Tax Forms New Employee Withholding – It’s possible that you’ll have to fill out several documents, such as I-9 and W-4 forms, in the event that you hire new staff. These documents are required to prove that your staff is legal in the United States. This article will supply you with all the necessary forms.

Checks made in the past

Employers can conduct a range of background checks to determine the best candidate to employ. Checks for educational, credit, and identification are a few of them and so are motor vehicle records checks. These checks are necessary to verify that applicants are who they say they are and have all the necessary qualifications for the job.

Background checks can safeguard employees and clients as well as the company. Criminal convictions as well as speeding fines are all possible red flags. Signs of occupational danger or violence might also be present.

Many companies will utilize a third-party background investigator firm. They now be able to access a database of data from all federal courts across the United States. Some companies wait for an offer to work on a conditional basis before performing background checks.

Background checks could be lengthy. Employers must have a list of questions. It is vital that applicants have sufficient time to respond. Five business days is the average amount of time required to receive an answer.

Formulation I-9

Each employee has to fill out an I-9 form every time they are recruited. Federal contractors as well as state employees must comply. The process can be time-consuming and difficult.

There are many components of the form. The first section is the most important and has to be finished before you begin working. This section includes both the information of the employer as well as the information of the worker. If you are going to employ someone from outside the country You will need to provide proof that they are legally able to work in the United States.

Make sure that the rest of the form is finished on time after finishing Section 1. Keep the required Form I-9 on file for three years starting at the date of your hire. It is mandatory to continue paying the required fee of 6A.

It is important to think about the different ways you might reduce your risk of being a victim when filling the Form I-9. In the beginning, make sure that every employee is registered on the database E-Verify. It is also important to make sure that you pay your contributions and administrative costs on-time.

