New York State New Employee Forms – It is possible that you will need to fill in a variety documents, like I-9 and W-4 forms, when you employ new staff. These forms are essential to prove that the employees have the legal right to work in America. This article covers the forms you’ll require.

Checks that were made in the past

Employers can use several background checks when deciding who to hire. Checks for educational, credit, and identification are just a couple of them as are motor vehicle records checks. These checks are performed to confirm that the candidate is honest about their qualifications and that they meet the requirements of the job.

Background checks can be beneficial to defend the business and its clients as well the staff. Criminal convictions in the past or speeding offenses, as well as bad driving habits can all indicate red flags. Possible indicators of occupational risk, such violence, may also be present.

Companies often employ background investigation firms through third party. They will now be able to access an information database of all 94 federal courts in America. Some companies wait for an employment contract with a conditional clause before performing background checks.

Background checks may take a while. Employers should create an inventory. It is crucial that applicants are given enough time to respond. The typical time to wait for a response is five days.

Formula I-9

Every employee must fill out the I-9 form at least once upon becoming a new hire. Federal and state employees as well as contractors are required to comply. However, the procedure could be lengthy and complicated.

The form consists of many sections. This is the most essential and must be completed before you start working. If you are planning to hire foreign workers, this should include the identifying details of those hired.

After completing Section 1, make sure that the rest of the form was completed by the deadline. Keep the required Form I-9 on file for three years beginning with the date of your hire. It is also necessary to pay Form 6A-related fees.

As you fill the Form I-9, you should think about all ways you can decrease your chances to fraud. Make sure that all employees have been added to the E Verify database. You should also send in all contributions and administrative expenses on time.

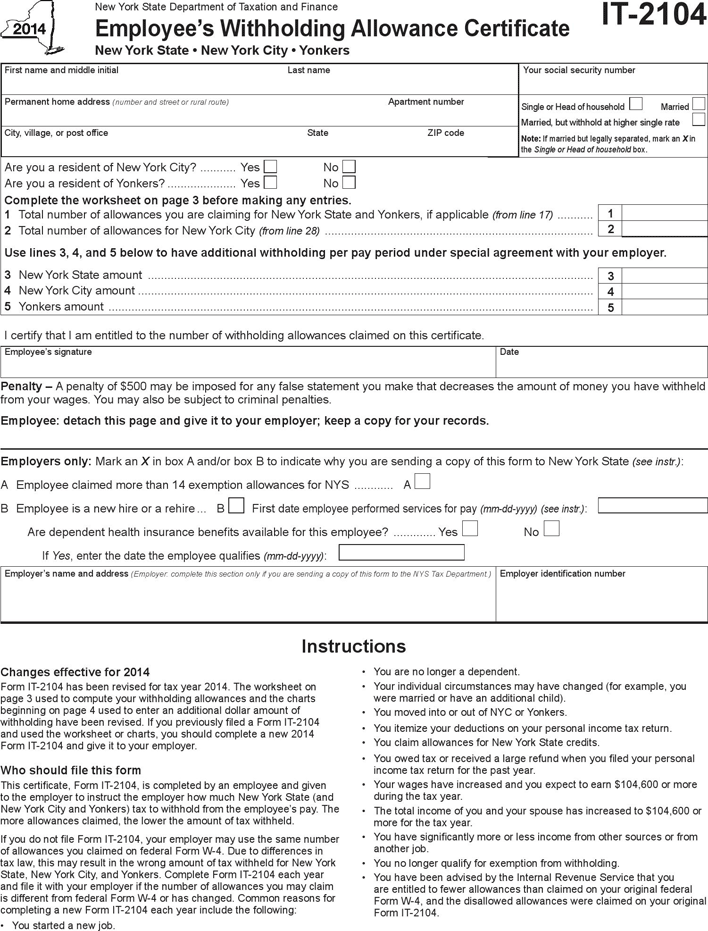

Formulas W-4

One of the first forms new employees will need to complete is the W-4 form. This page displays the amount of tax taken from their earnings. It’s also helpful for people to be aware of their tax obligations. Understanding the deductions the government will make to their earnings could aid them in getting a larger pay.

Since it instructs companies on how much to deduct from employee’s paychecks The W-4 is vital. This information is used to calculate federal income taxes. To avoid unexpected surprises later, it might be beneficial to keep track of your withholding.

The W-4 form is easy to fill out and contains your name, address as well as other details that could have an impact upon your federal income taxes. You can avoid overpaying by making sure you fill out the form correctly.

There are several variations of the W-4. It is possible to fill out the form online, or print it out and manually fill it. No matter which method you select to use it is essential to complete the form prior to your first paycheck.

Apply for an opening

Employers use applications to select candidates. They help in providing a clear picture of the applicant’s educational background and work experience.

You will need to submit personal information and contact details when filling out a job request form. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

On paper or online Job applications can be submitted. The application form must be simple to read and include all the information required.

Before you send out an application for employment, you should consult with a qualified expert. This is a way to make sure you don’t include any prohibited material.

Many companies store applications on files for a period of period of. Employers can then choose to contact applicants regarding future openings.

Your complete name, address, as well as email address are usually required on forms for job applications. These are the techniques companies use most frequently to contact candidates.