New Employee Tax Forms Florida – If you are looking to hire new staff members You may have to fill out several documents such as W-4 or I-9 forms. These documents are necessary to make sure that your employees can legally work in the US. This article provides all the forms you will need.

Checks that were made in the past

Employers can conduct a range of background checks to determine the best candidate to hire. There are numerous background checks employers can do in order to choose who to employ. They can include credit verifications, identification checks, and motor vehicle record checks. These checks ensure applicants are authentic to their identities and are able to meet the requirements of the job.

Background checks may be helpful in defending the company and its customers as well as the employees. Speeding fines, criminal convictions and driving violations are a few of the warning signs that might be in a candidate’s past. Other indicators of occupational danger like violence may be present.

Companies often employ background investigation firms from third parties. The background investigation company will have access to the entire details available from all of the 94 U.S. federal courts. Some businesses choose to wait until the stage of a conditional employment offer before conducting a background check.

Background checks can take a considerable amount of time. Employers have to create an outline. Employers should give applicants sufficient time for a response. Five business days is the standard time it takes to get an answer.

Formula I-9

If they are a new employee, all employees has to fill out an I-9 form. Federal contractors as well as state employees must follow the procedure. This can be tedious and time-consuming, but it is not impossible.

There are many components of the form. The first is the most important and should be completed by you prior to your start to work. It includes the employer’s identifying information , as well as the worker’s pertinent information.You will be required to present evidence of a foreign national’s legal right to work in the United States if you intend to hire the person.

After completing Section 1, you should make sure that the rest of the form was completed on time. The needed Form I-9 should also exist on file for 3 years following the date of hiring. It is also necessary to pay the Form 6A fee.

When filling out your Form I-9, consider how you can lower the risk of being a victim of fraud. You should ensure that all employees are registered to the E Verify database. Also, you must submit all administrative and donation expenses in time.

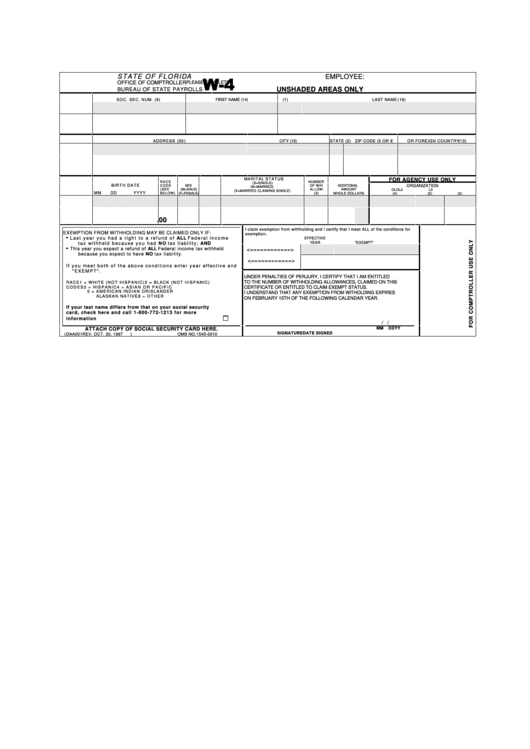

Forms W-4

W-4 forms are the first form that new employees complete. On this page you will see how much tax was taken out of the pay. The user can also use it to understand their tax liabilities. If they are aware of the tax deductions made from their income and expenses, they could be able to receive a bigger check.

W-4 is vital as it provides businesses with instructions on how much to take from employees’ wages. The data will be used to calculate federal income taxes. To avoid surprises, it may be beneficial to keep track of how much you withhold.

The W-4 forms contain your name and address and any other information that may impact the federal income tax you pay. It is possible to fill out the form accurately to help you avoid tax overpayments.

There are a variety of different versions of the W-4. It is possible to submit the form online or print it out and manually fill the form manually. No matter which method you choose to use, make sure to submit the paperwork before you get your first pay.

Apply for a job

Formulas for job applications are used by businesses to assess applicants. These forms aid in creating an accurate picture of the applicant’s educational background and experience in the workplace.

Personal information, contact information, and other information will be required when you complete an application form. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Application for employment can be made on the internet or via post. The application form should be simple to read and contain all of the required information.

When you submit a request for employment It is recommended to seek out a professional who is qualified. This will help you ensure your application doesn’t contain any unlawful information.

A majority of employers store applications in their file for a long period of. Employers are able to contact prospective applicants to discuss openings in the near future.

On forms for job applications the complete name address, email address and telephone number are required. These are the most common ways companies reach candidates.