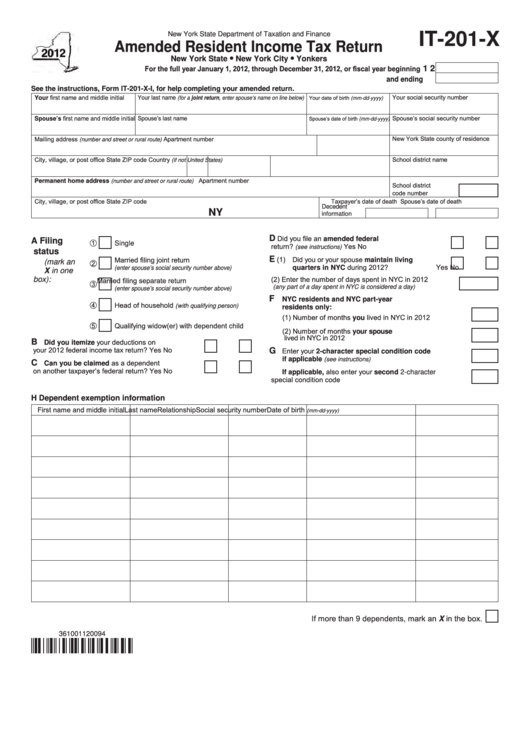

Ny City Local Resident Tax Deduction Employee Form – It is crucial to understand the requirements for employee tax returns in order to avoid interest, fines and burden of filing them. There are many tools to assist you in navigating this maze.

FICA employer contribution

Federal government requires that all companies deduct FICA, Social Security and Medicare taxes from employees their paychecks. Employers are required to file an annual return that details their tax obligations to their employers. The tax returns are filed using the form known as Form 941.

FICA is the federal tax that pays for Social Security and Medicare. The 12.4% social security tax on wages is the first part of the tax.

The Medicare tax is the second part of the tax. FICA’s Medicare tax is not subject to an upper wage base restriction therefore the tax rate is adjusted. This is beneficial for employers as it allows employers to deduct a portion of FICA as an expense.

For smaller companies Form 941 is used to report the employer’s FICA portion. This form is used by the IRS to provide information about the tax withheld from an employee’s salary.

Tax return for the quarter by the employer

If your business is required to pay employment taxes to be paid, it’s essential to know how to complete and submit Form 941. This form will provide information about your federal tax withholdings and payroll taxes.

It is mandatory to report the entire amount of Medicare and Social Security taxes that were deducted from employee earnings. The total amount is equal to the amount shown on the W-2 form. Furthermore, you need to disclose the amount that each employee paid in tips.

When you file your report make sure you include your company’s name and SSN. The number of employees you paid in the quarter should also be listed.

There are 15 lines in your Form 1040 that you must fill out. Each line is a representation of the various components of your compensation. This includes the amount of gratuities, wages, and salaries of all workers.

Employer’s yearly return for workers in agriculture

The IRS Form 943, which you are likely aware of is required when your agricultural business is to be registered with IRS. This form determines the appropriate amount of tax withholding from employees of agricultural employers. It contains crucial information to be aware of. This form can be submitted on the internet, however if you don’t have access to the internet, you may have to send it in.

A payroll program that is professional and reliable is the best method to increase the value of your tax form. Tax accounts should also be registered by the IRS. Once you have a legal account number it is possible to accelerate the process by using Web Upload. Verify the account number prior to you make the deposit.

If income is not disclosed, it could cause penalties or accrue interest.

Making sure you pay taxes on time is essential. Underpaying your taxes is a mistake that can end up costing you lots of money. If you’re underpaid, the IRS could issue penalties. So, it is important be sure that your withholdings as well as taxes are in order.

If you’re not certain of the amount of debt you have You can use the form 2210 provided by IRS to calculate it. When you complete this form, you’ll be able to determine if your situation qualifies to receive an exemption. This may be possible when you reside in a state that has high taxes, or have a large amount of unreimbursed expenses related to your job.

Calculators are also available to aid you in estimating your tax withholdings. You can do this using the most recent IRS Tax Withholding Estimator.