Paydata New Employee Forms – When you hire new staff, you might be required to fill out a variety of documents including I-9 forms and W-4 forms. These documents are required to prove that your staff is legally able to operate in the USA. The forms you’ll need are described in this article.

Checks written in the past

Employers are able to conduct background checks that they can use to make a decision on who to hire. You can check your educational background, credit history and identity. These checks are required to ensure that the applicants are who they say they are and have all the necessary qualifications for the job.

Background checks can help in defending the company as well as its customers as well as its employees. Bad driving habits, speeding tickets, and convictions for criminality are a few red flags that could be present in a candidate’s past. Signs of occupational danger like violence might also be present.

Most businesses will employ a third-party background investigation firm. They will now be able to access a database of information from all federal courts in the United States. Some businesses prefer waiting until they get an offer of employment conditional to doing a background check.

Background checks may take some time. Employers should have a list of questions. In addition, it is essential to give applicants enough time to respond. The average wait time for a response is five days.

Formula I-9

Once a potential employee is hired, every employee must fill out the I-9 form. Both federal contractors and state employees must follow the procedure. This can be long and difficult.

The form is divided into many sections. The most basic part must be completed when you begin your job. This section includes the employer’s details as well as the details of the employee. If you plan to employ someone from outside the country you’ll be required to prove that they are legally able to work in the United States.

After you’ve completed Section One, make sure that the remainder of the form gets completed. Keep the necessary Form I-9 on file for three years starting at the date of hire. You will need to continue paying the Form 6A dues.

When filling out the Form I-9, think about ways to decrease the chance of being fraudulent. In particular, you should ensure that every employee is included in the database E-Verify. It is crucial to promptly submit any administrative or donation costs.

