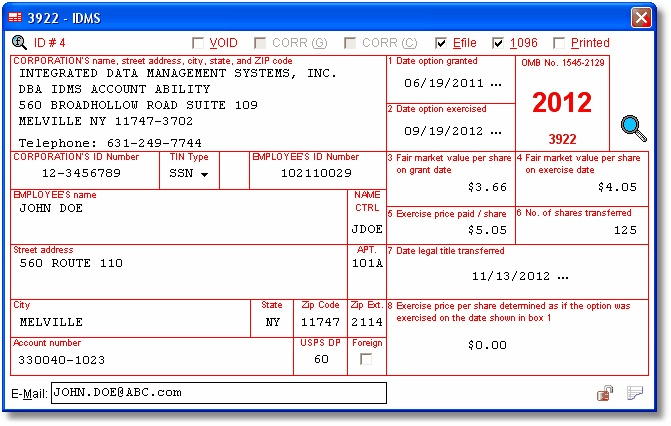

Tax Form For Employee Stock Purchase Plan – It is important to be aware about the procedures involved in submitting employee tax returns. This will help you avoid penalties, interest, and the hassle associated with it. Fortunately, there are several tools at your disposal to help you navigate through the maze.

FICA employer contribution

The FICA, Social Security and Medicare taxes are federal taxes that businesses have to take out of the pay of their employees. Employers must file a quarterly tax return. These taxes are reported using Form 941.

The federal tax known as FICA is the one that funds Social Security and Medicare. The 12.4 Social Safety levy of 12.4 percent on employees’ wages is the first component of the tax.

The Medicare tax is the additional component of tax. FICA’s Medicare component does not have any restrictions on the wage base, so the tax rates are subject to alter. Employers are able to write off FICA as business expenses that is a win-win-win.

For small businesses Form 941 is used to report the employer’s part of FICA. The IRS utilizes this form to reveal details about the taxes removed from the employee’s paycheck.

Quarterly tax return for employer

If your company is required to pay taxes on employment, it is important to know how to fill out and complete Form 941. Withholding tax for federal income taxes and payroll taxes are detailed on the form.

It is required to report the entire amount of Medicare and Social Security taxes that were deducted from employee earnings. The W-2 of the employee will reveal the exact amount. It is also necessary to disclose the tips your employees receive.

The company’s name as well as the SSN of your business when you submit your report. It is also necessary to include the number of workers who you employed in the period.

You will need to complete 15 lines on your Form 1040. The different components of your pay are represented by each line. These include the amount of employees employed paying their wages and the gratuities they receive.

The annual payment of agricultural workers to employers

The IRS Form 943, as you may have heard of, is required if your agricultural enterprise is required to be registered with IRS. The form determines the correct amount of tax withholding to employees of agricultural employers. You need to be aware of a few details regarding this form. This form can be submitted online, but if don’t have access to the internet, you may have to mail it in.

Professional payroll software is the best method to increase the tax form’s value. A tax account must also be opened by the IRS. You might be able to speed up the process by making use of Web Upload, once you have created a valid account. Prior to making the deposit, you might need to double-check that the number you have entered is correct.

Underreporting income can lead to penalties and interest.

It is important not to underpay the tax payers. Underpaying is a bad idea that could cost you cash. In actual fact it is possible that the IRS may impose fines on you if you underpay.

For a quick estimate of your debt, you can download Form 2210 from IRS. Once you’ve completed the form, you will be able to determine if you’re eligible for a waiver. If you live in a country with a high tax rate or have a significant amount of unreimbursed work expenses it could be that you qualify.

You can also use calculators to estimate your withholding. With the IRS Tax Withholding Estimator, you are able to calculate your tax withholding.