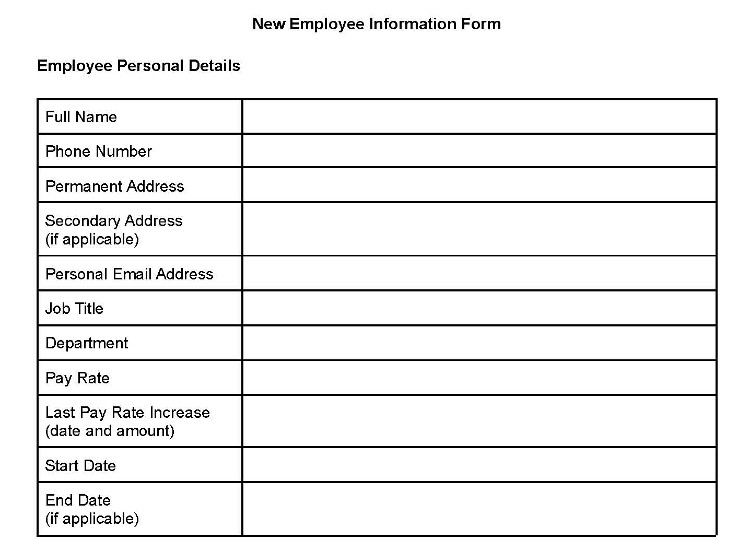

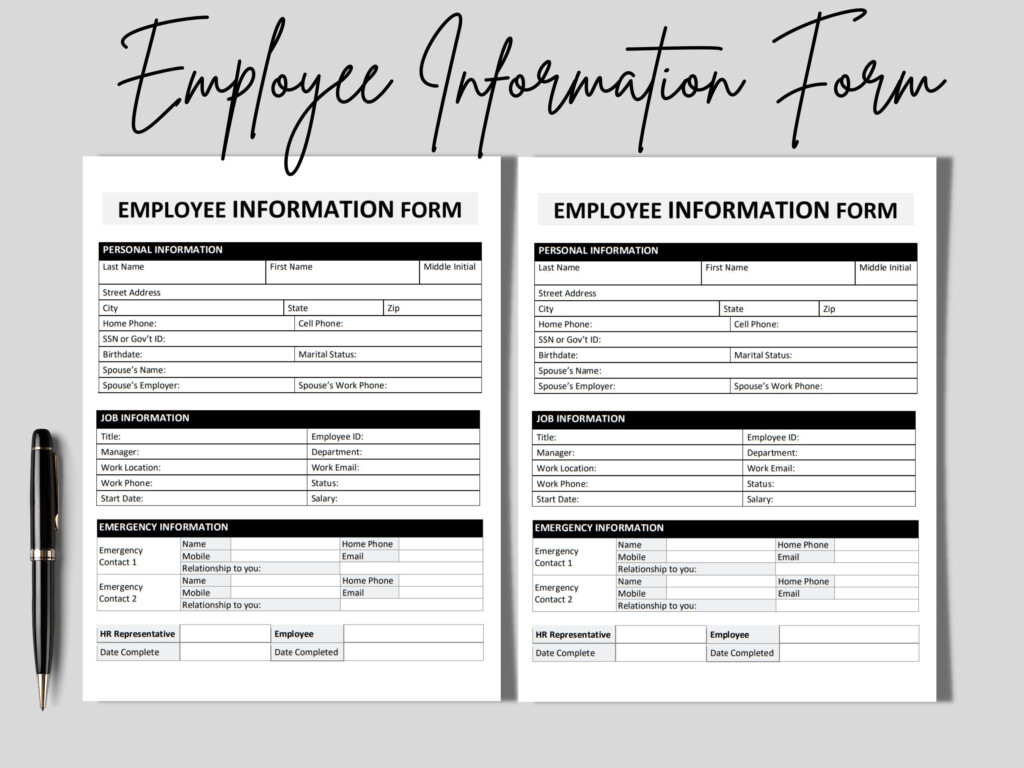

New Employee Information Form 7213 – If you are hiring new employees You may be required to complete a number of documents including I-9 forms and W-4 forms. These forms are required to ensure that your employees are legally able to work in the USA. The forms you’ll need to fill out are provided in this post.

In the past, checks

Employers can make use of various background checks to determine who to hire. They can conduct checks that verify educational, credit, identification and motor vehicle record checks. These checks make sure that applicants are authentic to their identities and are able to meet the requirements of the position.

Background checks are an excellent way to protect the business, its customers and its employees. Candidates’ past criminal convictions such as speeding tickets, traffic violations, and poor driving habits could all indicate red flags. Potential indicators of occupational threat, such violence, could also be present.

Most businesses will employ an outside background investigation company. They will now have access to a database of data of all federal courts across the United States. Some companies wait for an employment contract with a conditional clause before conducting background checks.

Background checks might take a considerable amount of time. Employers need to make an outline. Employers should give applicants sufficient time to get a response. The typical time for response to the request is 5 days.

Formula I-9

Each employee has to fill out an I-9 form each time they hire. Federal contractors as well as state employees are required to complete the form. However, the procedure might be difficult and time-consuming.

The form consists of many sections. The first section is essential and must be filled out by you prior to beginning to work. If you plan to hire a foreign national, this section will include the information of the employer, as well as the necessary information.

When you’ve completed Section 1, make sure that the rest of the form is completed on time. Keep the required Form I-9 on file for three years beginning with the date of hiring. You must also continue to pay Form 6A-related fees.

You should think about the many ways you can lessen your vulnerability to fraud while you fill out Form I-9. First, make sure that each employee is included in the E-Verify Database. The cost of administrative and donations should be submitted in time.

Forms W-4

One of the documents that new employees fill out is the W-4 form. On this form you will look up the tax deduction they receive from their salary. The user can also use it to find out more about the tax obligations they face. By having a better understanding of the tax deductions made from their income and expenses, they could be able to obtain a bigger tax refund.

W-4 is essential because it gives businesses instructions regarding how much they can deduct from wages paid to employees. The data is used to calculate federal income taxes. It is a good idea to keep the track of your withholdings so that you can stay away from shocks that could surprise you later on.

The basic Form W-4 includes your address, name as well as any other information that could have an effect on your federal income tax returns. To avoid overpaying, make sure you fill in the form in a timely manner.

There are several different versions of the W-4. It’s possible to fill out the W-4 online and print or manually fill it in. No matter which method you use, be sure to submit your paperwork before you get your first salary.

applying for an employment

Companies use forms for job applications to assess the qualifications of applicants. They allow for the creation of a comprehensive picture of the applicant’s education background and experience.

Filling out job applications will require you to provide your personal information as well as contact details. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Job applications can be submitted either online or by writing. Your application must be easy-to-read and contain all information required.

When you are submitting your job application, make sure to consult a qualified professional. This will make sure you don’t include any material that is illegal.

A lot of companies keep applications on file for a while. Employers may contact applicants to inquire about opportunities in the future.

On job application forms on job applications, you’ll often be asked for your complete name address, postal address, as well as email. These are the most common methods employed by companies to contact potential candidates.