New Employee Tax Forms Maryland – If you’re looking to hire new staff members it is possible that you will need to complete a variety of documents like W-4 or I-9 forms. These documents are required to confirm that your staff is legal in the USA. This article will cover the forms you’ll require.

Checks that were written in the past

Employers could use a variety of background checks to decide who they want to hire. There are a variety of background checks employers could make use of to verify the identity as well as the credit, education, and driving records of potential applicants. These checks confirm that an applicant is truly the person they claim to be been and meet the requirements of the job.

Background checks are an effective tool to protect the business, its customers as well as employees. Speeding tickets, and convictions for criminality are some of the red flags that could be present in a person’s past. You might also find indicators of risk in the workplace like violence.

Businesses will often hire background investigation firms from third-party companies. They now have access to the database of all 94 United States federal courts. Some businesses decide to not perform background checks until the stage of conditional employment offers.

Background checks can require a long time. Employers must compile a list. It’s crucial that applicants are given the time to reply. The average response time is 5 days. day.

Formula I-9

If they are a new employee, they has to fill out an I-9 form. Both federal contractors and state workers must comply. However, the procedure could be time-consuming and difficult.

The form consists of multiple sections. The first is the most essential and has to be finished before you begin working. This includes both the employer’s identifying as well as the worker’s relevant information. You will need to prove that a foreign national is allowed to work in America in order to hire them.

When you’ve completed Section 1, you should make sure that the rest of the form has been completed on time. Keep the mandatory Form I-9 on file for three years beginning with the date of hiring. You will need to continue to pay the Form 6A fee.

When you fill out your Form I-9, think about how you might decrease the chance of being fraudulent. You should ensure that all employees have been added to the E Verify database. In addition, you must send your donations and administrative expenses on time.

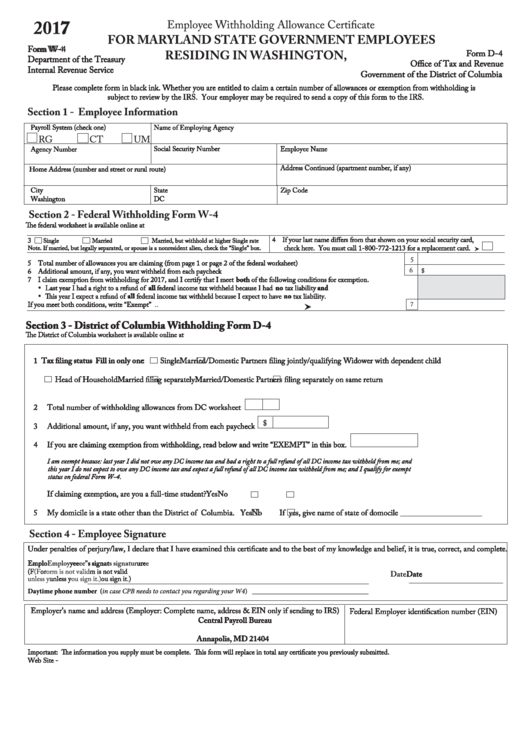

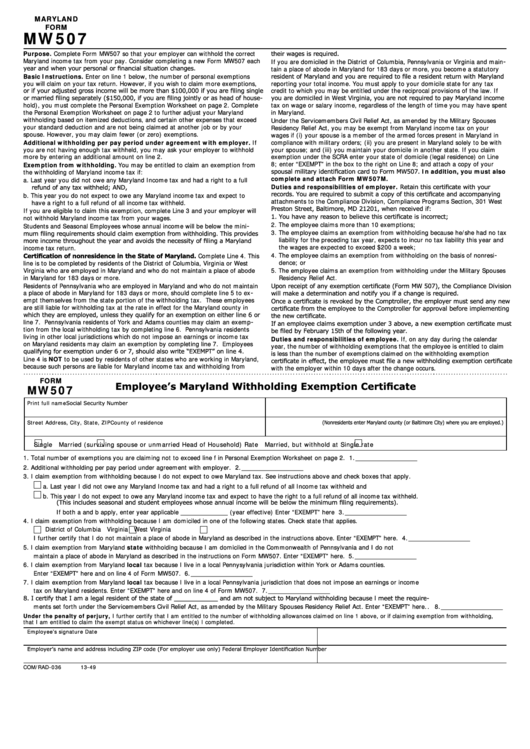

Forms W-4

The form W-4 is among the initial documents new employees must fill out. The tax amount deducted from their salary is shown on this webpage. It can be used by anyone looking to learn the details of their tax obligations. An understanding of the deductions the government will make to their earnings can help them get a bigger check.

It’s vital as it informs employers how much to deduct from employees’ pay. Federal income taxes will be computed using this information. It can be helpful to keep track and monitor your withholding so you are not surprised when you get to the end of the year.

The simple W-4 is a simple form. W-4 contains your address, name and any other information which could impact on the federal tax returns for income. You can avoid overpaying by taking the time to fill out the form accurately.

The W-4 comes in a variety of variants. It can be filed online, printed and filled out manually. No matter what method you decide to use you have to submit the form before you receive your first salary.

Applying for an employment

To evaluate job applicants companies use forms for job applications. These forms aid in creating a clear picture of the candidate’s education and work experience.

If you fill out an application for employment the personal and contact details will be required. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

If you are online or using paper, you can apply for an opening. It is essential to make sure that your application is clear and clear.

Before you submit your job application, make sure you talk to a professional. This will help you ensure your application doesn’t contain unlawful information.

Many employers keep applications for a specified period of time. Then, employers can call prospective applicants about openings that might be forthcoming.

On forms for job applications, your complete name address, email, and phone number must be included. This is usually one of the best way for companies to communicate with potential candidates.