Nys Employee Tax Form – It is essential that you understand the requirements for employee tax returns if you wish to minimize interest, fines and inconvenience of filing them. There are a variety of choices to help you navigate the maze.

FICA employer contribution

The FICA (Federal Income Taxes), Social Security (Medicare taxes) are three taxation which federal law obliges businesses to deduct from the wages of employees. Employers are required to file a quarterly return detailing their tax obligations to their employers. Taxes are reported on an application known as Form 941.

FICA is the federal tax, is the one that is used to fund Medicare as well as Social Security. The first part of FICA tax is the 12.4 percent social security tax on worker wages.

The Medicare tax is the second part of the tax. FICA’s Medicare component is not subject to any limitations on the wage base, so the tax rates may be adjusted. This allows employers to claim FICA as an expense for business.

The employer’s portion of FICA is listed on Form 941 for small firms. The IRS can use this form to report details on taxes withheld at an employee’s pay.

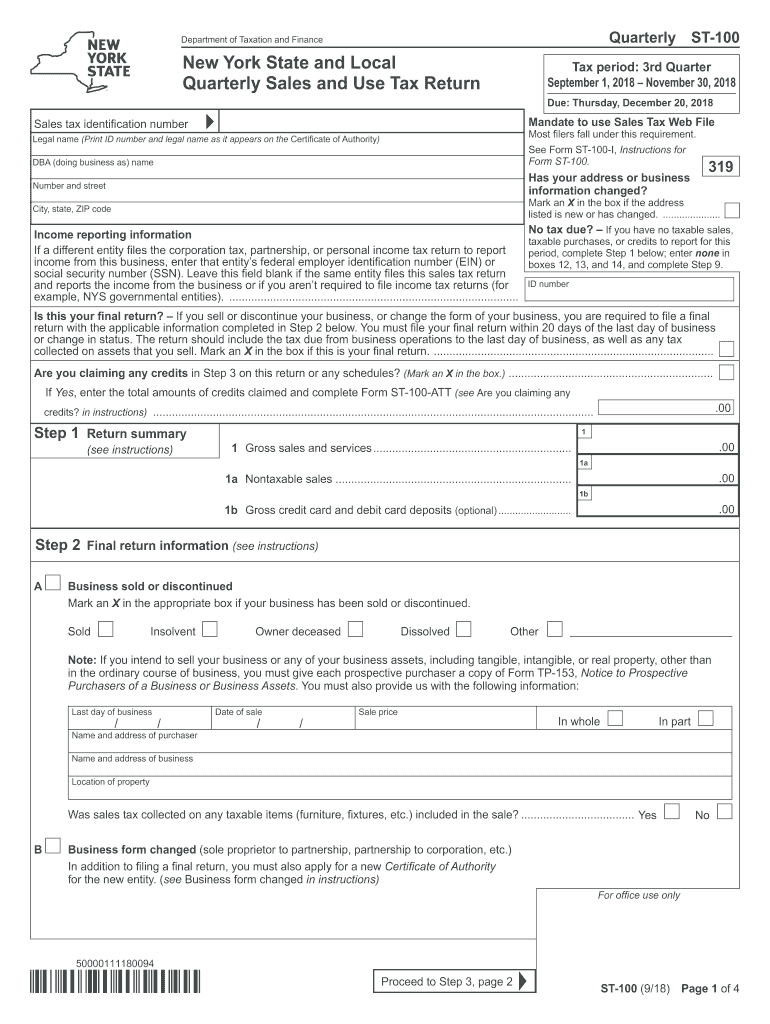

Quarterly tax return from the employer

If your business is required by law to pay taxes on employment, it is essential to be aware of how to fill out Form 941. The form provides details regarding your federal income tax withholdings and payroll taxes.

The total amount to be reported is the amount of Medicare and Social Security taxes taken from employee earnings. This sum will be similar to the amount reported on the W-2 form. Furthermore, you need to declare the amount that each employee receiving in tips.

Your submission must include the name of your company and SSN. The number of employees you paid in the period must also be included.

The form 1040 you receive has 15 lines that must be filled out. Each line represents the different elements of your remuneration. Each line represents different elements of your compensation. This includes the amount and wages of employees, as well as their gratuities.

Annual investment return for employers for agricultural workers

As you are aware, IRS Form 943 is required to determine the proper amount of tax withholding for employees by employers that employ farmers. This form has some important information you need to be aware of. Online submissions are possible, but you may have send it in person.

Utilizing a professional payroll software is the best way to maximizing the value of this tax form. It is important to note that the IRS will also require you to open an account. It is possible to speed up the process by making use of Web Upload, once you have obtained a valid account number. Verify the account number prior to you make the deposit.

The incorrect reporting of income can result in interest and penalties.

It is crucial not to underpay government tax taxpayers. It will be regrettable and you’ll end having to pay more. If you are underpaid then the IRS could impose fines. So, it is important be sure that your withholdings and taxes are in order.

For a quick estimate of your financial obligations, download the Form 2210 available from IRS. Once you submit the form, you will find out if you are qualified for a waiver. You could be eligible if you live or work in an extremely taxed state.

There are calculators to estimate your withholding. This is done with the help of the latest IRS Tax Withholding Estimator.