Ny State New Employee Forms – It’s possible that you will need to fill out several documents, such as I-9 and W-4 forms, when you hire new employees. These forms must be filled out to ensure that your employees have the liberty to work within the US. This article will cover the documents you’ll need.

Checks written in the past were written

Employers can conduct a variety of background checks that they can employ to make a decision regarding who to employ. Checks for education, credit and identity are just a handful of these, along with the checks for motor vehicle records. These checks are made to make sure an applicant is who they say they are and that they meet the requirements of the post.

Background checks are a great way to safeguard employees and clients and the business. Criminal convictions, speeding fines and driving violations are just a few potential red flags that a person’s history may reveal. Signs of occupational danger or violence could also be present.

Businesses will often hire background investigators from third-party companies. They will now be able to access a database of records from all federal courts in the United States. Some companies prefer waiting until a conditional acceptance is received before they conduct background checks.

Background checks can be time-consuming. Employers should prepare a list of questions. Employers must allow applicants adequate time to respond. The average response time is 5 business day.

Formulation I-9

Every employee has to fill out the I-9 form at least one time when they are a new hire. Both federal contractors and state workers must comply. It’s not easy and time-consuming.

The form consists of several sections. The first one is crucial and should be completed by you prior to beginning working. This includes the employer’s name and the information of the worker. You will need to provide proof that the foreign national is legally authorized to work in the United States if you want to employ the person.

You must ensure the completion of Section 1 is on time. Keep the required Form I-9 on file for three years beginning with the date of hire. You must continue to pay the required fee of 6A.

It is important to think about the many ways you can decrease your risk of fraud as you fill out Form I-9. You must ensure that every employee is added to E-Verify. Donations and administrative costs should be submitted in time.

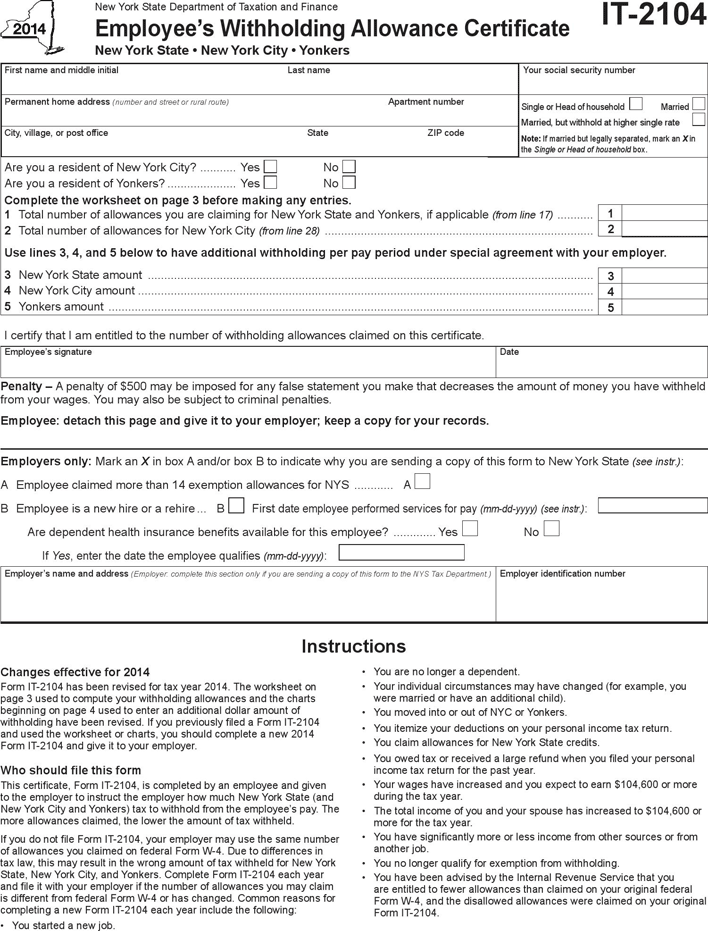

Forms W-4

W-4 form will be one of the first documents new hires must fill out. This page shows the amount of tax deducted from their salary. This page can be used by anyone looking to learn the details of their tax obligations. By having a better understanding of the tax deductions earned from their earnings, they might be able get a larger check.

