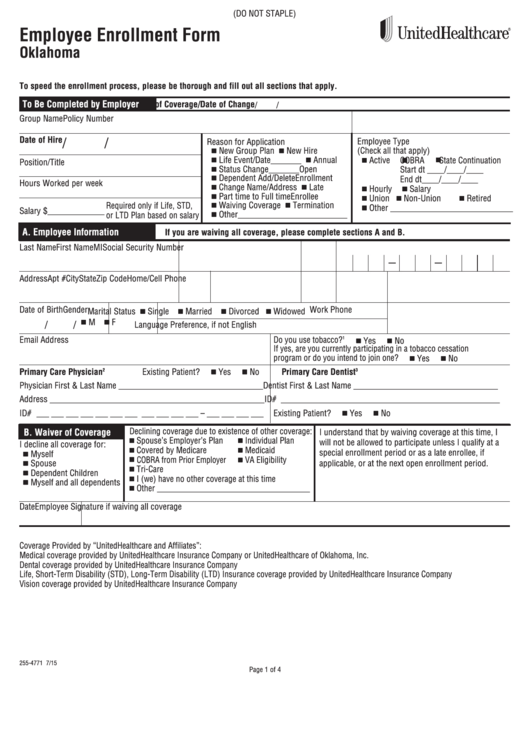

New Employee Forms Oklahoma – There is a chance that you will need to fill out several documents, like I-9 and W-4 forms, in the event that you hire new staff. These forms are required for ensuring that your staff can legally work within the US. This article covers the documents you’ll need.

Checks that were made in the past

Employers may conduct a range of background checks when selecting the person to employ. There are many background checks that employers are able to conduct to determine who to hire. These include credit verifications, identification checks and motor vehicle records checks. These checks are conducted to ensure that the applicant is who they say they are, and that they meet the requirements of the post.

Background checks can help in protecting the business, its clients, and its personnel. Past criminal convictions, speeding violations, and bad driving habits can all be red flags. Signs of occupational danger or violence may also be present.

Most businesses engage a third-party company to conduct background investigations. They’ll have access to information from all 94 United States Federal Courts. Some businesses prefer to wait until a conditional acceptance is received before they conduct background checks.

Background checks can take a long time. Employers must prepare a list of questions. It is crucial that applicants are given the time to reply. The typical time to wait for an answer is five days.

Form I-9

Every employee must fill out the I-9 form at least once while they are a new recruit. Both federal contractors as well state workers are required to complete the form. This can be long and challenging.

There are many components of the form. The most fundamental section should be completed when you begin work. If you plan to employ foreign nationals, this includes their identification information.

Once you’ve completed Section 1 Make sure the remainder of the form is completed. The required Form I-9 should also exist on file for 3 years following the date of hiring. You must continue paying the Form 6A fees.

When filling out the Form I-9, consider ways to reduce your risk of fraud. It is important to ensure that all employees have been added to the E Verify database. You should also send in all donations and administrative expenses on time.

Formulas W-4

The W-4 form is one of the first documents that new hires must complete. The form reveals how much tax taken from their wages. The user can also use it to learn more about their tax liabilities. People may be able receive a larger paycheck when they have a greater comprehension of the deductions the government makes out of their income.

Because it instructs businesses on how much to deduct from employee’s paychecks The W-4 is crucial. Federal income taxes will be calculated using this data. To avoid surprises, it may be beneficial to track how much you are able to deduct.

The straightforward Form W-4 includes your address, name, as well as other information that could have an impact on the federal income tax you pay. You can stay clear of overpaying taxes by making sure to complete the form correctly.

The W-4 is available in a range of variants. It’s possible to submit the W-4 online and print or manually fill it in. Regardless of the approach you choose to use, make sure to submit your paperwork prior to receiving your first pay.

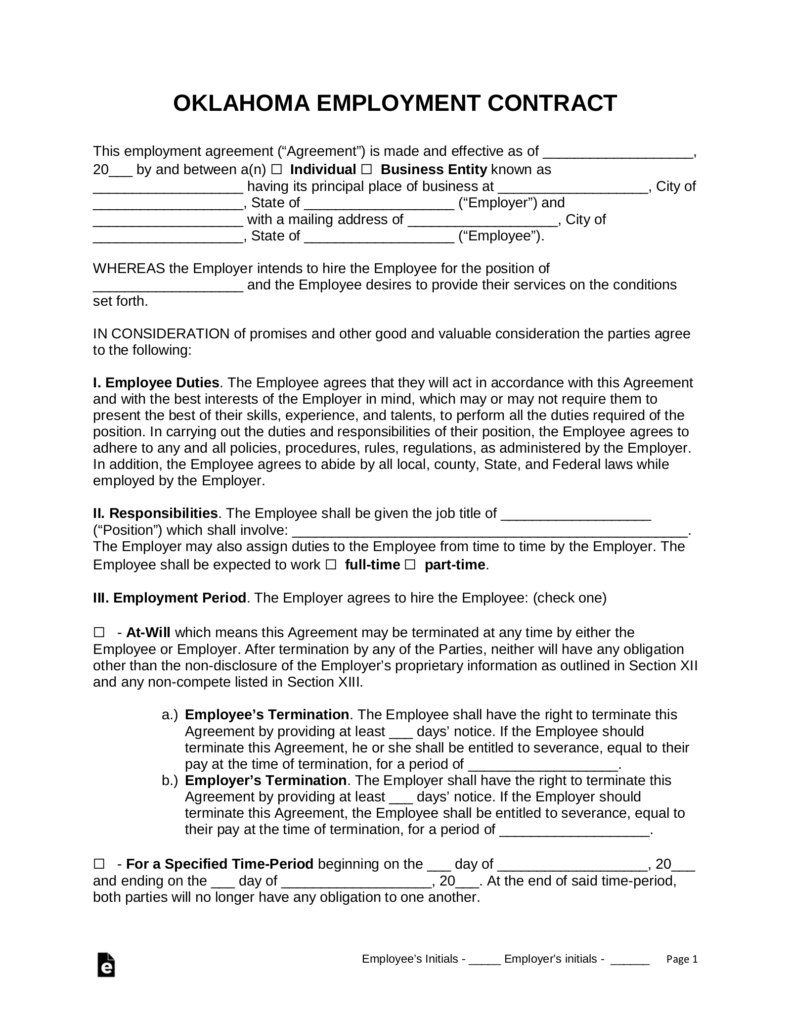

Make an application for a job

To evaluate job applicants Employers use forms to evaluate application forms. They help in creating an accurate picture of an applicant’s educational background as well as professional experience.

When you complete an application for a job with your contact and personal information are required. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Either online or on paper You can submit an application for an employment. The application should be simple to read and contain all information required.

Before you send out a request for work, it is advisable to consult a qualified expert. This will help you ensure your application doesn’t contain any unlawful information.

Many employers keep applications on file for a time. Employers can then contact applicants to discuss future openings.

Many job applications require your full name as well as your address and email. This is the preferred method for applicants to be contacted by employers.