New Employee Reporting Form – If you are looking to hire new staff members it is possible that you will need to sign several forms such as I-9 or W-4 forms. These documents will be required to verify that your staff are allowed to travel freely in the US. This article will give you all the required forms.

Checks that were written in the past

Employers may use several background checks when deciding whom to employ. Checks for educational, credit, and identification are just a few of them, along with motor vehicle records checks. These checks are performed to ensure that the person applying is honest about their qualifications and that they meet the requirements for the position.

Background checks can be beneficial in defending the company and its customers as well as the employees. Poor driving habits, speeding tickets, and convictions for criminality are a few warning signs that may be present in a candidate’s past. There are indicators of occupational risk, like violence.

A majority of companies will use an independent background investigation firm. They will now be able to access a database of data of all federal courts across the United States. Certain businesses await a conditional offer of employment prior to conducting background checks.

Background checks can take quite a while. Employers need to compile a list. In addition, it is essential to allow applicants plenty of time to answer. The typical response time is 5 business day.

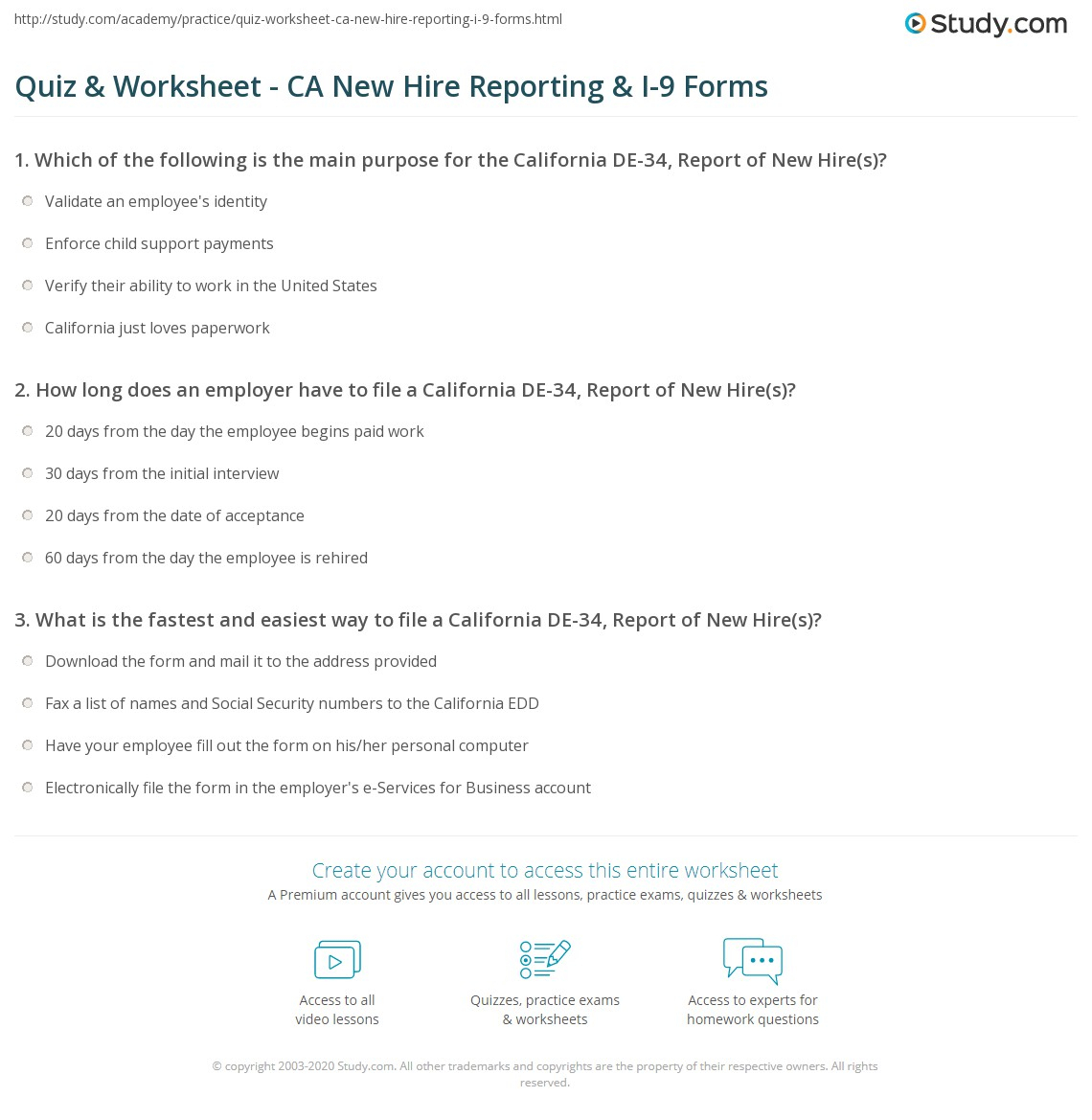

Form I-9

When a recruit is hired, every employee is required to fill out the I-9 form. Federal contractors and state employees are required to complete the form. This could be difficult and lengthy.

There are many components to the form. The first section is the most essential and must be completed at the time you begin your job. If you plan to employ foreign nationals, this includes the identifying details of those hired.

Make sure that the remainder of the form is finished on time following the completion of Section 1. You should keep the Form I-9 required for your hire date for a period of three years. It is mandatory to continue paying the required fee of 6A.

Consider the various ways to reduce your risk of being a victim while you fill out Form I-9. It is important that you add each employee to the database E-Verify. Also, it is important to make sure that you pay your contributions and administrative costs on-time.

Forms W-4

One of the documents new hires will complete is the W-4 form. On this page you will see how much tax was taken from the salary. It is a good resource for anyone who wants to know the details of their tax obligations. People may be able receive a larger paycheck with a better understanding about the deductions the government makes on their income.

It’s crucial because it informs employers how much to deduct employees’ paychecks. The information used in the W-4 is used to calculate federal income tax. It may be beneficial to keep track of and monitor your withholding so you don’t get caught out when you get to the end of the year.

The simple Form W-4 contains your address, name and any other information that could have an effect on your federal income tax returns. The form can be completed accurately to help you avoid paying too much.

There are numerous methods to fill out the W-4. You can submit the form online or print it out and manually fill it manually. No matter which method you decide to take, you must be sure to submit the paperwork prior to receiving your first paycheck.

Apply for a job

Employers utilize job application forms to screen candidates. These forms aid in creating an accurate picture of the applicant’s education and experience in the workplace.

If you fill out a job application form, personal information including contact information is required. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Job applications can be submitted either online or by writing. It is essential to make sure that your application is clear and succinct.

When you are applying for an opportunity, it is recommended to talk to a certified expert. This will make sure you don’t include any prohibited material.

A lot of companies keep applications on file for a period of time. Employers can contact candidates to discuss potential future opportunities.

On the forms used for job applications On job application forms, it is standard to ask for your entire name, address and email. This is the preferred method for job applicants to be reached by employers.