W-4 is critical because it provides business with guidelines on how much they should deduct from employees’ pay. This data will be utilized for federal income tax purposes. It may be helpful to keep track on your withholding in order to avoid unexpected shocks in the future.

The W-4 forms include your address and name and any other information that may impact the federal income tax you pay. You can stay clear of overpaying taxes by making sure to complete the form correctly.

There are many variations of the W-4. It is possible to fill out the form online, or print it and manually complete it manually. Whatever method you choose to use, it is important that you complete the paperwork prior to your first paycheck.

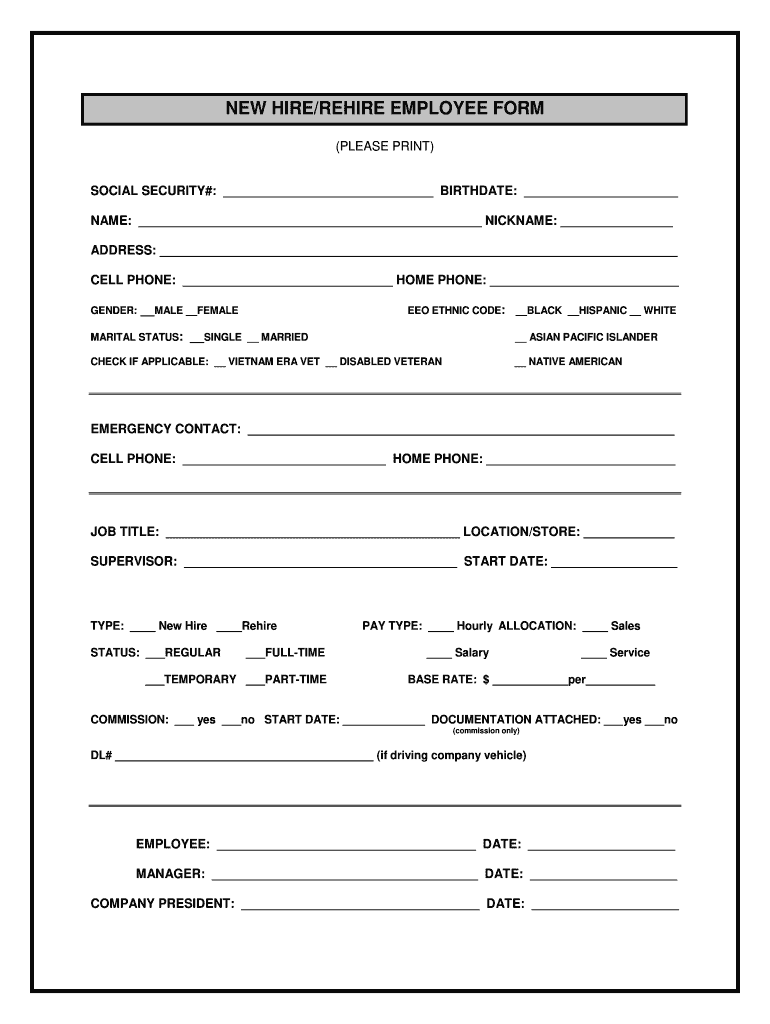

Applying for an employment

Companies use job applications to select applicants. They can be used to provide a complete image of the applicant’s education background and previous work experience.

Your personal information, contact information, as well as other information will be required when you submit an application form. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

The application for jobs can be submitted either online or by writing. It is important that your application be concise and succinct.

Before you submit your application, be sure to speak with a certified professional. This is a way to make sure that you are not submitting any material that is illegal.

Many companies keep applications on file for a time. Employers may then contact potential applicants to discuss openings in the near future.

On the forms used to apply for jobs on job applications, you’ll often be required to provide your full name, address, as well as email. These are the methods that companies use most frequently for contacting candidates.