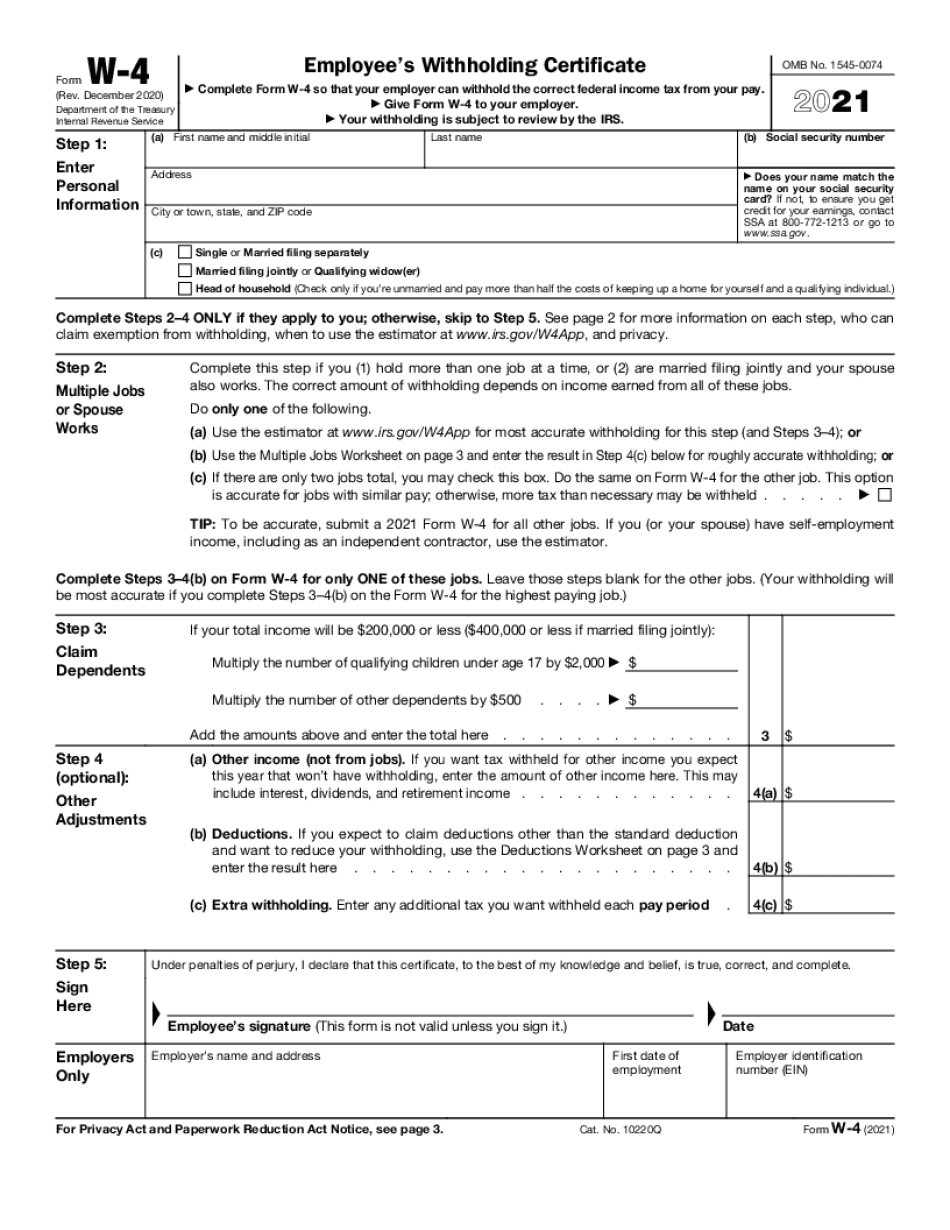

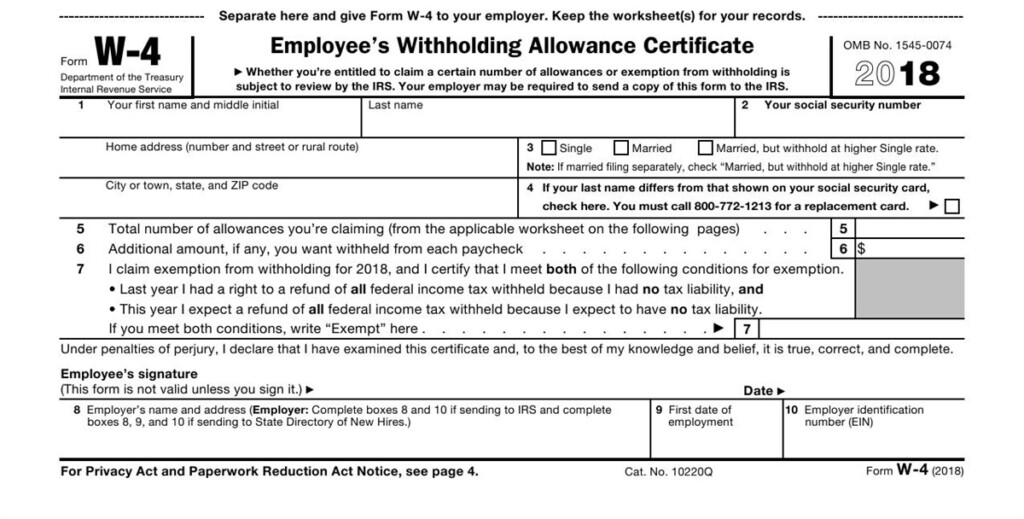

Formulas W-4

One of the first forms new employees will need to fill out is the form W-4. On this page it is possible to find the tax deductions from their pay. People can also use it to learn more about the tax obligations they face. If they’re able to understand the tax deductions that the government will take from their earnings They may be eligible for a larger check.

It is vital because it informs employers how much to deduct from employees’ pay. Federal income taxes are calculated based on this information. To avoid any surprise tax bills, it can be beneficial to track the amount you deduct.

The W-4 form is straightforward and contains your address, name and other information that can affect your federal income taxes. In the event that you are able to fill out the form could aid you in avoiding overpaying.

The W-4 comes in a variety of forms. Online submission is also possible and manual printing. No matter which method you select to use it is essential to complete the form prior to the start of your first pay period.

Apply for an opening

Employers make use of applications to review the potential candidates. They aid in creating an exact picture of the applicant’s academic background and professional background.

The application process will require you to provide the information regarding your personal details and contact details. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Applications for jobs can be made via the internet or in person. It is essential to make sure that your application is clear and succinct.

Before applying for a job, you should talk to a certified expert. This is a way to make sure you don’t include any prohibited material.

A lot of companies keep applications on file for a long time. Employers can then choose to contact candidates about future openings.

Your entire name, address and email are often requested on job application forms. These are the methods that employers use the most often for contacting candidates.