New Employee Information Forms Template – There may be a range of documents that you have to complete when hiring new employees. This includes W-4 and I-9 forms. These forms are required in order to ensure that your employees can legally be employed within the US. This article outlines the forms you’ll require.

Checks from the past

Employers have a number of background checks they can employ to make a decision regarding who to employ. These checks consist of verifications of educational, credit, identification and motor vehicle record checks. These checks are required to ensure that the applicants are who they say they are and satisfy the requirements of the job.

Background checks can be an effective tool to protect the business, its customers and employees. A criminal record of a candidate, driving records that are poor and speeding fines are just a few examples of potential red flags. Indicators of occupational danger like violence might exist.

The majority of companies will hire a third party background investigation company. The background investigation firm has access to all of the details available from all 94 U.S. federal courts. Some companies wait for an employment contract with a conditional clause prior to conducting background checks.

Background checks can take a considerable amount of time. Employers have to create an inventory. In addition, it is essential to allow applicants sufficient time to answer. It takes about five days to get an average response.

Formula I-9

Every employee must fill out the I-9 form at least once upon becoming an employee new. Federal contractors as well as state employees must comply. However, the procedure might be lengthy and complicated.

The form is comprised of multiple sections. The first section is essential and must be completed by you before you start to work. If you intend to hire foreign nationals, you must include the identifying details of those hired.

After you have completed Section 1, you should ensure that the remainder of the form has been completed on time. Keep the Form I-9 required for your hiring date for three years. You must also continue to pay Form 6A-related fees.

While filling out Forms I-9, be sure to think about the various ways that you can minimize your vulnerability to being a victim of fraud. In the beginning, make sure that all employees are included on the database E-Verify. Also, you must submit all contributions and administrative expenses on time.

Formulas W-4

W-4 forms will be the first form that new employees complete. The tax amount they deduct from their wages is listed on this webpage. It is also useful for people to understand their tax liabilities. By having a better understanding of the tax deductions earned from their earnings, they might be able obtain a bigger tax refund.

Since it provides businesses with instructions about how much they can deduct from employees’ paychecks In this regard, the W-4 is essential. This information is used to calculate federal income taxes. It is a good idea to keep the track of your withholdings in order to steer clear of unexpected shocks in the future.

The easy Form W-4 includes your address, name and any other information that could have an effect on your federal tax returns for income. Making an effort to correctly fill in the form can aid you in avoiding overpaying.

There are many ways to complete the W-4. It can be filed online, printed, and then completed manually. No matter which method you select to use it is essential that you fill out the paperwork prior to your first paycheck.

Apply for an opening

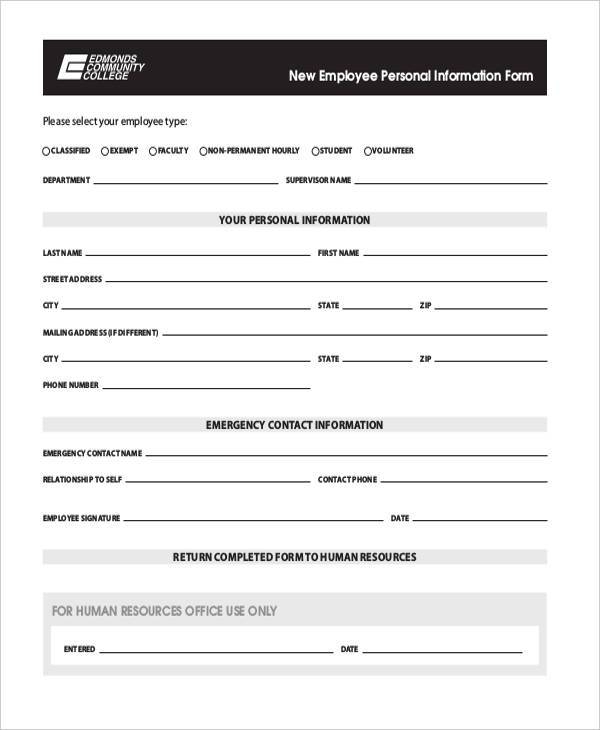

Employers use application forms to screen applicants. They aid in forming a clear picture of an applicant’s academic background and professional background.

