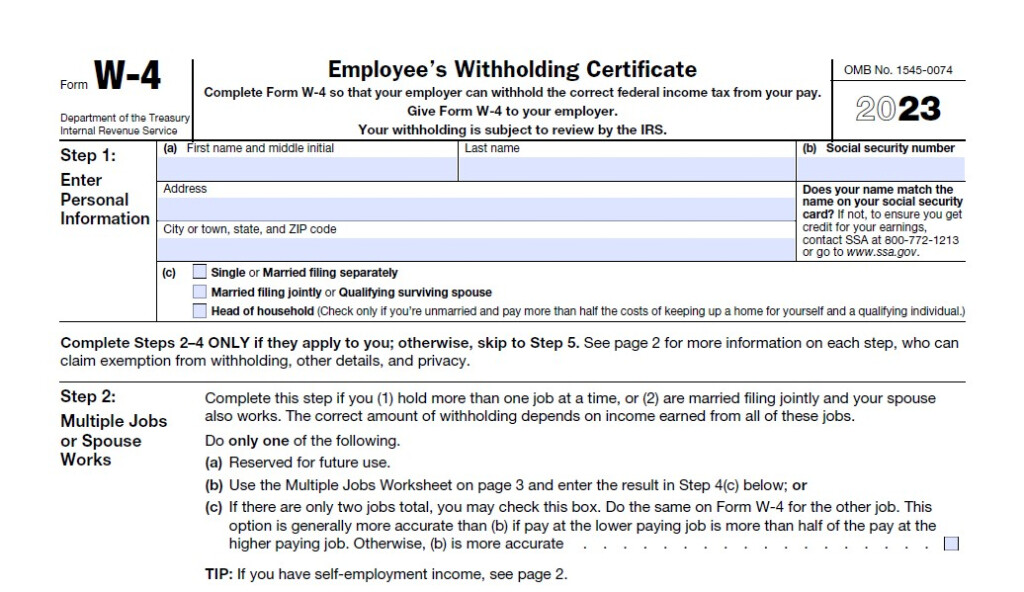

Starbucks Employee Tax Forms – If you want to reduce fines, interest, or the stress of submitting tax returns to your employees, it is essential to know how to deal with your employee tax forms. There are a variety of options to help you get through the maze.

FICA employer contribution

The FICA (Federal Income Taxes), Social Security (Medicare taxes) are three taxation that federal law requires companies to deduct from their employee’s paychecks. Employers are required to submit a quarterly tax return. Taxes are reported on Form 941.

FICA is the federal tax that pays for Social Security and Medicare. The 12.4% employee wage social security tax is the main component of the tax.

The Medicare tax which is the second part of tax, is called the Medicare tax. The Medicare tax is the second component. It does not have any upper wage base limitations so the tax rate may change. This allows employers to write off FICA as business expenses.

For small businesses, Form 941 is used to record the employer’s share of FICA. The form is utilized by the IRS to provide information about the tax deductions made by the employee’s pay.

Tax return for the quarter from the employer

If your company is legally required to pay employment taxes it is essential to be aware of how to fill out Form 941. It provides information regarding the withholding of federal income taxes and payroll tax.

Input the total amount of Medicare and Social Security taxes taken from the earnings of employees. The amount reported must be the same as that shown on an employee’s W-2. Additionally, it is necessary to reveal the amount of tips given to employees.

When you file your report make sure you include your business name and SSN. Include the number of employees you hired in the last quarter.

You will need to complete 15 lines on the Form 1040. The different elements of your pay are represented by each line. Each line is a representation of the various elements of your remuneration. These include the number and salaries of employees, as well as their gratuities.

Workers in agriculture receive a yearly return from their employers

As you know, the IRS Form 933, which is mandatory for all agricultural enterprises that calculate the proper amount of tax withholding paid by agricultural employers. The form contains certain important information that you need to be aware of. It is possible to submit this form online. If, however, you aren’t connected to the internet or a computer, you might have to send it by mail.

Payroll software that is professional-designed and certified will increase the value of tax forms. It is also necessary to create an account with the IRS. Once you have an account number that is legal and you are able to accelerate the process by making use of Web Upload. Before you deposit your money it is possible to double-check that the number is correct.

Unreported income could result in penalties or interest.

Paying taxes on time is crucial. Paying taxes too low is a poor choice that can end up costing you lots of money. In fact it is possible that the IRS might impose fines for underpayment.

If you’re not sure of the amount of debt you have to pay you, complete Form 2210. You will find out what waivers are available after you’ve completed this form. You might be eligible if you reside or work in a highly taxed state.

Calculators are also available to help you estimate your withholdings. You can do this by using the most current IRS Tax Withholding Estimator.