New Mexico Employee Withholding Form 2023 – If you’re planning to recruit new employees, you may need to sign several forms like W-4 or I-9 forms. These forms must be filled out to ensure that your employees have the freedom to operate within the US. This article covers the documents you’ll need.

In the past, checks

Employers can conduct a range of background checks to choose the right candidate to employ. Checks for education, credit and identification are just a couple of them as are the checks for motor vehicle records. These checks ensure applicants are authentic to their identities and that they meet the standards for the position.

Background checks may be helpful in defending the company and its clients as well the employees. Bad driving habits, criminal convictions, and speeding fines are all possible red flags. Other indicators of workplace danger like violence could be present.

A majority of businesses will hire a third party background investigation company. They will have access now to all the 94 United States Federal Courts. But, some companies decide to wait until they have reached the stage of a conditional job offer before conducting a background check.

Background checks may take some time. Employers need to create a list. Employers must allow applicants adequate time to get a response. Five business days is the typical time to receive a reply.

Formula I-9

If they are a new employee, all employees has to fill out an I-9 form. Federal contractors as well as state employees must follow the procedure. This could be difficult and lengthy.

There are many parts to the form. The most fundamental section should be completed prior to the start of your job. This covers both the employer’s identification as well as the worker’s relevant information. You will need to provide proof that a foreign national is legally authorized to work in America in order to employ them.

Once you’ve completed Section 1, make sure that the rest of the form is completed. In addition, the Form I-9 must be kept on file for three years from the date you hired. You should continue to make the required payments on Form 6A.

When filling out Form I-9, you should consider the different ways you can decrease your risk to being a victim of fraud. To begin with, ensure that each employee is included in the E-Verify Database. Also, it is important to submit your donations and administrative costs on-time.

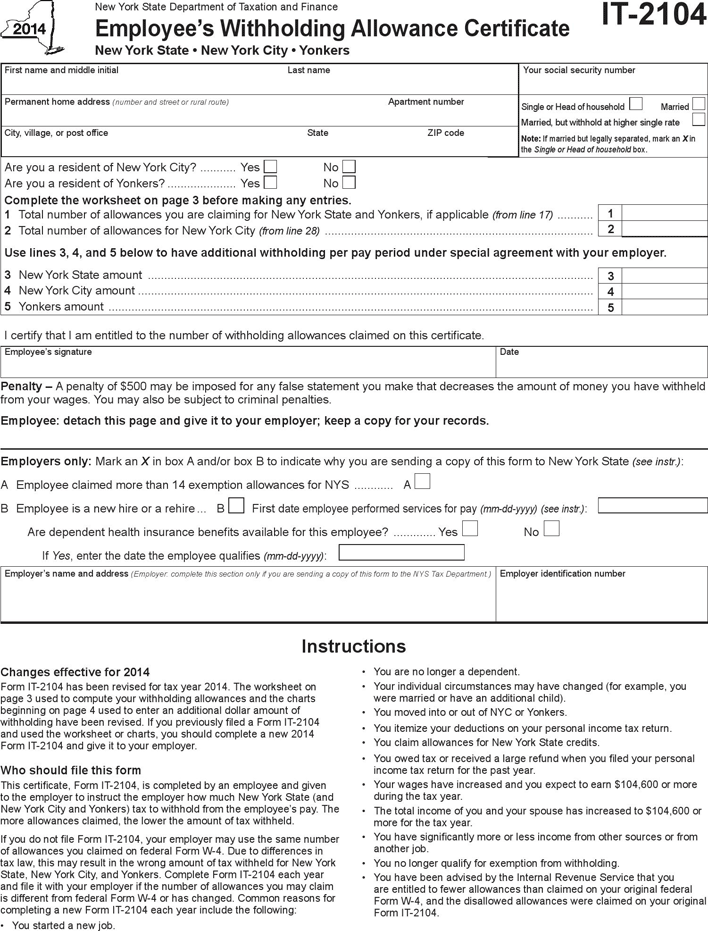

Forms W-4

One of the first forms that new employees fill out is the form W-4. The form displays the amount of tax taken from their wages. It’s also helpful for people to understand the tax obligations they face. Understanding the deductions the government will make to their earnings can help them get a bigger check.

W-4 is critical because it offers guidance to businesses about what amount they should deduct from employees’ pay. Federal income taxes will be calculated using this data. To avoid any unexpected surprises, it could be beneficial to track how much you are able to deduct.

The W-4 forms will include your name and address as well any information that could affect the federal income tax you pay. Avoid paying more than you should by taking the time to complete the form correctly.

There are numerous variations of the W-4. It can be filed online, printed and filled out manually. No matter which method you choose to use it is essential that you complete the paperwork prior to your first paycheck.

Apply for an opening

Formulas for job applications are utilized by employers to assess applicants. They permit the development of a comprehensive image of the applicant’s educational background and previous experience.

When you submit an application form, your personal information, including contact information, is required. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

On paper or online, you can apply for a job. It is crucial that your application be concise and concise.

When you are submitting an application for employment, you should seek out a professional who is qualified. You can be sure you’re not submitting illegal content by following this.

Many companies store applications on the file for an extended period of period of. Employers have the option to contact applicants regarding future openings.

On forms for job applications, your complete name address, email address, and phone number must be included. These are typically the best methods for employers to reach out to applicants.