New Mexico Employee Withholding Form – If you are looking to hire new staff members, you may need to sign several forms like W-4 or I-9 forms. These forms will be needed to prove that your employees are permitted to travel without restriction within the US. This article outlines the forms you’ll require.

Checks that were written in the past

Employers can perform a variety of background checks before deciding who to hire. There are many background checks employers can use to verify the identity, credit, education and driving record of applicants. These checks are done to ensure that the person applying has been honest in their statements and also to verify that they have met the requirements of the job.

Background checks are a great way to protect clients and employees and the business. Past criminal convictions such as speeding tickets, traffic violations, and poor driving habits could all indicate red flags. Signs of occupational risk including violence might also be present.

The majority of businesses employ an outside background investigation company. They will have access to the database of all 94 United States federal courts. Some companies prefer to wait until they receive a conditional employment offer before conducting a background check.

Background checks can take time. Employers should have an inventory of questions. It is essential to give applicants sufficient time to respond. Five business days is the average time to receive an answer.

Formulation I-9

Every employee must complete an I-9 form every time they recruit. Federal contractors and state workers are required to fill out the form. This can be tedious and time-consuming.

The form is divided into many sections. The first section is the most important and has to be finished before you begin working. The section contains both the employer’s information and the information of the worker. If you plan to employ someone from outside the country You will need to prove that they have the right to work in the United States.

Once you’ve completed Section 1 Make sure the rest of the form is completed. It is also important to save the Form I-9, which you must have for purposes of employment, on file for at minimum 3 years. You should continue to make the required payments using Form 6A.

When filling out your Form I-9 you should consider all the ways you could reduce your vulnerability for fraud. You must ensure that every employee is enrolled in E-Verify. Also, you must submit all contributions and administrative expenses on time.

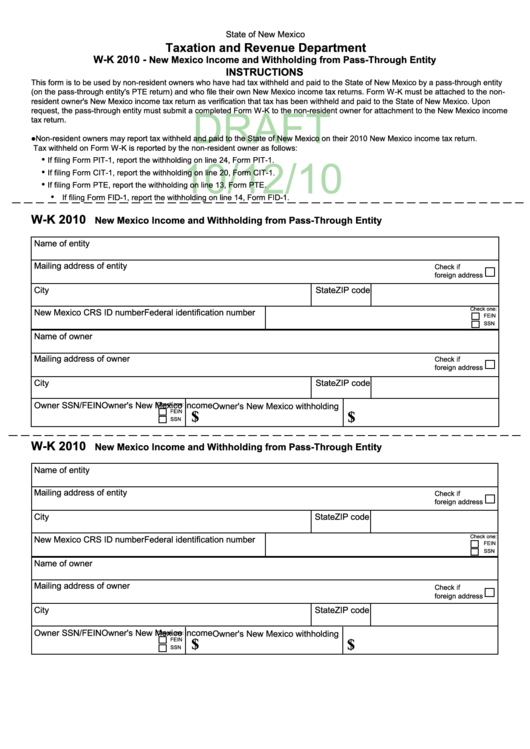

Forms W-4

W-4 forms will be the first document new hires must fill out. The tax amount that is deducted from their earnings is displayed on this page. It can be used by anyone looking to learn more about their tax obligations. They may be able to receive a larger check when they have a clear knowledge of the deductions the government can make from their income.

Because it instructs businesses on how much to take from the paychecks of employees The W-4 is essential. This information will be used for federal income taxes. In order to avoid surprise tax bills, it can be beneficial to track how much you are able to deduct.

The W-4 is a basic form that lists your address, name and any other information that could impact federal income taxes. You can stay clear of overpaying taxes by making sure to fill out the form in the correct manner.

There are many options to fill out the W-4. You can submit the form online, or print it out and manually fill it. Whatever method you choose, you must submit the paperwork before receiving the first pay check.

Looking for an employment

To assess job candidates companies use forms for job applications. They help in creating an accurate picture of the applicant’s academic background as well as professional experiences.

When you complete an application for employment the personal and contact details will be required. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Online or on paper Job applications can be made on paper or online. Your application should be easy to read and contain all required information.

A qualified professional should be checked before applying for a job. By doing this, you can make sure that you don’t contain any illegal content.

Many companies store applications on files for a period of period of. Employers are able to contact prospective candidates to discuss future openings.

Your full name, address and email are often requested on job application forms. These are the techniques companies most frequently employ for contacting candidates.