If you complete a job application, your personal details including contact information is required. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Job applications can be submitted via the internet or by paper. It is crucial to make sure that your application is clear and concise.

When you are submitting your job application, make sure you seek out a professional who is qualified. This will make sure you don’t include any illegal material.

Many companies retain applications for quite a long time. Employers can call candidates to ask about opportunities in the future.

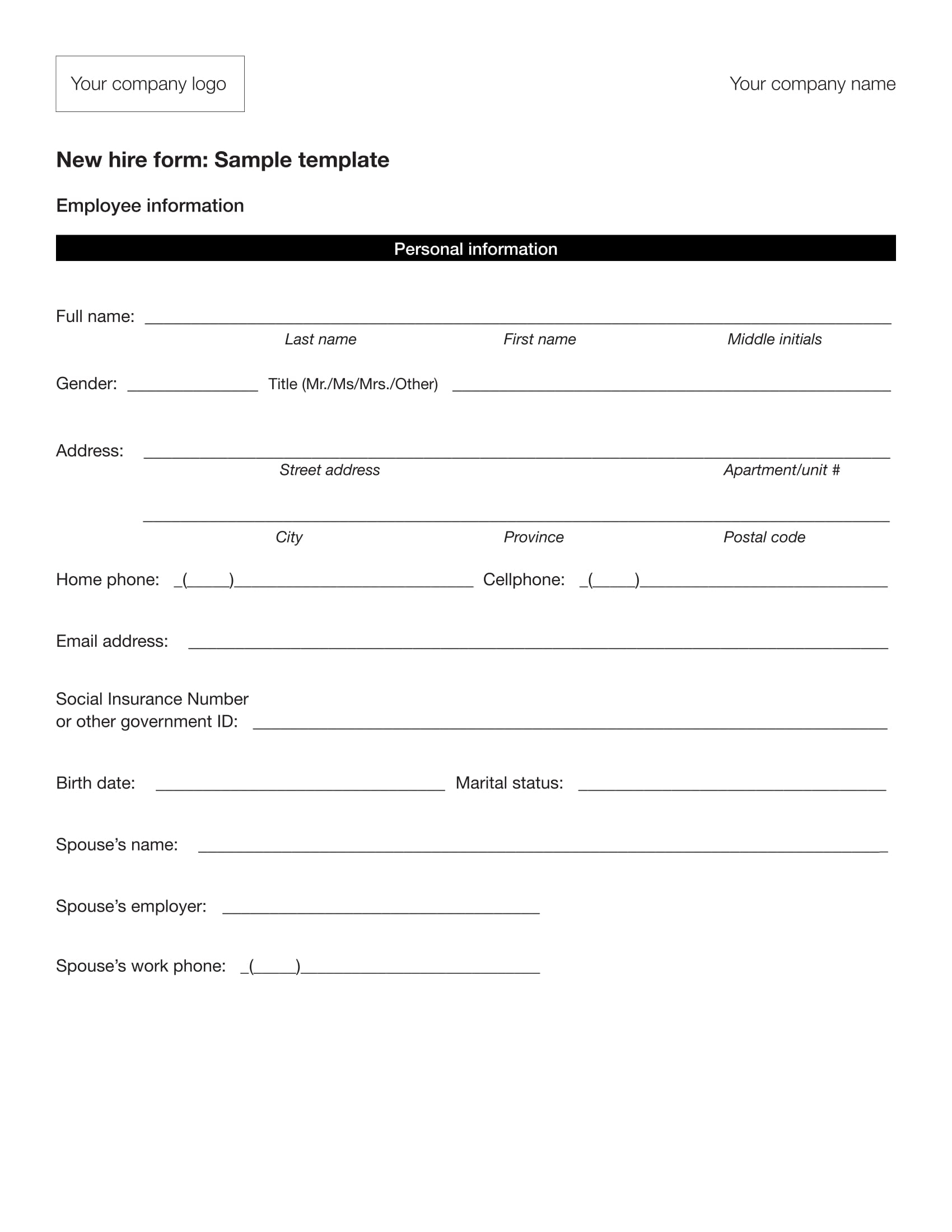

When filling out forms for job applications on job applications, you’ll often be requested to supply your full name address, postal address, as well as email. These are the primary methods employed by employers to contact potential candidates.