Forms W-4

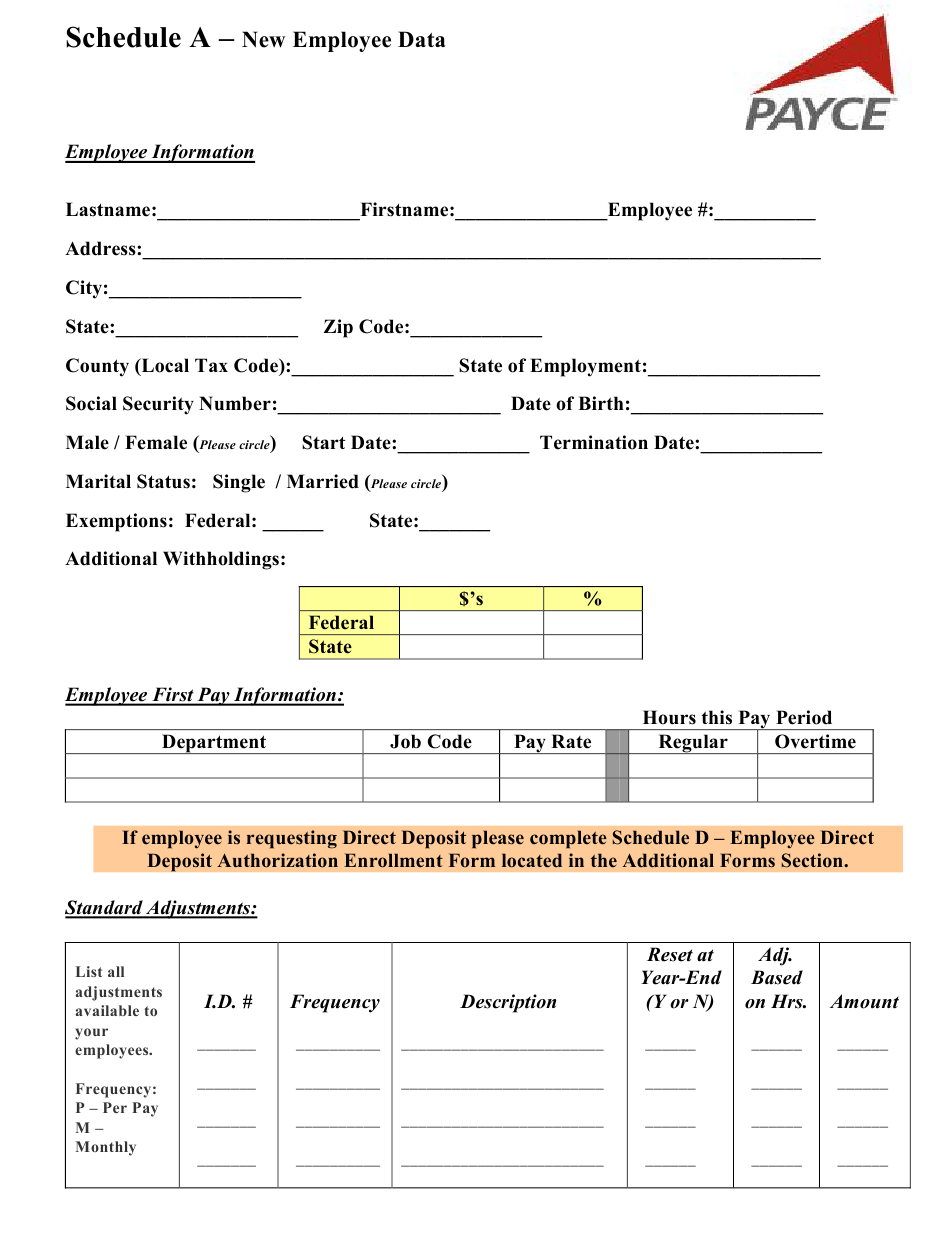

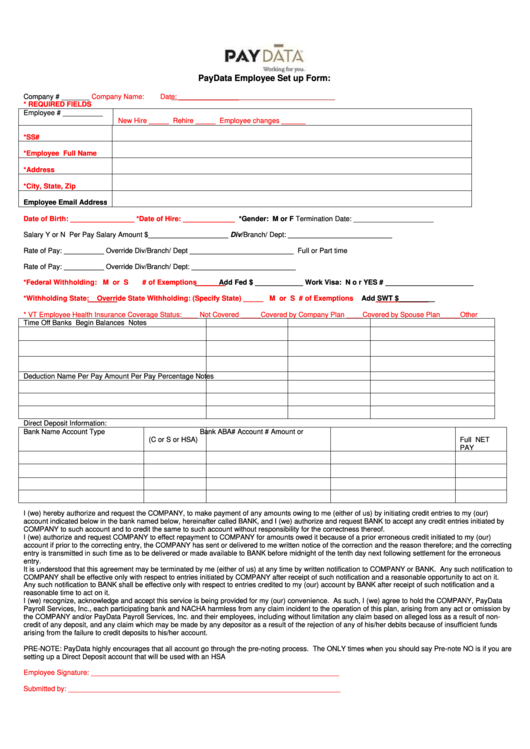

W-4 form will be one of the first forms that new employees must complete. On this form, you can see how much tax was taken from the pay. It can be used by anyone to find out more about their tax obligations. An understanding of the deductions the government can make to their earnings can help them get a bigger pay.

W-4 is crucial as it gives business with guidelines on the amount they can take from the wages of employees. The information used in the W-4 is used to compute federal income taxes. To avoid any surprise tax bills, it can be beneficial to keep track of the amount you deduct.

The simple W-4 is a simple form. W-4 contains your name, address as well as other information that could have an impact on the federal income tax you pay. You can avoid overpaying by making sure you complete the form correctly.

The W-4 can be found in a variety of forms. The W-4 can be submitted online, printed, and then completed manually. Whatever method you select to use, it is important that you fill out the paperwork prior to your first paycheck.

Make an application for a job

Formulas for job applications are utilized by employers to review the qualifications of applicants. They assist in forming a clear picture of the applicant’s education background as well as professional experience.

Personal information, contact information, and other information will be requested when you fill out a job application form. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Applications for jobs can be made via the internet or in person. It is essential that your application be concise and succinct.

When you are submitting your job application, make sure to seek out a professional who is qualified. This will ensure you do not include any prohibited material.

Many employers keep applications on file for a period of time. Employers have the option to contact applicants regarding future openings.

Many job applications require your complete name address, email, and postal address. This is usually one of the best methods for employers to communicate with candidates.