New Employee Tax Form 2023 – You might need to fill out various forms when employing new staff such as W-4 and I-9 forms. These documents must be filled out to ensure that your staff maintain the freedom to operate within the US. This article includes all the necessary forms.

Checks written in the past

Employers can conduct a variety of background checks that they can utilize to make a choice about who to hire. It is possible to verify your credit score, education, and your identity. These checks verify that an applicant is truly the person they claim to have been and that they fulfill the requirements of the job.

Background checks can help in safeguarding the company as well as its clients and its personnel. Speeding fines, criminal convictions and driving violations are a few of the possible red flags that could be present in a candidate’s past. It is also possible to find signs of occupational risk, such as violence.

A majority of companies contract a third-party firm to conduct background checks. They will have access to a database of data of all federal courts in the United States. Some businesses choose to wait until the stage of a conditional employment offer before conducting a background screening.

Background checks may take a long time. Employers need to compile a list. Additionally, it’s crucial to allow applicants sufficient time to respond. Five business days is the average time to receive an answer.

Formula I-9

If they’re a new employee, each employee must fill out an I-9 form. Both federal contractors and state employees are required to comply. This can be tedious and time-consuming, but it is not impossible.

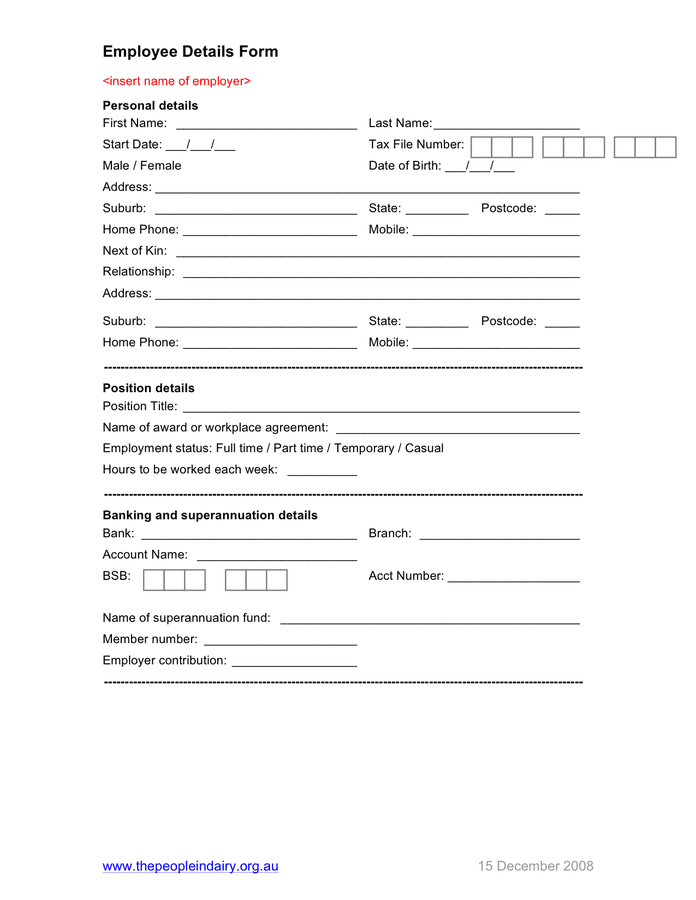

There are numerous parts to the form. The first one, which is the most essential to complete before you begin working. This covers the employer’s name and the information of the worker. It is necessary to show proof that the foreign national is allowed to work in the United States if you want to employ the person.

After you’ve completed Section One Make sure all the remaining information gets completed. The needed Form I-9 should also exist in the file for three years after the date of hiring. It is imperative to continue making the necessary payments on Form 6A.

You should think about the different ways you might reduce your risk of being a victim when filling out your Form I-9. Make sure that all employees are registered to the E Verify database. In addition, you must send in donations and administrative costs in time.

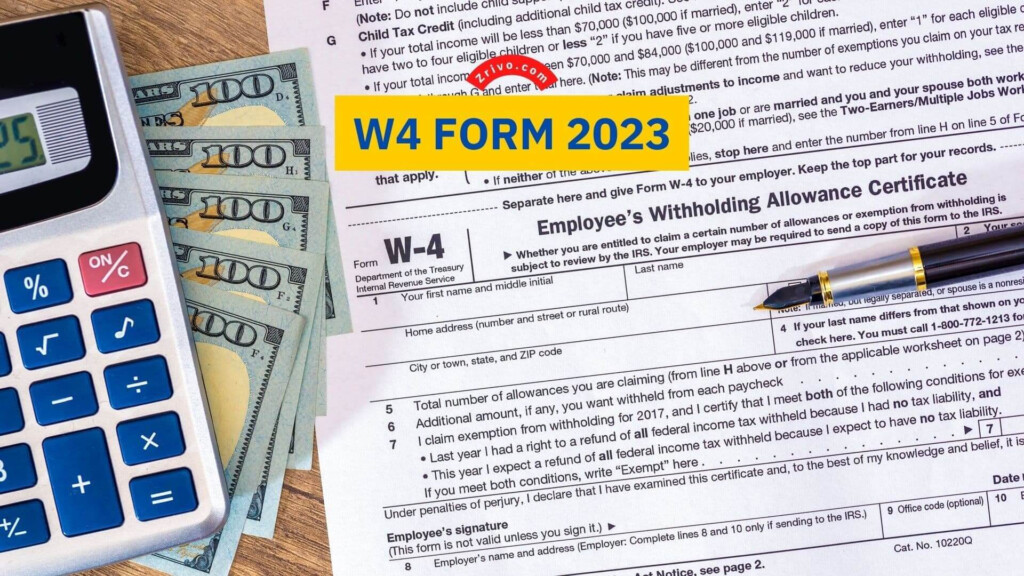

Forms W-4

One of the first documents that new employees fill out is the form W-4. This form lets you see how much tax was taken out of the wages. This page could also be used to help people understand their tax liabilities. A better understanding of what deductions the government can make to their income could aid them in getting a larger amount of tax.

W-4 is vital because it gives businesses instructions on how much to take from the wages of employees. This information will be used to calculate federal income taxes. To avoid surprise tax bills, it can be beneficial to track how much you are able to deduct.

The W-4 is a basic form that lists your name, address and any other information that could impact federal income taxes. In the event that you are able to fill out the form could help you avoid overpaying.

There are numerous ways to complete the W-4. It is both possible to fill out the W-4 online and print or fill it out manually. Whatever method you use, be sure to submit your paperwork before you get your first pay.

Apply for a job

Employers make use of applications for jobs to evaluate the potential candidates. They can be used to make a clear picture of the applicant’s educational background and previous work experience.

When you submit an application for employment with your contact and personal details will be required. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

If you are online or using paper it is possible to apply for an employment. The application must be easy to comprehend and include all the required information.

Before you send out a job application, consult with a qualified expert. By doing this you will be able to ensure that you don’t contain any illegal content.

A lot of companies keep applications for a certain period of time. Employers can reach out to candidates to discuss open positions in the near future.

On forms for job applications the complete name address, email, and phone number are required. These are the primary methods employed by employers to contact potential candidates.