New Employee Hire Forms California – There could be a variety of paperwork you must complete when hiring new staff. They include W-4 as well as I-9 forms. These forms are essential to prove that the employees have the right to work in the USA. This article provides the forms you’ll need.

Checks from the past

Employers may use various background checks when deciding whom to employ. There are many background checks that employers may use to verify the identity and credit, educational and driving record of prospective employees. These checks are required to verify that applicants are who they claim to be. are and meet all requirements for the job.

Background checks are a great way to ensure the safety of employees and customers as well as the company. Criminal convictions in the past, speeding violations, and poor driving habits could all be warning signs. It is also possible to find signs of occupational risk, such as violence.

Many companies will utilize a third-party background investigator firm. They will now have access the database of all 94 United States federal courts. Some businesses decide to not conduct background checks until the stage of conditional offers to employees.

Background checks can be time-consuming. Employers need to make a list. Employers must give applicants enough time to get a response. The typical time for response to an application is five days.

Formula I-9

If they’re a new employee, they has to fill out an I-9 form. Both federal contractors as well state workers are required to fill out the form. It can be tedious and time-consuming, but it is not impossible.

There are many components of the form. The most fundamental section should be completed when you begin working. If you are planning to hire foreign workers, this should include their identification information.

After completing Section 1, make sure the rest of the form is completed by the deadline. It is also essential to keep the Form I-9, which you require for your employment, on file for at least 3 years. It is mandatory to continue paying the required 6A fees.

When filling in the Form I-9, think about how you can lower the risk of being a victim of fraud. You should ensure that each employee is enrolled in E-Verify. It is also important to submit all donations and administrative costs on time.

Formulas W-4

W-4 forms are the first paper new employees complete. On this page you will see how much tax was taken from the salary. The user can also use it to learn more about their tax liabilities. If they are able to comprehend the tax deductions the government will take from their income and assets, they could be eligible for a larger check.

W-4 is crucial because it gives businesses instructions on the amount to deduct from the wages of employees. This data will assist in calculating the federal income tax. It can be beneficial to keep track of your withholding so that you can stay clear of unexpected shocks later on.

The basic W-4 is a simple form. W-4 includes your address, name and any other information which could impact on the federal tax returns for income. The form can be completed accurately to help you avoid paying too much.

There are a variety of methods to fill out the W-4. Online submission is also possible as is manual printing. Whichever method you decide to use you have to submit the paperwork before receiving the first pay check.

Apply for a job

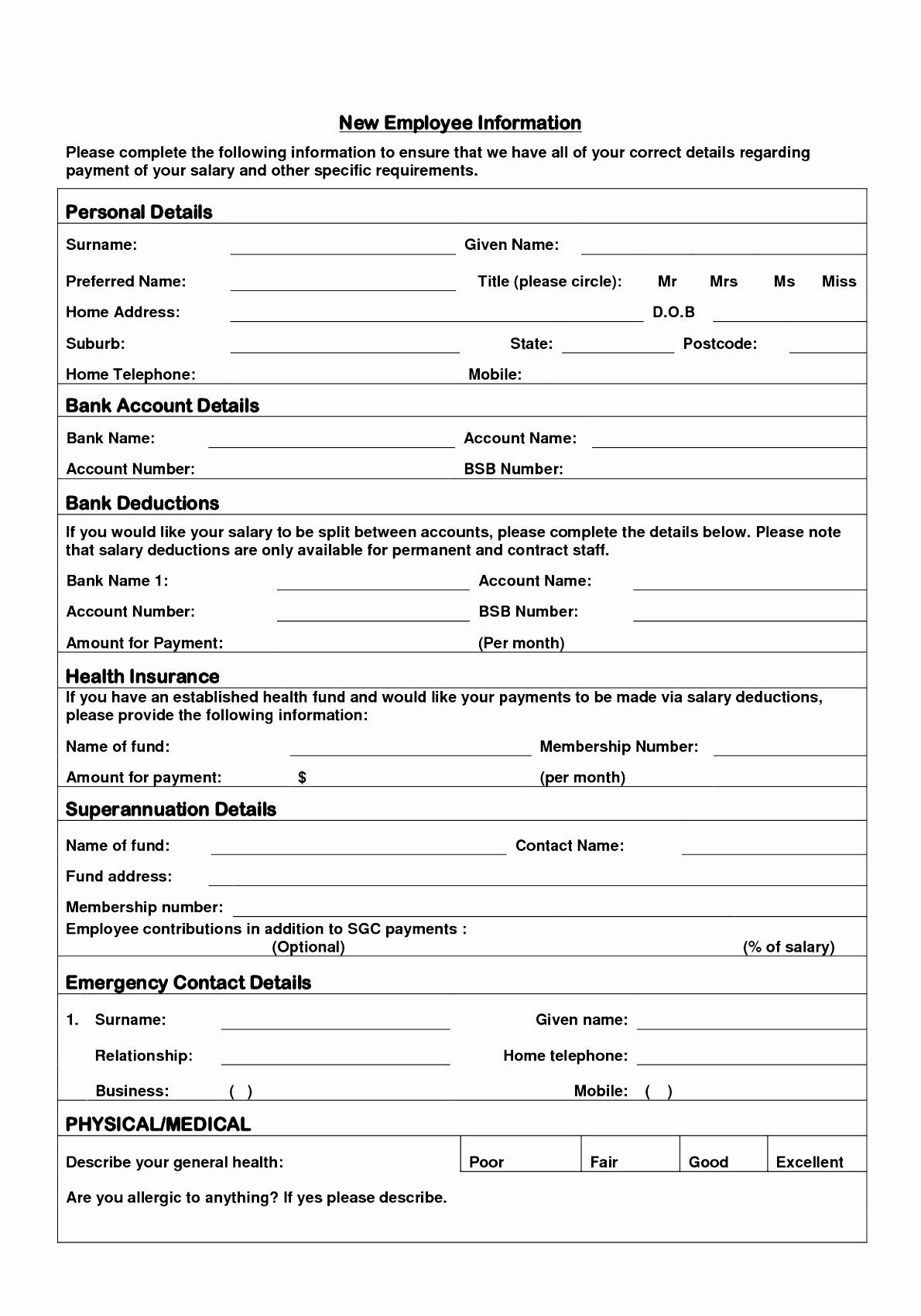

Businesses use forms for job applications to assess applicants. They enable the creation of a complete description of the applicant’s education background and experience.

You’ll need to provide personal information and contact details when making a request for employment form. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Paper or online, job applications are accepted on paper or online. Your form must be simple to comprehend and include all the information required.

Before you submit your job application, be sure to speak with a certified professional. This will ensure that your job application is not filled with illegal content.

A lot of companies keep applications in their files for a period of time. Employers can call candidates to ask about opportunities in the future.

On forms for job applications the complete name, address, email and telephone number are required. These are the preferred methods for applicants to be contacted by employers.